Are you tired of living paycheck to paycheck, feeling like you’re constantly struggling to make ends meet? Do you dream of financial freedom, but feel overwhelmed by the thought of reaching your goals? You’re not alone! Many people struggle with their finances, but setting financial goals can be a powerful tool to achieve financial stability and security. Setting clear and achievable goals helps you stay motivated, track your progress, and make informed financial decisions. This article will guide you through the importance of setting financial goals and provide practical tips on how to achieve them, empowering you to take control of your financial future.

The benefits of setting financial goals go beyond simply having more money. Achieving your financial goals can bring a sense of accomplishment, boost your confidence, and reduce financial stress. It allows you to prioritize your spending, make informed decisions about your money, and build a solid financial foundation for the future. Whether you’re saving for a down payment on a house, paying off debt, or planning for retirement, setting clear financial goals and taking consistent action towards them is essential for achieving financial success.

The Power of Goal Setting in Personal Finance

Setting financial goals is a crucial step towards achieving financial stability and fulfilling your dreams. Goals provide a clear roadmap, guiding you towards financial success. When you have a defined objective, you are more likely to prioritize saving, budget effectively, and make informed financial decisions.

Motivation and Focus: Goals infuse a sense of purpose and motivation, driving you to take the necessary actions to reach your financial aspirations. Having a clear goal, whether it’s buying a home, retiring early, or simply building an emergency fund, provides a strong incentive to make financial sacrifices and stay on track.

Clarity and Direction: Financial goals provide a framework for your financial decisions, giving you a clear direction for your money. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, you can align your spending, saving, and investing strategies to achieve your desired outcomes. This clarity eliminates confusion and helps you prioritize your financial efforts.

Accountability and Progress Tracking: Setting financial goals also promotes accountability. By having specific targets, you can regularly track your progress and adjust your strategies as needed. This regular monitoring ensures you stay on course and make necessary adjustments to reach your financial objectives.

Financial Success: Financial goals provide a tangible measure of your financial success. As you progress towards your goals, you gain a sense of accomplishment and satisfaction. This positive reinforcement encourages you to continue pursuing your financial aspirations and strive for even greater achievements.

Identifying Your Short-Term and Long-Term Goals

Financial goals are essential for achieving your desired financial future. They give you direction, motivation, and a roadmap to follow. The first step in setting financial goals is identifying what you want to achieve. These goals can be broken down into two categories: short-term goals and long-term goals.

Short-term goals are those that you aim to achieve within a year or less. Examples of short-term goals include saving for a vacation, paying off credit card debt, or building an emergency fund. These goals can be smaller and more attainable, providing you with a sense of accomplishment and momentum as you work towards your larger financial aspirations.

Long-term goals, on the other hand, are those that extend beyond a year. Examples of long-term goals include saving for retirement, buying a house, or funding your child’s education. These goals require a more strategic approach and may involve consistent saving and investment over a longer period.

Identifying your short-term and long-term goals is crucial as it helps you prioritize your financial efforts. By understanding your financial aspirations, you can create a clear plan and allocate your resources accordingly.

Creating SMART Financial Goals (Specific, Measurable, Achievable, Relevant, Time-Bound)

SMART goals are a powerful tool for achieving financial success. They provide a clear roadmap to guide your actions and keep you motivated throughout your journey.

Specific goals clearly define what you want to achieve. Instead of saying “I want to save more money,” specify “I want to save $10,000 for a down payment on a house.”

Measurable goals allow you to track your progress and celebrate milestones. For instance, instead of “I want to invest more,” state “I want to invest $500 per month in a diversified portfolio.”

Achievable goals are realistic and within your reach. While aiming high is important, setting goals that are too ambitious can lead to discouragement. For example, instead of “I want to become a millionaire,” consider “I want to increase my net worth by $10,000 in the next year.”

Relevant goals align with your overall financial aspirations. For example, if your goal is to retire early, relevant goals could include maximizing contributions to a retirement account or reducing debt.

Time-bound goals establish a clear deadline to motivate action and hold yourself accountable. Instead of “I want to pay off my student loans,” set a specific timeframe like “I want to pay off my student loans in 3 years.”

By following these steps, you can create SMART financial goals that will help you stay on track, achieve your financial aspirations, and build a secure future.

Building a Budget to Support Your Financial Goals

A budget is a critical tool for achieving your financial goals. It helps you track your income and expenses, identify areas where you can save money, and allocate funds towards your goals. By creating a budget, you gain control over your finances and make informed decisions about your spending.

The first step in building a budget is to track your income and expenses. This involves listing all your sources of income and all your expenses for a certain period, such as a month. There are many budgeting apps and tools available that can simplify this process. Once you have a clear picture of your income and expenses, you can start to identify areas where you can cut back on spending.

Next, you need to allocate your funds to your financial goals. This involves prioritizing your goals and assigning a specific amount of money to each one. For example, if your goal is to buy a house, you might allocate a certain percentage of your income to savings for a down payment.

It’s essential to be realistic about your budget. Don’t set unrealistic goals that you can’t achieve. Start with small, achievable goals, and gradually work your way up to larger ones. It’s also important to review your budget regularly and make adjustments as needed.

Here are some tips for building a budget that supports your financial goals:

- Track your income and expenses

- Identify areas where you can cut back

- Allocate funds to your goals

- Be realistic about your budget

- Review your budget regularly

By following these tips, you can create a budget that helps you achieve your financial goals and live a more financially secure life.

Tracking Your Progress and Making Adjustments Along the Way

Once you’ve set your financial goals, it’s important to track your progress and make adjustments along the way. This will help you stay motivated and on track to achieve your goals.

There are a number of ways to track your progress. You can use a spreadsheet, a budgeting app, or even just a simple notebook. The important thing is to find a system that works for you and that you’ll actually use.

As you track your progress, you’ll likely find that you need to make some adjustments to your plan. This is perfectly normal. Life is full of surprises, and your financial situation can change unexpectedly. Be prepared to make adjustments as needed, and don’t be afraid to seek professional advice if you need it.

For example, you may find that you’re not saving as much as you’d like. In this case, you may need to adjust your budget or find ways to increase your income. Alternatively, you may find that you’re on track to reach your goals sooner than you expected. In this case, you may want to consider setting a new, more ambitious goal.

Tracking your progress and making adjustments along the way is an essential part of achieving your financial goals. It’s a way to stay accountable, stay motivated, and ensure that you’re on the right track.

Staying Motivated and Overcoming Financial Challenges

Setting financial goals is crucial, but the journey can be challenging. Staying motivated and overcoming obstacles requires a strategic approach. Here are some tips:

Visualize your goals: Imagine yourself achieving your financial aspirations. This can fuel your motivation and keep you focused.

Break down large goals: Divide your big goals into smaller, achievable milestones. This makes the process less daunting and provides a sense of accomplishment as you progress.

Track your progress: Regularly monitor your financial progress. Seeing your accomplishments can boost motivation and keep you on track.

Seek support: Don’t hesitate to reach out for support from friends, family, or financial advisors. Their guidance and encouragement can be invaluable.

Celebrate milestones: Acknowledge and celebrate your achievements, big or small. This helps maintain enthusiasm and reinforces your commitment.

Embrace setbacks as learning opportunities: Don’t let setbacks discourage you. Analyze what went wrong and use the experience to improve your approach.

Remember your “why”: Remind yourself of your reasons for pursuing your financial goals. This can provide the necessary inspiration to persevere.

Stay informed: Keep yourself updated on financial news and strategies. This knowledge can help you make informed decisions and adapt to changing circumstances.

Celebrating Milestones and Achieving Financial Success

Setting financial goals isn’t just about reaching a specific number; it’s about the journey and the milestones you achieve along the way. These milestones provide motivation, a sense of accomplishment, and a clear path towards your ultimate financial success. Celebrating these milestones, no matter how small, is crucial for staying on track and maintaining your motivation.

Imagine finally paying off a credit card debt. This milestone deserves a celebration! A small dinner out, a weekend getaway, or even a simple evening of self-care can mark this achievement and reinforce your commitment to financial freedom. Every milestone, big or small, serves as a reminder of your progress and fuels your drive to reach the next level.

Financial success isn’t a destination; it’s a continuous process. By celebrating your milestones, you not only acknowledge your efforts but also create a positive feedback loop that encourages you to push further. This sense of achievement and progress will keep you motivated and focused on your long-term financial goals.

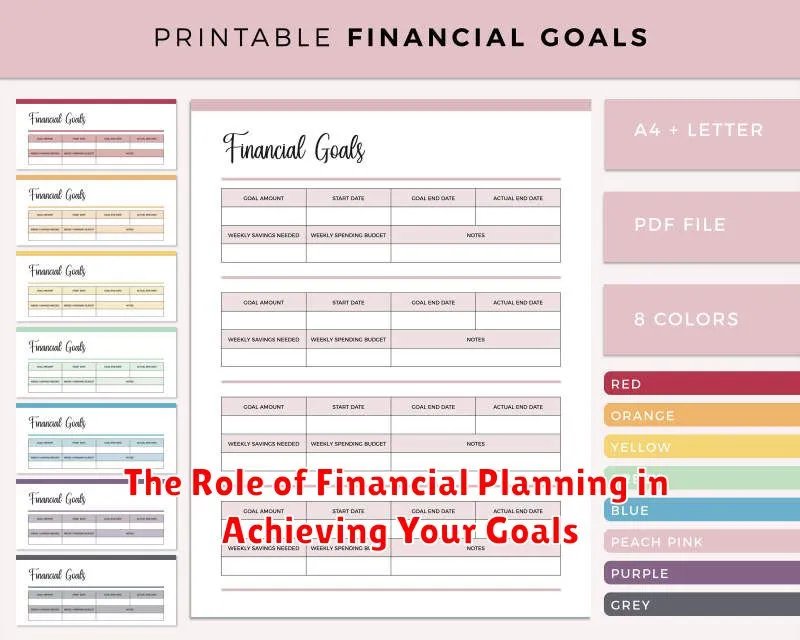

The Role of Financial Planning in Achieving Your Goals

Financial planning is the cornerstone of achieving any financial goal, be it buying a house, retiring comfortably, or saving for your children’s education. It’s a strategic process that helps you define your financial goals, map out a path to reach them, and stay on track.

The core of financial planning lies in understanding your current financial situation. This includes your income, expenses, assets, and debts. Once you have a clear picture of your financial landscape, you can set realistic and specific financial goals. These goals should be measurable and have a defined time frame.

With your goals established, a financial plan provides a roadmap for achieving them. It outlines strategies to manage your income and expenses, allocate your savings, and invest wisely. It’s a living document that should be revisited and adjusted as your circumstances change.

The benefits of financial planning are numerous. It can help you reduce stress and anxiety about money, increase your confidence in making financial decisions, and maximize your chances of achieving your financial goals. It empowers you to take control of your financial future and build a secure foundation for your financial well-being.

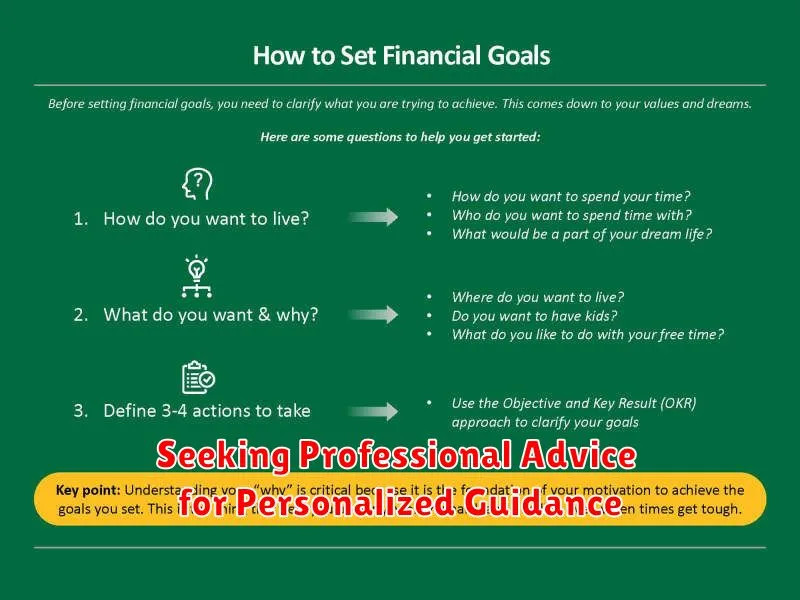

Seeking Professional Advice for Personalized Guidance

While self-guided financial planning can be helpful, seeking professional advice can significantly elevate your journey toward achieving your financial goals. A qualified financial advisor can provide personalized guidance tailored to your unique circumstances, ensuring you’re on the right track. Here’s why it’s crucial to seek professional help:

Comprehensive Financial Assessment: Financial advisors conduct a thorough assessment of your income, expenses, assets, and liabilities. This analysis provides a clear picture of your current financial situation, highlighting areas for improvement and potential risks.

Customized Goal Setting: Every individual has different financial goals. A financial advisor can help you set realistic and achievable goals, whether it’s saving for retirement, buying a home, or paying off debt. They can create a customized plan that aligns with your aspirations and timeline.

Investment Strategies: Choosing the right investments is critical for long-term financial success. A financial advisor has the expertise to recommend appropriate investment strategies based on your risk tolerance, time horizon, and financial goals. They can help diversify your portfolio and navigate market fluctuations.

Tax Optimization: Tax laws and regulations can be complex. Financial advisors can assist you in optimizing your tax situation and ensuring you’re taking advantage of all available deductions and credits.

Retirement Planning: Retirement planning is a crucial aspect of financial well-being. A financial advisor can help you develop a retirement plan that accounts for your expected expenses, income sources, and desired lifestyle. They can also provide guidance on saving and investment strategies.

Accountability and Support: Having a financial advisor provides you with accountability. Regular check-ins and reviews help you stay on track with your goals and make necessary adjustments along the way. They offer ongoing support and guidance, ensuring you’re confident in your financial decisions.

Building a Secure Future by Setting and Reaching Your Goals

Financial goals serve as a compass, guiding you toward a secure and fulfilling future. They provide a clear path to financial stability and help you achieve your long-term aspirations. By setting and reaching your financial goals, you build a solid foundation for financial security and peace of mind.

When you set financial goals, you take control of your financial destiny. It’s about defining what you want to achieve and creating a plan to make it happen. Whether it’s purchasing a home, paying off debt, investing for retirement, or simply building an emergency fund, having specific goals motivates you to take action and make responsible financial decisions.

The process of setting and reaching financial goals is not always smooth sailing. You might encounter obstacles along the way, but it’s important to stay focused and adjust your approach as needed. By tracking your progress, celebrating small wins, and seeking professional advice when necessary, you can overcome challenges and stay on course towards your desired outcomes.

Building a secure future is not just about accumulating wealth; it’s about creating a life that aligns with your values and aspirations. By setting and reaching your financial goals, you empower yourself to achieve financial independence, pursue your passions, and enjoy the fruits of your hard work. It’s a journey that takes dedication, discipline, and a commitment to making smart choices.