Are you worried about the rising cost of living? You’re not alone. Inflation, the ongoing increase in the price of goods and services, is a major concern for many people. It erodes the purchasing power of your hard-earned money, making it harder to afford the things you need and want. But understanding inflation doesn’t have to be a scary concept. This article will break down the fundamentals of inflation, explain how it impacts your savings, and offer strategies to protect your financial well-being.

Whether you’re a seasoned investor or just starting to save, understanding inflation is essential. It affects everything from the price of groceries to the value of your retirement nest egg. By grasping the forces that drive inflation, you can make informed financial decisions and take steps to safeguard your financial future. Let’s dive in and explore the intricacies of inflation and its impact on your savings.

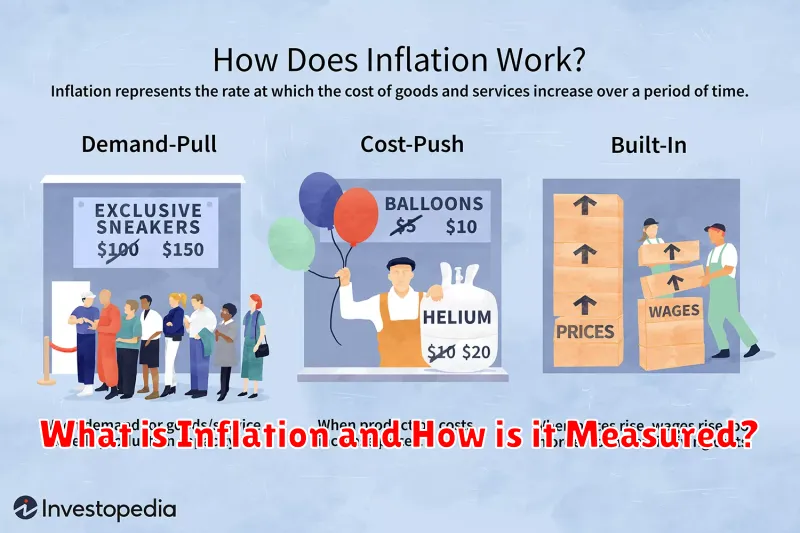

What is Inflation and How is it Measured?

Inflation is a gradual increase in the price of goods and services over time. When the price of items goes up, your money buys less than it used to. In essence, inflation erodes the purchasing power of your money.

There are several ways to measure inflation, but the most common is the Consumer Price Index (CPI). The CPI tracks changes in the price of a basket of consumer goods and services, such as food, housing, transportation, and healthcare. The CPI is often referred to as the “inflation rate.”

Here are some of the key ways to measure inflation:

- Consumer Price Index (CPI): This is the most commonly used measure of inflation. It tracks changes in the price of a basket of goods and services that are typically consumed by urban households.

- Producer Price Index (PPI): This measure tracks changes in the prices of goods at the wholesale level. It can provide an early indication of potential future changes in consumer prices.

- Personal Consumption Expenditures (PCE) Price Index: This index tracks the prices of goods and services purchased by consumers. It is often considered a more comprehensive measure of inflation than the CPI, as it includes a wider range of goods and services.

Understanding inflation is crucial for managing your finances effectively. By staying informed about inflation trends, you can make better decisions about your savings and investments.

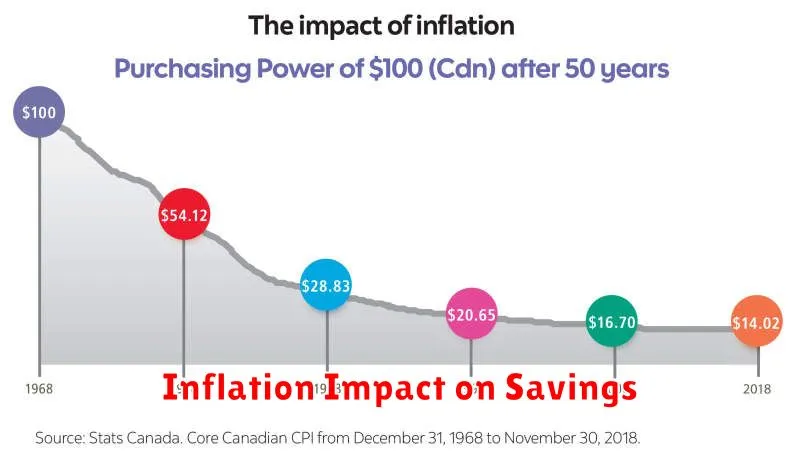

The Erosive Effects of Inflation on Purchasing Power

Inflation is a natural part of a healthy economy, but it can have a significant impact on your savings and your purchasing power. When prices rise, the value of your money decreases. This means that you can buy fewer goods and services with the same amount of money. This is known as the erosive effect of inflation.

Think about it this way: if a gallon of milk cost $3.00 last year and now costs $3.50, you can buy 14% fewer gallons of milk with the same amount of money. This may not seem like a big deal, but over time, the effects of inflation can add up. If prices continue to rise at a steady rate, your savings will lose value over time.

One of the most significant ways inflation erodes purchasing power is through the impact on interest rates. When inflation is high, banks need to charge higher interest rates to protect their profits. This means that you may not earn enough interest on your savings to keep pace with inflation. In some cases, you may even lose money in real terms because the interest you earn is less than the rate of inflation.

The erosive effects of inflation can have a significant impact on your financial well-being. It’s important to understand the effects of inflation and to take steps to protect your savings.

How Inflation Affects Different Asset Classes

Inflation is a general increase in the prices of goods and services over time. It can erode the purchasing power of your savings, meaning that your money will buy less in the future than it does today. The impact of inflation on different asset classes can vary significantly. Here’s a breakdown of how some common asset classes are affected:

Cash is the most vulnerable asset class to inflation. As prices rise, the real value of your cash declines. Holding onto large amounts of cash during periods of high inflation can lead to significant purchasing power loss.

Bonds are fixed-income securities that pay a fixed interest rate. When inflation rises, the value of bonds can decline. This is because the fixed interest payments become worth less in real terms as prices increase. Bonds with longer maturities are generally more sensitive to inflation.

Stocks, on the other hand, can offer some protection against inflation. Companies can raise prices for their goods and services, which can help offset the impact of inflation on their profits. Additionally, stocks often have the potential to grow in value over time, outpacing inflation.

Real estate is a tangible asset that can provide a hedge against inflation. Land values tend to rise during inflationary periods, and rent increases can also help offset the impact of inflation on your investment.

Gold is often considered a safe haven asset during periods of economic uncertainty. Gold tends to rise in value during periods of high inflation, as it is perceived as a store of value. However, gold does not produce income, and its value can fluctuate significantly.

It’s important to note that the impact of inflation on different asset classes can vary depending on several factors, including the level of inflation, the type of asset, and the investment strategy. Therefore, it’s crucial to carefully consider your investment goals and risk tolerance before making any investment decisions.

Protecting Your Savings from Inflation: Strategies and Tips

Inflation is a natural part of a healthy economy, but it can erode the value of your savings over time. Knowing how to protect your savings from inflation is crucial to ensuring your financial security. Here are some strategies and tips:

1. Invest in Assets That Outpace Inflation: Investing in assets that historically outpace inflation, such as stocks and real estate, can help you maintain the purchasing power of your savings. Stocks tend to rise in value faster than inflation, while real estate also appreciates over time. However, it’s essential to remember that investing carries risks, and past performance is not an indicator of future returns.

2. Consider Inflation-Protected Securities: Treasury Inflation-Protected Securities (TIPS) are bonds whose principal value adjusts with inflation. This means that your investment grows with inflation, protecting your purchasing power. However, TIPS typically have lower interest rates compared to traditional bonds.

3. Diversify Your Investments: Diversifying your investment portfolio across different asset classes like stocks, bonds, and real estate helps to mitigate risk. By spreading your investments, you reduce the impact of any single asset’s performance on your overall portfolio.

4. Increase Your Savings Rate: If inflation is eroding your savings, consider increasing your savings rate to counter the effects. Saving more frequently and in larger amounts can help you stay ahead of inflation.

5. Invest in Yourself: Investing in your skills and knowledge can enhance your earning potential, allowing you to earn more and offset the effects of inflation. Consider taking courses or workshops to improve your career prospects.

Protecting your savings from inflation is an essential part of financial planning. By adopting these strategies and remaining vigilant, you can maintain the value of your hard-earned money and secure your financial future.

Investing in Assets that Outpace Inflation

Inflation is a natural part of any healthy economy. It is a measure of how much the price of goods and services has increased over time. When the cost of goods and services rises, your purchasing power decreases. To combat inflation, investors look for assets that can outpace the rate of inflation. In other words, they want to invest in assets that will grow in value faster than the rate of inflation. This ensures that your money keeps its value and doesn’t lose ground over time.

There are many different assets that can help you outpace inflation. Some popular examples include:

- Real estate: Real estate is a tangible asset that tends to appreciate in value over time. As inflation rises, the value of real estate typically rises as well.

- Stocks: Stocks represent ownership in a company. As companies grow and become more profitable, the value of their stock can increase. Over time, the stock market has historically outpaced inflation.

- Commodities: Commodities are raw materials, such as gold, oil, and copper. As inflation rises, the prices of these commodities tend to go up. However, be aware that commodities can be very volatile and subject to price swings.

It’s important to remember that there is no guarantee that any investment will outpace inflation. There is always risk involved in investing. It is essential to research and understand the risks associated with any investment before making a decision. Consult with a financial advisor to determine the best investment strategy for your individual circumstances.

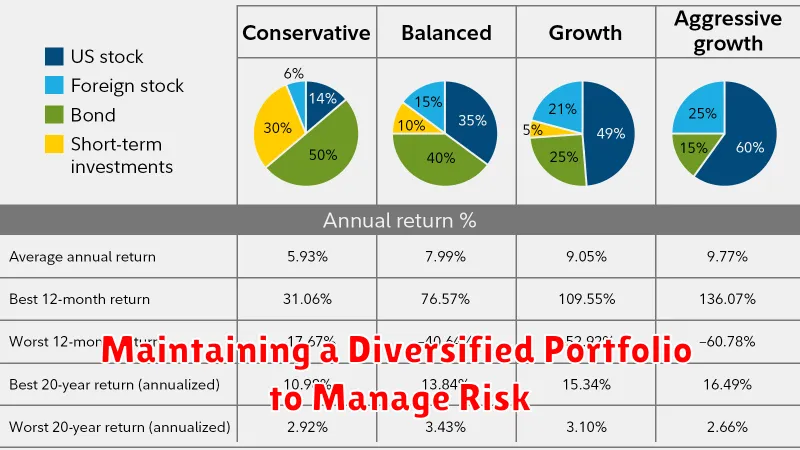

Maintaining a Diversified Portfolio to Manage Risk

Inflation can significantly impact your savings by eroding their purchasing power over time. To mitigate this risk and protect your savings, it’s essential to maintain a diversified portfolio. Diversification involves investing in various asset classes, such as stocks, bonds, real estate, and commodities, to reduce overall risk and enhance potential returns.

When you diversify your portfolio, you spread your investments across different assets with varying levels of risk and return. This means that if one asset class performs poorly, the others can potentially offset those losses, reducing the overall impact on your portfolio. For instance, during periods of high inflation, stocks tend to perform well, while bonds may struggle. By holding a mix of both, you can cushion yourself against potential losses.

A well-diversified portfolio helps you manage inflation risk by:

- Reducing Concentration Risk: Spreading investments across different asset classes minimizes the impact of any single investment’s underperformance.

- Balancing Returns: By including assets with varying levels of risk and return, you can potentially achieve consistent returns over time.

- Protecting Against Inflation: Some asset classes, like real estate and commodities, tend to perform well during inflationary periods, helping to preserve the purchasing power of your savings.

Remember, the specific asset allocation within your diversified portfolio should depend on your individual risk tolerance, investment goals, and financial situation. It’s crucial to consult with a financial advisor to determine the best allocation strategy for your circumstances.

Reviewing and Adjusting Your Savings Plan Regularly

In a world where inflation is constantly at play, it is crucial to review and adjust your savings plan regularly. Inflation erodes the purchasing power of your savings over time, so it is essential to stay ahead of the curve and ensure your goals remain achievable.

Here are some key factors to consider when reviewing your savings plan:

- Inflation rate: Monitor the current inflation rate and its projected trajectory. This will give you an idea of how quickly the value of your savings is declining.

- Investment returns: Ensure your investments are outpacing inflation. If your returns are not keeping pace, you may need to adjust your portfolio or consider higher-yielding options.

- Financial goals: Reassess your financial goals and adjust your savings plan accordingly. If your goals have changed or become more ambitious, you may need to increase your savings contributions.

- Life changes: Major life events such as marriage, childbirth, or a career change can impact your savings needs. Make sure your plan is aligned with these changes.

By regularly reviewing and adjusting your savings plan, you can protect your hard-earned money and ensure your financial goals remain achievable in the face of inflation.

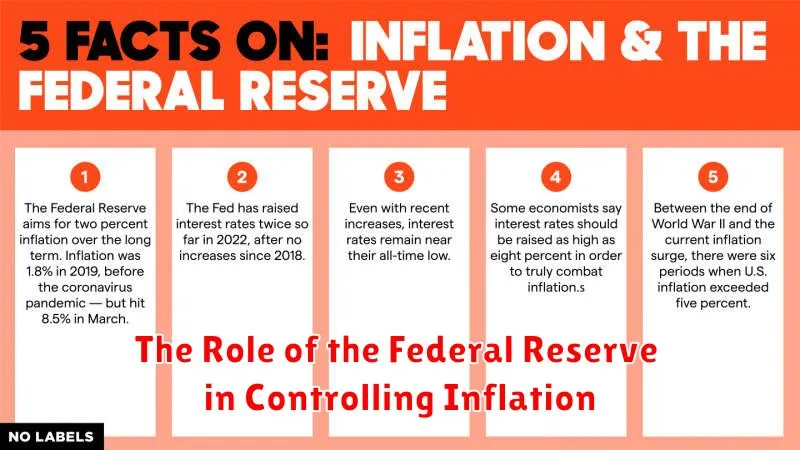

The Role of the Federal Reserve in Controlling Inflation

The Federal Reserve, often referred to as the Fed, is the central bank of the United States. One of its primary responsibilities is to control inflation and ensure price stability. The Fed uses several tools to achieve this goal, the most important being monetary policy.

Monetary policy refers to actions the Fed takes to influence the money supply and credit conditions. These tools include:

- Setting the federal funds rate: This is the interest rate banks charge each other for overnight loans. By raising or lowering the federal funds rate, the Fed influences overall interest rates in the economy.

- Buying and selling government securities: When the Fed buys bonds, it injects money into the economy, increasing the money supply. Selling bonds has the opposite effect, withdrawing money from circulation.

- Setting reserve requirements: This refers to the amount of money banks must hold in reserve. Lowering reserve requirements increases the amount of money banks can lend out, boosting the money supply.

By manipulating these tools, the Fed aims to keep inflation at a target level, typically around 2%. When inflation rises too quickly, the Fed can raise interest rates to slow down economic activity and reduce demand. Conversely, when inflation is too low, the Fed can lower interest rates to stimulate the economy and increase demand.

The Fed’s role in controlling inflation is crucial for a healthy economy. Uncontrolled inflation can erode the purchasing power of savings and create uncertainty for businesses. By maintaining price stability, the Fed helps ensure a stable and sustainable economy.