You’ve finally reached that point in your career where you’re earning a comfortable salary. Congratulations! But with this increase in income comes the temptation to spend more. The good news is that you can still enjoy the fruits of your labor without falling into the trap of lifestyle inflation. This is when your spending habits rise in line with your income, leaving you no better off financially than before. If you don’t actively combat this tendency, you might find yourself back in the red, struggling to manage your finances.

Avoiding lifestyle inflation doesn’t mean you have to live a life of deprivation. It’s about making smart choices and prioritizing your financial goals. In this article, we’ll explore practical strategies to help you maintain a healthy financial balance while enjoying the benefits of a higher income. We’ll delve into topics like creating a budget, setting financial goals, and understanding your spending habits. Read on to learn how you can break free from the cycle of lifestyle inflation and build a secure financial future.

Understanding Lifestyle Inflation: The Silent Wealth Killer

As your income grows, it’s tempting to upgrade your lifestyle accordingly. You might move to a larger house, buy a new car, or indulge in more frequent vacations. This phenomenon, known as lifestyle inflation, can be a silent wealth killer, eroding your financial progress and leaving you struggling to save for the future.

The core problem with lifestyle inflation is that your expenses increase in proportion to your income. This means that even though you’re earning more, you’re not necessarily getting ahead financially. Instead, you’re simply maintaining the same standard of living, but at a higher cost.

The danger lies in the insidious nature of lifestyle inflation. It happens gradually, often without you even realizing it. You might justify each upgrade as a reward for your hard work, but over time, these small increases can add up to a significant financial burden. The more you spend, the harder it becomes to break free from the cycle.

Lifestyle inflation can lead to a vicious cycle of spending and debt. If your expenses outpace your savings, you might find yourself relying on credit cards or loans to make ends meet. This can create a snowball effect, with interest payments adding to your financial burden.

The Psychology of Lifestyle Inflation: Why We Spend More as We Earn More

Lifestyle inflation is a common phenomenon where people tend to increase their spending as their income grows. This can be a tricky trap to fall into, as it can lead to a vicious cycle of spending more and earning more, without ever truly feeling financially secure. The psychology behind this behavior is complex, but some key factors contribute to it.

One reason we spend more as we earn more is simply cognitive bias. As our income increases, we tend to adjust our perception of what constitutes a “necessity.” A fancy coffee that was once a luxury becomes a daily habit, and a new car that was once out of reach becomes a reasonable purchase. This shift in our perception makes it easy to justify spending more, even if our actual needs haven’t changed.

Another factor is social comparison. We often compare ourselves to others, and as our income increases, we tend to compare ourselves to people who earn even more. This can lead to a feeling of keeping up with the Joneses, where we feel pressure to spend money on things we don’t actually need, just to maintain a certain image or status.

Finally, there’s also the “hedonic treadmill” at play. This is the idea that we adapt to our circumstances, meaning that even as our income and spending increase, we don’t experience a lasting increase in happiness. We may experience a temporary boost of satisfaction from a new purchase, but it quickly fades, and we find ourselves wanting more. This can create a never-ending cycle of spending and dissatisfaction.

Understanding the psychology behind lifestyle inflation is the first step in avoiding it. By being aware of these cognitive biases and social pressures, we can start to make more conscious spending decisions and break free from the cycle of spending more as we earn more.

The Dangers of Lifestyle Inflation: Derailing Your Financial Goals

Lifestyle inflation is the insidious tendency to increase your spending as your income rises. It can be a silent killer of your financial goals, making it harder to save, invest, and achieve financial freedom. As your income increases, you may find yourself upgrading your car, buying a bigger house, taking more vacations, or indulging in more expensive hobbies. This gradual increase in spending can quickly outpace your income growth, leaving you with less money to reach your financial goals.

The dangers of lifestyle inflation are numerous. It can:

- Increase your debt: If your spending grows faster than your income, you may find yourself taking on more debt to maintain your lifestyle. This can create a vicious cycle of debt, making it harder to escape.

- Delay your financial goals: Whether you’re saving for retirement, a down payment on a house, or a child’s education, lifestyle inflation can significantly delay your progress towards these goals.

- Create financial stress: When your spending constantly exceeds your income, it can lead to financial stress and anxiety. You may feel overwhelmed, pressured, and constantly worried about money.

- Limit your opportunities: By spending more, you may have less money available for investments, entrepreneurship, or other opportunities that can help you build wealth.

Understanding and avoiding lifestyle inflation is crucial for building a strong financial future. It’s essential to prioritize saving, investing, and achieving your long-term financial goals rather than succumbing to the allure of an ever-expanding lifestyle. By being mindful of your spending habits and making conscious decisions about how you allocate your money, you can avoid falling victim to lifestyle inflation and stay on track towards financial freedom.

Practical Tips to Avoid Lifestyle Inflation

As your income grows, it’s easy to fall into the trap of lifestyle inflation – spending more money on things like fancy dinners, vacations, and expensive clothes. This can leave you feeling financially stressed, even if your salary has increased. Here are some practical tips to help you avoid lifestyle inflation:

Create a Budget and Stick to It: Create a realistic budget that tracks your income and expenses. This will give you a clear picture of where your money is going and help you identify areas where you can cut back.

Prioritize Saving: Make saving a priority. Set aside a portion of your income for your savings goals, such as retirement, a down payment on a house, or an emergency fund. This will help you build financial security and avoid accumulating unnecessary debt.

Delay Purchases: Before making a big purchase, give yourself time to think it through. Consider whether you truly need the item or if you can live without it. If you can wait, it can help prevent impulsive spending.

Embrace a Minimalist Lifestyle: Consider living a more minimalist lifestyle. Focus on experiences and relationships instead of material possessions. This can help you appreciate the simple things in life and save money in the process.

Set Financial Goals: Having financial goals can motivate you to stay disciplined and avoid unnecessary spending. It could be anything from paying off debt to investing in your future. These goals can keep you focused on building a secure financial foundation.

Automate Savings: Set up automatic transfers to your savings account so that you don’t even have to think about it. This will ensure that you’re consistently saving, even when you’re busy with other things.

Track Your Spending: Use a budgeting app or a spreadsheet to monitor your spending habits. This will help you stay aware of how much you’re spending and identify areas where you can cut back.

By following these tips, you can avoid lifestyle inflation and use your growing income to build a secure financial future.

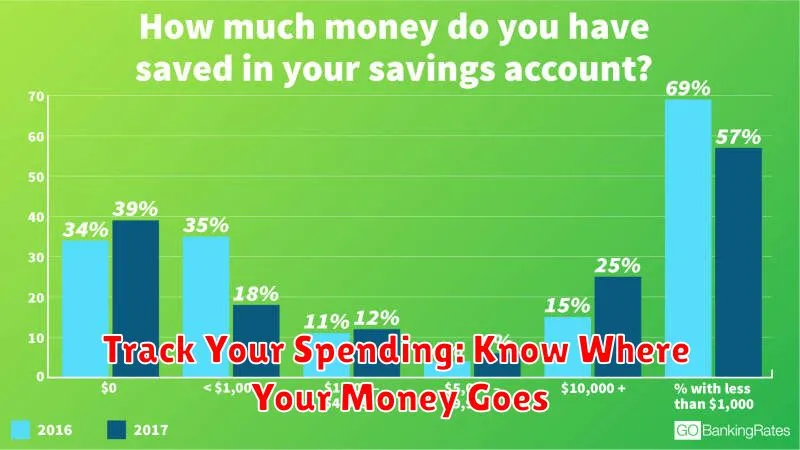

Track Your Spending: Know Where Your Money Goes

As your income grows, it’s easy to fall into the trap of lifestyle inflation, where you spend more without realizing it. Tracking your spending is the first step to avoiding this pitfall. By knowing where your money is going, you can identify areas where you can cut back and free up more cash for saving and investing.

There are several ways to track your spending. You can use a budgeting app, a spreadsheet, or even just a notebook. The important thing is to choose a method that works for you and to be consistent in tracking your expenses.

Once you have a good understanding of your spending habits, you can start to look for areas where you can cut back. Maybe you’re spending too much on dining out, entertainment, or clothes. Or maybe you’re paying for subscriptions that you don’t use.

By tracking your spending, you can take control of your finances and avoid the pitfalls of lifestyle inflation.

Create a Budget: Plan Your Finances and Stick to It

A budget is the foundation of any financial plan. It helps you track your income and expenses, identify areas where you can save money, and make informed decisions about your spending. When you’re facing lifestyle inflation, a budget is especially important. It can help you stay on track and avoid overspending just because you have more money.

To create a budget, start by listing all your income sources. This includes your salary, any side income, and any other regular income you receive. Next, list all your expenses, both fixed and variable. Fixed expenses are those that stay the same each month, such as rent, mortgage payments, and car payments. Variable expenses are those that can change from month to month, such as groceries, entertainment, and travel.

Once you have a clear picture of your income and expenses, you can start to allocate your money. This means deciding how much you will spend on each category. There are many different budgeting methods, so find one that works for you. Some popular methods include the 50/30/20 method, the zero-based budgeting method, and the envelope method.

The key to avoiding lifestyle inflation is to stick to your budget. This means being disciplined about your spending and avoiding impulse purchases. It also means being realistic about your needs versus your wants. You may need to make some sacrifices, but it will be worth it in the long run. Having a budget helps you control your spending and keeps your financial goals in sight, even as your income rises.

Set Financial Goals: Stay Motivated and Focused

As your income grows, it’s easy to fall prey to lifestyle inflation – the tendency to increase your spending as your earning power rises. To avoid this trap, setting clear and achievable financial goals is crucial. These goals act as a roadmap, guiding you towards a secure financial future and preventing impulsive spending.

When you have specific financial objectives in mind, you are more likely to make conscious decisions about your money. Whether it’s saving for a down payment on a house, funding your child’s education, or retiring comfortably, having a clear vision helps you stay motivated and focused. It’s much easier to resist the temptation to upgrade your lifestyle when you have a compelling reason to save.

Write down your financial goals and break them down into smaller, manageable steps. This will help you stay on track and track your progress. Regularly reviewing and updating your goals ensures they remain relevant and aligned with your changing circumstances.

By setting financial goals and committing to them, you’ll not only avoid lifestyle inflation but also gain greater control over your financial destiny. Remember, a strong financial foundation is built on discipline and a clear understanding of your priorities.

Live Below Your Means: Save and Invest Before Spending

As your income grows, it’s tempting to upgrade your lifestyle. But, living below your means is essential for financial security. When you prioritize saving and investing before spending on unnecessary luxuries, you’re building a solid financial foundation.

Think about your future self. What will you be grateful for in a few years? A comfortable retirement? A down payment on a dream home? The freedom to pursue your passions? By living below your means now, you can create the financial flexibility to achieve these goals.

Start by creating a budget. Track your income and expenses to understand where your money goes. Look for areas where you can cut back on unnecessary spending. This could involve cooking more meals at home, opting for free or low-cost entertainment, or finding ways to reduce your housing costs.

Automate your savings. Set up automatic transfers from your checking account to your savings or investment accounts. This ensures that you’re saving consistently, even when you’re busy. By prioritizing savings before spending, you’re setting yourself up for long-term financial success.

Differentiate Between Needs and Wants: Prioritize Essential Expenses

As your income grows, it’s easy to fall into the trap of lifestyle inflation. This happens when your spending increases along with your income, leaving you with little to no savings. To avoid this, you need to differentiate between your needs and your wants and prioritize spending on essential expenses.

Needs are the things you require for survival and basic well-being. They include things like food, shelter, clothing, healthcare, and transportation. Wants, on the other hand, are things that you desire but don’t necessarily need to survive. These can include things like expensive gadgets, designer clothes, vacations, and eating out frequently.

The key to avoiding lifestyle inflation is to focus your spending on your needs while being mindful of your wants. Here are some practical tips to prioritize essential expenses:

- Create a budget: Track your income and expenses to see where your money is going.

- Identify your needs: Determine which expenses are essential for your well-being.

- Cut back on wants: Look for areas where you can reduce your spending on non-essential items.

- Automate savings: Set up automatic transfers to your savings account each month.

By carefully managing your finances and prioritizing your needs, you can avoid lifestyle inflation and build a solid financial foundation for your future.

Avoid Impulse Purchases: Think Before You Buy

As your income rises, it’s tempting to upgrade your lifestyle and spend more on things you don’t necessarily need. This can lead to lifestyle inflation, where your expenses grow faster than your income, leaving you with less money for savings and financial goals. One of the best ways to combat this is to avoid impulse purchases.

Impulse purchases are unplanned spending decisions made without careful consideration. They often happen when you’re browsing online, shopping in stores, or even watching ads. Before you buy anything, ask yourself these questions:

- Do I really need this?

- Can I afford it?

- Will this item make me happy in the long run?

- Is there a cheaper alternative?

If you answer “no” to any of these questions, it’s probably a good idea to put the item back. There are also helpful strategies to reduce impulse buying:

- Shop with a list. This helps you stay focused on your needs and avoid buying unnecessary items.

- Leave your credit cards at home. This will force you to only spend the cash you have on hand, which can help curb impulse spending.

- Wait 24 hours before making a purchase. This gives you time to cool off and decide if you really want the item.

- Unsubscribe from promotional emails and social media accounts. This will limit your exposure to tempting offers.

By being mindful of your spending habits and practicing these strategies, you can avoid impulse purchases and prevent lifestyle inflation from consuming your hard-earned income. Remember, true wealth comes from financial freedom, and that’s something you can achieve by being a smart and intentional shopper.

Practice Gratitude: Appreciate What You Have

As your income grows, it’s tempting to upgrade your lifestyle. You might feel like you deserve all the things you’ve been wanting for so long. But it’s crucial to practice gratitude and appreciate what you already have. Instead of constantly focusing on what you lack, take the time to recognize the good things in your life. This can help you avoid lifestyle inflation and keep your spending in check.

There are several ways to practice gratitude. You can start by keeping a gratitude journal and writing down things you’re thankful for each day. You can also make it a habit to express gratitude to people around you, whether it’s your family, friends, or colleagues. By focusing on the positives in your life, you’ll shift your mindset and be less likely to feel the need to spend more to feel happy.

Seek Financial Advice: Get Professional Guidance

As your income grows, it’s tempting to increase your spending on things you’ve always wanted or to upgrade your lifestyle. This is called lifestyle inflation, and it can quickly derail your financial goals. That’s why seeking financial advice from a professional is crucial.

A financial advisor can help you develop a budget that aligns with your income and financial goals. They can also provide insights on how to manage your money wisely and avoid unnecessary spending. By working with a financial advisor, you can create a plan to ensure that your increased income benefits you in the long term, not just in the short term.

Building a Solid Financial Foundation

As your income grows, it’s tempting to upgrade your lifestyle. This is known as lifestyle inflation, where your spending increases proportionally to your income. While it’s great to enjoy the fruits of your labor, unchecked lifestyle inflation can derail your financial goals. Instead of automatically increasing your spending, focus on building a solid financial foundation.

Start by establishing an emergency fund. This acts as a safety net for unexpected expenses, preventing you from going into debt. Aim for 3-6 months’ worth of living expenses. Once that’s in place, focus on paying off high-interest debt like credit card debt. This will free up more of your income for other financial priorities.

Building a solid financial foundation also involves saving for the future. Contribute to retirement accounts like 401(k)s or IRAs. Take advantage of employer matching programs to maximize your contributions. Consider investing in a diversified portfolio to grow your wealth over time.

It’s easy to get caught up in the cycle of spending more when you earn more. By building a solid financial foundation, you can break that cycle. You’ll be more financially secure and have the freedom to make informed choices about your spending, allowing you to enjoy the benefits of your increased income without sacrificing your long-term financial goals.

Long-Term Benefits of Avoiding Lifestyle Inflation

While it’s tempting to upgrade your lifestyle as your income grows, resisting lifestyle inflation offers significant long-term benefits. By intentionally keeping your expenses in check, you can unlock a wealth of financial advantages that will serve you well for years to come.

One of the most significant benefits of avoiding lifestyle inflation is the ability to accelerate your savings. When you’re not constantly upgrading your living standards, a larger portion of your income can be directed towards building a strong financial foundation. This translates to more money for retirement savings, emergency funds, and investments, setting you up for financial security in the long run.

Another key benefit is increased financial freedom. By keeping your expenses manageable, you create a buffer against unexpected financial challenges. This can be crucial during economic downturns or personal setbacks, allowing you to maintain your financial stability without feeling overwhelmed. You’ll also have more flexibility to pursue your passions and goals, whether it’s starting a business, traveling the world, or simply enjoying more time with loved ones.

Beyond personal finance, avoiding lifestyle inflation also has positive environmental implications. The constant desire for more and bigger often leads to increased consumption and waste. By prioritizing conscious spending and living within your means, you can reduce your environmental footprint and contribute to a more sustainable future.

In essence, resisting lifestyle inflation is a powerful strategy for achieving long-term financial security, personal freedom, and a positive impact on the world around you. It’s a mindset that prioritizes thoughtful spending and long-term goals, paving the way for a more fulfilling and prosperous future.