Having children is one of the most rewarding experiences in life, but it can also have a significant financial impact. From the moment your little one arrives, there are countless expenses that come along with raising them, including diapers, formula, childcare, and education. While these costs may seem daunting, they are all part of the incredible journey of parenthood.

Understanding the financial impact of having children and preparing for it is crucial for ensuring a secure future for your family. This article will delve into the key expenses associated with raising children, provide tips on how to budget effectively, and offer strategies for building financial stability. By taking proactive steps, you can navigate the financial aspects of parenthood with confidence and create a strong foundation for your children’s future.

Understanding the Costs of Raising a Child

Having children is a beautiful and fulfilling experience, but it’s also a significant financial commitment. The costs of raising a child extend far beyond basic necessities and can easily add up over the years. Understanding these costs is crucial for preparing financially for the arrival of a little one.

The most significant expenses include housing, food, healthcare, education, and childcare. Housing costs encompass mortgage or rent payments, utilities, and home maintenance. Food expenses include groceries, formula or breast milk, and snacks. Healthcare costs include doctor visits, vaccinations, and potential medical emergencies. Education encompasses preschool, elementary, and secondary school tuition, books, and supplies. Childcare can be particularly expensive, especially if both parents work.

Beyond these basic needs, there are also additional costs such as clothing, toys, activities, and entertainment. Clothing needs change as children grow, and parents often find themselves buying new clothes frequently. Toys, activities, and entertainment are important for a child’s development and can also add up quickly.

It’s important to remember that these costs are just estimations and can vary greatly depending on your location, lifestyle, and individual circumstances. It’s a good idea to do your own research and create a realistic budget based on your own family’s needs.

Housing and Transportation Adjustments

The arrival of a child often necessitates adjustments to your housing and transportation arrangements. As your family grows, you may require more space, which could involve moving to a larger home or considering renovations. This can significantly impact your housing expenses, including mortgage payments, rent, or property taxes.

Transportation costs can also increase with the addition of a child. You may need a larger vehicle to accommodate car seats, strollers, and other baby gear. Additionally, you might find yourself driving more frequently for activities like school drop-offs, playdates, and doctor’s appointments. Consider the impact of these potential expenses on your budget and explore options like carpooling, public transportation, or walking for shorter trips to help mitigate costs.

Childcare Expenses and Options

One of the most significant financial impacts of having children is the cost of childcare. Whether you choose a daycare center, in-home care, or family members, the expense can be substantial.

The average annual cost of childcare in the U.S. can range widely depending on location, type of care, and the age of the child. Factors that can affect the cost of childcare include:

- Location: Childcare costs are often higher in urban areas compared to rural areas.

- Age of the child: Infant care is typically the most expensive, followed by toddler care.

- Type of care: Daycare centers, in-home care, and family-based care have varying costs.

- Number of children: Some providers offer discounts for multiple children.

To help offset these expenses, there are a few options:

- Tax Credits: The Child Tax Credit and the Dependent Care Tax Credit are federal tax credits available to families with children. The amount of credit you receive is based on your income and the expenses you incurred.

- Employer-Sponsored Childcare: Some employers offer childcare assistance programs, such as on-site childcare centers or subsidies for childcare costs. Check with your employer for available options.

- State-Funded Programs: Some states provide childcare subsidies to low- and middle-income families. Contact your state’s Department of Human Services or your local child care resource and referral agency for information.

- Flexible Spending Accounts (FSAs): FSAs allow you to set aside pre-tax dollars for childcare expenses. This can lead to significant savings on your taxes.

- Family and Friends: If possible, consider asking family members or friends for help with childcare. This can save you money, especially if you can trade childcare with another family.

Remember to research all your options thoroughly and explore every avenue to minimize the financial burden of childcare.

Education Planning and Savings

The cost of education, especially higher education, is a major financial burden for many families. Planning and saving early for your children’s education is crucial to mitigate this burden. Start saving as soon as possible, even if it’s just a small amount each month. Consider a 529 plan, a tax-advantaged savings plan specifically for educational expenses. This allows your savings to grow tax-free and withdrawals are tax-free when used for qualified education expenses.

Research the costs of different educational options, including public and private schools, colleges, and universities. Consider potential financial aid and scholarships, which can significantly reduce your out-of-pocket expenses. Incorporate the cost of education into your overall financial plan, ensuring you can afford to support your children’s educational goals.

Healthcare Costs and Insurance

Children can be a huge financial burden. Healthcare costs are one of the biggest expenses parents face. Newborns require regular checkups, immunizations, and potential emergency care. As children grow, the costs continue to rise as they experience more illnesses and injuries. And while children’s health insurance is generally more affordable than adult insurance, the cost can still be significant.

It’s important to factor in the cost of health insurance premiums, deductibles, copayments, and coinsurance. Shop around and compare different insurance plans to find the best coverage and value. Consider a Health Savings Account (HSA), which can help you save money on healthcare expenses, and look into flexible spending accounts (FSAs), which can be used to pay for eligible healthcare expenses before taxes are deducted from your paycheck.

Here are a few tips to help you plan for healthcare costs:

- Budget for healthcare expenses. Set aside a certain amount of money each month for healthcare costs.

- Make a list of all the healthcare expenses you are expecting. This will help you estimate your total healthcare costs.

- Consider a family health insurance plan. This can help you save money on your premiums, especially if you have more than one child.

- Take advantage of preventive care. Preventative care can help you avoid more expensive health problems in the future.

Food and Clothing Budgets

Children come with a hefty price tag, and one of the biggest expenses is food and clothing. As a parent, you’ll need to budget for a constantly growing appetite, as well as the seemingly endless need for new clothes as your child grows and gets messy.

To prepare for this, it’s essential to create a realistic budget for both food and clothing. For food, consider meal planning and cooking at home to save money. Look for deals on groceries, and don’t be afraid to buy in bulk if it makes sense for your family. When it comes to clothing, shop for sales and consignment stores. Don’t feel pressured to buy the latest fashions, and consider swapping clothes with other families.

It’s also a good idea to set aside a “clothing fund” for unexpected expenses, such as school uniforms or sports equipment. Be sure to include these items in your budget to avoid surprises and stress.

Extracurricular Activities and Entertainment

Children need opportunities to explore their interests, develop new skills, and socialize. This often translates to extracurricular activities, such as sports, music lessons, and after-school programs. The cost of these activities can vary widely depending on the type, frequency, and location. Be sure to factor in the cost of transportation, uniforms, and equipment when budgeting.

Entertainment for the whole family can also add up. Movies, theme parks, and even simple outings to the zoo or a museum can all come with a price tag. While these activities are important for creating lasting memories, it’s important to find ways to make them affordable.

Consider looking for free or discounted events and activities in your area. Many museums offer free admission days, and parks and recreation departments often have free programs for children. You can also find online resources for coupon codes and deals on family entertainment.

Financial Planning Strategies for New Parents

Becoming a parent is a life-changing experience, filled with joy, love, and a whole lot of financial responsibility. Bringing a new life into the world comes with many costs, from diapers and formula to childcare and education. It’s essential to prepare financially for these expenses, as they can significantly impact your budget.

Here are some practical financial planning strategies for new parents to ensure a smoother transition into parenthood and a secure future for your family:

1. Create a Realistic Budget

Before your baby arrives, it’s crucial to create a realistic budget that includes all the expenses associated with raising a child. Factor in costs like diapers, formula, clothing, healthcare, childcare, and potential education expenses. Don’t forget to consider the financial impact of taking parental leave.

2. Track Your Spending

With a newborn, it’s easy for expenses to spiral out of control. Tracking your spending diligently helps you identify areas where you can save. Use budgeting apps or spreadsheets to monitor your cash flow and ensure you’re sticking to your budget.

3. Establish an Emergency Fund

An emergency fund is a vital financial safety net, especially with a new baby. Aim to save at least three to six months of living expenses in a readily accessible account. This will cover unexpected costs, such as medical bills, car repairs, or lost income.

4. Review Your Insurance Coverage

Ensure you have adequate health, life, and disability insurance coverage. With a new baby, your insurance needs may change. Consider increasing your life insurance policy to protect your family financially in the event of your passing.

5. Plan for Childcare

Childcare can be a significant expense, especially if you’re both working parents. Explore different options, such as daycare, in-home care, or family members, and budget for these costs. It’s essential to consider the affordability and quality of each option.

6. Consider College Savings

While college seems far off, it’s never too early to start saving for your child’s education. Research different college savings plans, such as 529 plans, and begin contributing regularly. Even small contributions can grow significantly over time.

7. Re-evaluate Your Investments

With the added financial responsibilities of raising a child, you may need to adjust your investment strategy. Consider a more conservative approach, especially in the short term, to ensure you have sufficient liquidity to cover your family’s immediate needs.

Building an Emergency Fund

Having children can bring unexpected expenses, making an emergency fund more crucial than ever. Aim for a fund that covers 3-6 months of your household expenses. This cushion can help you navigate unexpected medical bills, car repairs, or job loss without derailing your financial stability.

Start small, even $50 per month, and gradually increase your contributions. Explore automated savings tools, which can automatically transfer funds from your checking account to your savings account, making it easier to build your emergency fund.

Remember: Your emergency fund is meant for emergencies only. Avoid using it for non-essential expenses or lifestyle upgrades.

Saving for College

One of the most significant financial impacts of having children is the cost of their education. College tuition, fees, and living expenses can quickly add up, and it’s never too early to start planning and saving. A college savings plan allows you to set aside funds specifically for your child’s future education, ensuring they have the resources to pursue their academic goals without overwhelming debt.

There are several different college savings plans available, such as 529 plans and Coverdell Education Savings Accounts (ESAs). Each option has its own set of rules and benefits, so it’s essential to research and choose the plan that best fits your family’s needs. Consider factors like the plan’s tax advantages, investment options, and withdrawal rules when making your decision.

Start small, even if you can only afford a small amount each month. Every contribution, no matter how small, can make a significant difference over time. As your income increases, consider gradually raising your contributions to reach your target savings goals.

In addition to contributing regularly, try to take advantage of any employer-sponsored matching programs for college savings plans. This is essentially free money for your child’s education, so don’t miss out on this opportunity to boost your savings.

Life Insurance and Estate Planning

Having children is a life-changing event that brings immense joy, but it also introduces new financial responsibilities. One crucial aspect to consider is life insurance and estate planning. These elements are essential for protecting your family’s financial future in the event of your untimely demise.

Life insurance provides a financial safety net for your loved ones, covering expenses such as mortgage payments, education costs, and living expenses. The death benefit from a life insurance policy can alleviate the financial burden your family would face in your absence. Consider the amount of coverage you need, factoring in your family’s financial needs and lifestyle.

Estate planning ensures that your assets are distributed according to your wishes. It involves creating documents like a will, trust, and power of attorney. These documents clearly define who inherits your assets and how they are managed, ensuring that your family is taken care of financially after your passing.

Consult with a financial advisor or estate planning attorney to determine the appropriate level of life insurance coverage and to establish an estate plan that aligns with your family’s needs. Proactive planning can provide peace of mind, knowing that your loved ones are financially secure even in your absence.

Budgeting Tips for Growing Families

Having children is a beautiful and life-changing experience, but it also brings significant financial changes. As your family grows, so do your expenses. From diapers and formula to daycare and extracurricular activities, the costs can quickly add up. However, with careful planning and budgeting, you can manage your finances effectively and ensure a comfortable life for your growing family.

One of the most important aspects of budgeting for a growing family is creating a realistic budget that accounts for all your essential expenses and allows for some flexibility. This budget should include items like housing, food, transportation, healthcare, childcare, and education.

Here are some specific tips to help you budget effectively for your growing family:

- Track your spending: This is crucial to understanding where your money is going. Use a budgeting app or spreadsheet to track all your expenses for a month or two. This will give you a clear picture of where you can cut back.

- Look for savings: There are many ways to save money, such as shopping around for better deals on insurance, utilities, and groceries. You can also consider negotiating with your current providers for lower rates.

- Set financial goals: Having financial goals, like saving for college or a down payment on a house, will help you stay motivated and make sacrifices when necessary.

- Establish an emergency fund: Unexpected expenses happen, so it’s important to have a cushion for financial emergencies. Aim to save at least 3-6 months of living expenses in an emergency fund.

- Talk to your partner: Open communication about finances is essential. Sit down together and discuss your budget, goals, and financial strategies.

- Review your budget regularly: Life changes, so it’s important to revisit your budget every few months to make sure it’s still accurate and meeting your family’s needs.

By following these budgeting tips, you can manage your finances effectively and provide a comfortable and secure future for your growing family.

Government Assistance Programs

Having children can be a beautiful and rewarding experience, but it also comes with a significant financial burden. There are various government assistance programs available to help families offset the cost of raising children. These programs can provide crucial financial support, easing the financial strain and allowing parents to focus on their children’s well-being.

One of the most well-known programs is the Child Tax Credit, which can provide a tax credit of up to $2,000 per qualifying child. This credit can be claimed on your federal tax return, reducing your tax liability or providing a refund. In addition to the Child Tax Credit, many states offer their own state-level tax credits for families with children. These credits can vary in amount and eligibility requirements, so it’s important to check with your state’s tax agency for details.

For families with low incomes, the Temporary Assistance for Needy Families (TANF) program provides cash assistance and other support services. These services can include childcare, job training, and case management. Additionally, the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, can provide financial assistance for food purchases.

Other programs that can help with childcare costs include the Child Care Tax Credit and the Child and Dependent Care Tax Credit. These credits can reduce your tax liability based on the amount you spend on childcare.

Government assistance programs can provide a valuable lifeline to families struggling to make ends meet. By taking advantage of these programs, parents can alleviate financial pressure and focus on nurturing their children’s growth and development. It’s important to research and understand the eligibility requirements and application processes for each program to ensure you’re receiving the support you need.

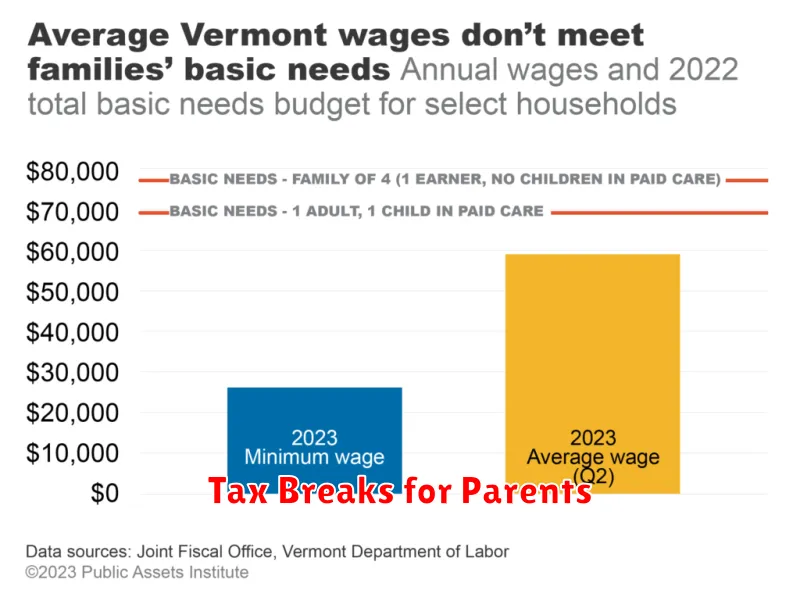

Tax Breaks for Parents

Having children comes with a range of financial obligations, but the government offers several tax breaks to help ease the burden. These tax benefits can significantly reduce your tax liability and provide financial relief for families. Here are some of the most common tax breaks for parents:

Child Tax Credit: This credit is available to families with qualifying children under the age of 17. The credit amount varies depending on the child’s age and can be claimed as a refundable credit, meaning you can receive a refund even if you don’t owe any taxes.

Dependent Care Credit: If you pay for childcare expenses so you can work or look for work, you may be eligible for the Dependent Care Credit. This credit is nonrefundable and is based on your adjusted gross income and the amount of care expenses you incurred.

Education Credits: If your child is pursuing higher education, you may be eligible for education credits such as the American Opportunity Tax Credit or the Lifetime Learning Credit. These credits can help offset the costs of tuition, fees, and other educational expenses.

Deductions for Qualified Adoption Expenses: If you’re adopting a child, you may be eligible for certain tax deductions related to adoption expenses, such as legal fees, travel expenses, and court costs.

Other Benefits: In addition to these tax breaks, there are other government programs that provide financial assistance to families with children, such as food stamps, Medicaid, and housing assistance. These programs can help alleviate some of the financial pressures associated with raising a family.

It’s important to note that tax laws and regulations can change, so it’s crucial to consult with a tax professional to determine your eligibility for these tax breaks and to ensure you’re taking advantage of all available benefits.

Managing Finances with a New Baby

Bringing a new life into the world is an incredible journey, but it also comes with significant financial implications. As you navigate the joys and challenges of parenthood, managing your finances with a newborn can feel overwhelming. This section will explore practical strategies to help you stay on top of your financial responsibilities while cherishing every precious moment with your little one.

Budgeting and Tracking Expenses: One of the most crucial steps is to create a realistic budget and track your expenses meticulously. Newborns require numerous essentials, including diapers, formula (if breastfeeding isn’t an option), clothing, and healthcare costs. Create a detailed breakdown of your monthly income and allocate funds for these essential items.

Prioritizing Savings: While the influx of expenses may seem daunting, establishing a savings plan is crucial. Start by setting aside a portion of your income for unexpected costs, such as doctor’s visits, childcare, or potential emergencies. A dedicated savings account for your child’s future education or college fund can also provide peace of mind.

Exploring Cost-Saving Measures: Don’t be afraid to seek out cost-saving opportunities. Consider buying used baby clothes and furniture, utilizing free or low-cost resources, such as local community centers for childcare support, and maximizing your healthcare benefits. Look for discounts and promotions on essential items, and explore subscription services for diapers or formula to potentially save money in the long run.

Communicating and Seeking Support: Don’t hesitate to communicate with your partner or family about your financial concerns. Sharing responsibilities and seeking support from loved ones can alleviate stress and create a stronger financial foundation. Explore resources and programs offered by your local community or government, such as financial counseling or support groups for new parents.

Reviewing Your Insurance: Ensure that your health insurance plan covers the needs of your newborn. Review your life insurance policy and consider increasing coverage to protect your family financially in case of unforeseen circumstances.

Managing finances with a new baby requires careful planning and a commitment to financial discipline. By implementing these strategies, you can create a secure financial environment for your growing family, allowing you to focus on the joys of parenthood without unnecessary financial stress.