Are you feeling overwhelmed by your financial goals? Do you struggle to prioritize your savings, investments, and debt repayment? You’re not alone. Many people find it challenging to navigate the complex world of personal finance, especially when it comes to establishing a clear roadmap for long-term success. The good news is that with a strategic approach and a clear understanding of your financial priorities, you can achieve your financial goals and build a secure financial future.

This article will guide you through the process of prioritizing your financial goals, helping you create a realistic plan that aligns with your individual needs and aspirations. We’ll delve into the key considerations for setting effective financial goals, explore strategies for maximizing your resources, and provide practical tips for staying motivated and on track. Whether you’re saving for retirement, paying off debt, or simply aiming to build a solid financial foundation, this article will equip you with the knowledge and tools to make informed decisions and achieve lasting financial success.

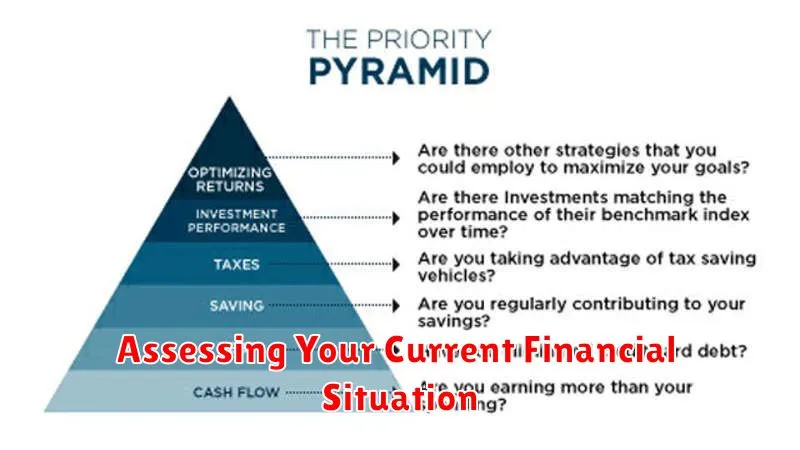

Assessing Your Current Financial Situation

Before you can effectively prioritize your financial goals, you need a clear understanding of where you stand financially. This involves taking stock of your current assets, liabilities, and income. By getting a handle on your current financial situation, you can identify areas for improvement and make informed decisions about your financial future.

Start by listing all your assets, which are items you own that have monetary value. These could include:

- Checking and savings accounts

- Investments (stocks, bonds, mutual funds)

- Real estate (home, rental property)

- Vehicles

- Valuables (jewelry, art, collectibles)

Next, list all your liabilities, which are debts you owe to others. These could include:

- Credit card debt

- Student loans

- Mortgage or rent

- Car loans

- Personal loans

Finally, document your income, which is the money you receive from various sources, including:

- Salary or wages

- Investment income

- Rental income

- Government benefits

- Side hustles

Once you have gathered this information, you can calculate your net worth, which is the difference between your assets and liabilities. This provides a snapshot of your overall financial health.

This assessment will help you understand your financial strengths and weaknesses, enabling you to develop a plan for achieving your long-term financial goals.

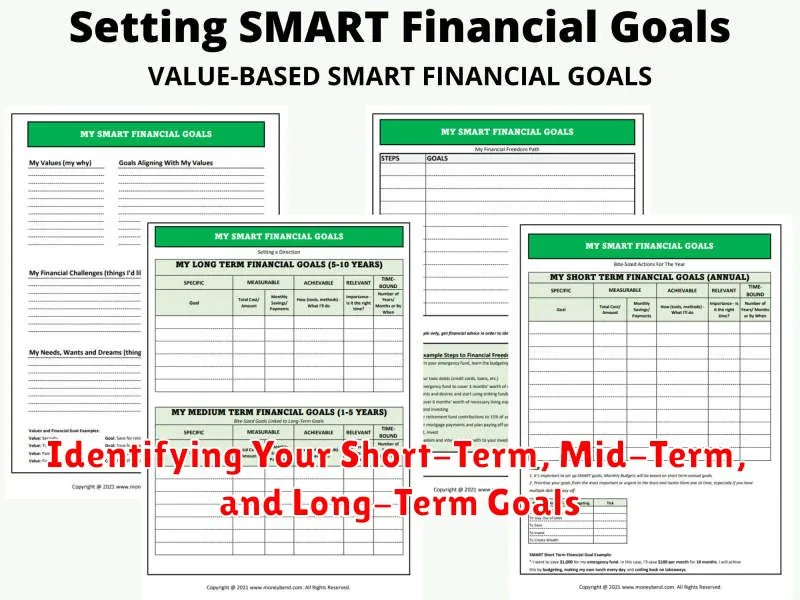

Identifying Your Short-Term, Mid-Term, and Long-Term Goals

Before you can prioritize your financial goals, you need to identify what they are. It’s helpful to categorize them into short-term, mid-term, and long-term goals.

Short-term goals are those that you want to achieve within the next year. These might include things like paying off a credit card balance, saving for a vacation, or buying a new appliance.

Mid-term goals are those that you want to achieve within the next 1-5 years. This could include things like putting a down payment on a house, paying off student loans, or saving for your child’s education.

Long-term goals are those that you want to achieve in 5+ years. These might include things like retiring comfortably, leaving a legacy, or investing in real estate.

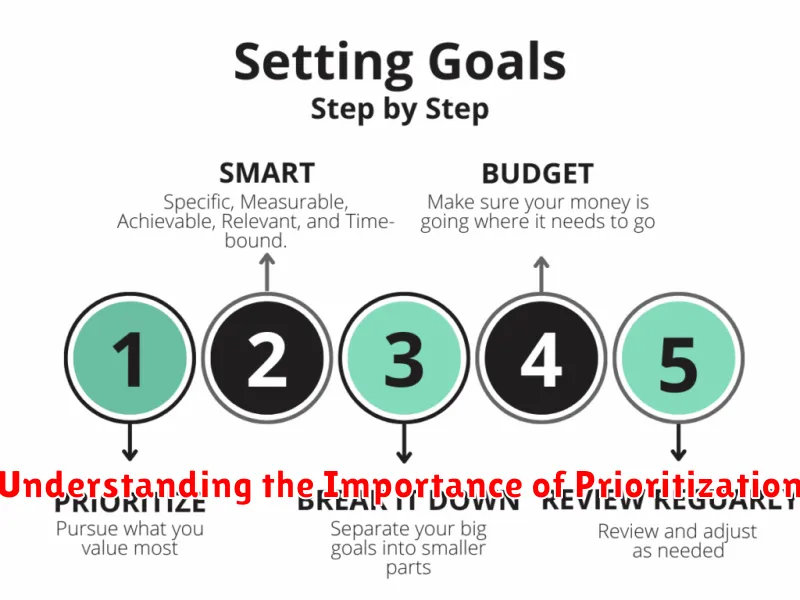

Understanding the Importance of Prioritization

In the pursuit of long-term financial success, setting goals is essential. However, simply having goals isn’t enough. Prioritization is the key to achieving your financial aspirations. It involves strategically ranking your goals based on their importance and urgency, ensuring that your efforts are directed towards the most impactful pursuits.

Prioritization provides clarity and direction. When you have a clear understanding of your priorities, you avoid feeling overwhelmed by the sheer number of financial goals you might have. It allows you to focus your energy and resources on the goals that will make the most significant difference in your overall financial well-being.

Moreover, prioritization helps you avoid spreading yourself too thin. Trying to tackle too many financial goals at once can lead to exhaustion, procrastination, and ultimately, failure to achieve any of them effectively. By prioritizing, you can break down your financial goals into manageable steps, increasing your chances of success.

Factors to Consider When Ranking Your Financial Goals

Once you’ve identified your financial goals, it’s time to prioritize them. Not all goals are created equal, and some may be more important to achieve than others. Here are some factors to consider when ranking your financial goals:

Urgency: Some goals, like paying off high-interest debt, may be more urgent than others, like saving for retirement. Consider the potential consequences of not achieving a goal in a timely manner.

Impact: How will achieving this goal affect your overall financial well-being? Goals with a greater impact on your future, such as securing a stable income, may deserve higher priority.

Timeframe: How long will it take to achieve each goal? Short-term goals (like saving for a down payment) might be ranked higher than long-term goals (like retirement planning).

Resources: What resources do you have available to help you achieve your goals? Consider your income, savings, and access to credit.

Personal Values: Your financial goals should reflect your values and priorities. If you value financial independence, you might prioritize goals related to building wealth and reducing debt.

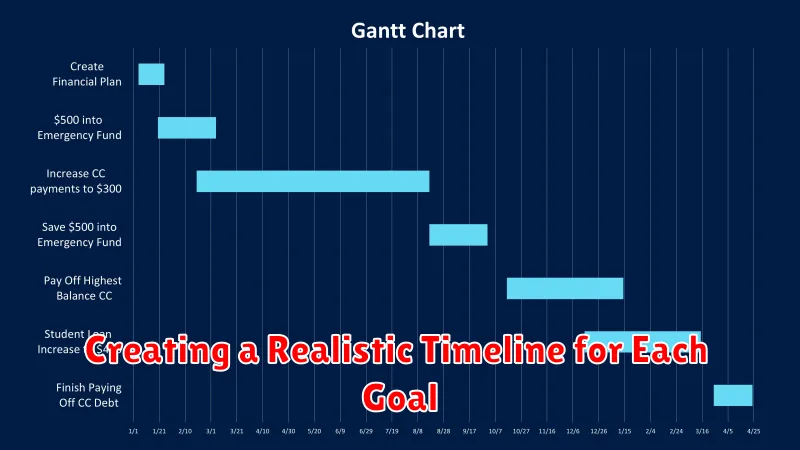

Creating a Realistic Timeline for Each Goal

Once you’ve prioritized your financial goals, it’s time to assign a realistic timeline to each one. This involves understanding the time commitment required to achieve each goal and setting achievable deadlines.

To create a realistic timeline, consider factors like:

- The financial resources needed: How much money will you need to save or invest to reach your goal?

- Your current financial situation: What is your current income, expenses, and debt load?

- The complexity of the goal: Some goals, like buying a house, require significant planning and effort.

- External factors: Economic conditions, interest rates, and market fluctuations can impact your progress.

Don’t be afraid to adjust your timeline as needed. Life throws curveballs, and your financial circumstances can change. Regularly review your timelines and make adjustments to ensure you’re still on track to achieve your goals.

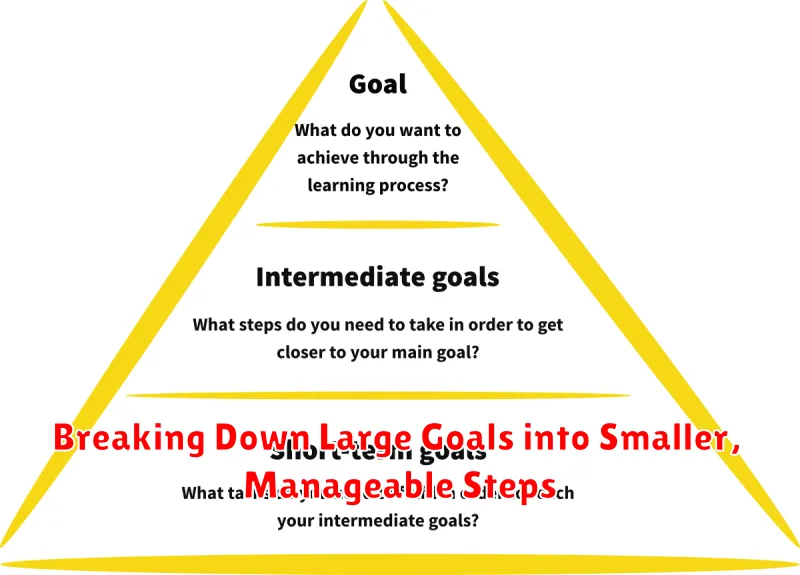

Breaking Down Large Goals into Smaller, Manageable Steps

One of the biggest hurdles in achieving financial goals is the feeling of being overwhelmed by their enormity. Large, long-term goals, like saving for retirement or buying a home, can seem distant and unattainable. However, the key to success lies in breaking these goals down into smaller, manageable steps. This approach helps make the process feel less daunting and more achievable.

Instead of focusing on the distant future, concentrate on the present and what you can do right now. Start by asking yourself: “What is the next small step I can take towards this goal?” For instance, if you want to save for retirement, your first step might be to open a retirement account. Then, you might focus on contributing a specific amount each month. By breaking down the goal into these smaller steps, you create a roadmap to success.

The benefits of this approach extend beyond just feeling less overwhelmed. By taking smaller, consistent steps, you build momentum and gain a sense of accomplishment. Each step achieved strengthens your commitment to the overall goal and fuels your motivation to continue. This consistent progress fosters a sense of control over your finances and instills confidence in your ability to reach your objectives.

Remember, financial goals are a journey, not a race. Embrace the process, celebrate your small victories, and stay focused on the next step. By breaking down large goals into manageable chunks, you can turn your financial aspirations into a reality.

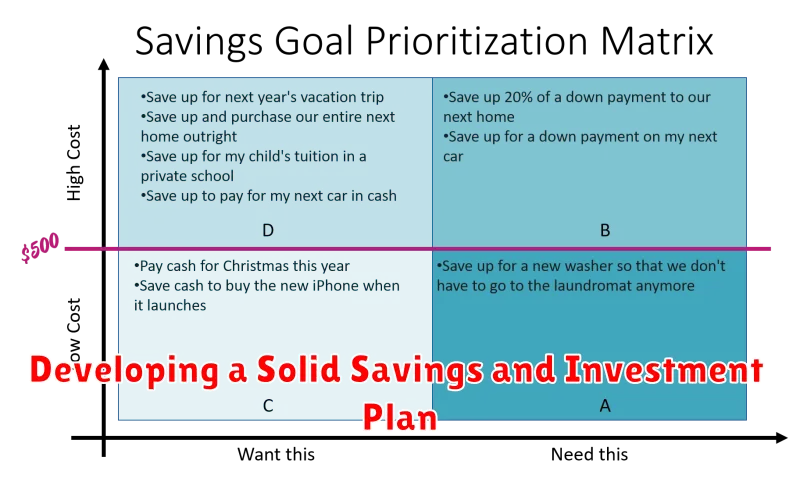

Developing a Solid Savings and Investment Plan

A well-structured savings and investment plan is crucial for achieving long-term financial success. It’s not just about saving money but about strategically allocating your funds to grow over time and reach your financial goals. Here’s a breakdown of how to develop a solid plan:

1. Define Your Financial Goals: Before starting, clearly define your financial objectives. What are you saving for? Retirement? A house? Your children’s education? Having specific goals will guide your savings and investment decisions.

2. Assess Your Current Financial Situation: Conduct a thorough assessment of your income, expenses, debts, and existing savings. This will give you a clear picture of your starting point and help you determine how much you can realistically allocate to savings and investments.

3. Set Realistic Savings Goals: Based on your goals and financial situation, set achievable savings targets. Aim to save a certain percentage of your income each month. Start small if necessary and gradually increase your contribution as your income grows.

4. Choose the Right Savings and Investment Accounts: Explore different savings and investment options such as high-yield savings accounts, money market accounts, Roth IRAs, and mutual funds. Consider factors such as interest rates, fees, and risk tolerance when making your choices.

5. Diversify Your Investments: Don’t put all your eggs in one basket. Spread your investments across different asset classes such as stocks, bonds, real estate, and commodities. Diversification helps mitigate risk and potentially increase returns over the long term.

6. Monitor and Adjust Regularly: Keep track of your savings and investments. Review your progress periodically and make adjustments as needed. This includes reassessing your goals, adjusting your investment allocation, and ensuring your portfolio remains aligned with your risk tolerance and financial objectives.

Developing a solid savings and investment plan takes time and effort, but it’s a vital step towards securing your financial future. By following these steps, you can create a plan that helps you achieve your long-term goals and build a strong financial foundation for yourself and your family.

Reviewing and Adjusting Your Priorities Regularly

Financial priorities are not static. They evolve with your life circumstances, changing needs, and evolving goals. It’s crucial to regularly review and adjust your financial priorities to ensure they remain aligned with your aspirations.

Schedule periodic reviews of your priorities, ideally at least annually, or even more frequently during significant life events like a job change, marriage, or the birth of a child.

During your review, consider the following:

- Short-term vs. long-term goals: How have your short-term goals changed? Are they still in line with your long-term ambitions? For example, if you were focusing on paying off debt, have you reached that goal and can now focus on saving for retirement?

- Lifestyle changes: Have your spending habits changed? Are you facing any new financial challenges?

- Financial performance: Evaluate your progress towards your goals. Have you been saving enough? Are you on track to meet your investment objectives?

- Economic conditions: Changes in the economy can significantly impact your priorities. Consider adjusting your savings rate or investment strategy based on economic forecasts.

Be flexible and open to making adjustments. Don’t be afraid to reprioritize if your circumstances or goals change. Adjusting your financial plan allows you to stay on track and maximize your chances of long-term success.