Retirement is a time to relax, travel, and enjoy the fruits of your labor. But it’s also a time when you need to plan for potential long-term care costs, which can be significant. The average cost of a private room in a nursing home is over $100,000 per year, and many people will need care for several years. If you’re not prepared financially, long-term care costs could wipe out your retirement savings, leaving you with little to no money left for your needs.

Luckily, there are steps you can take to plan for long-term care costs. With some foresight and planning, you can ensure that you have the financial resources to meet your needs in the event of a health crisis. This article will discuss how to plan for long-term care costs, including how to estimate your potential expenses, explore different payment options, and make smart financial decisions to protect your retirement savings.

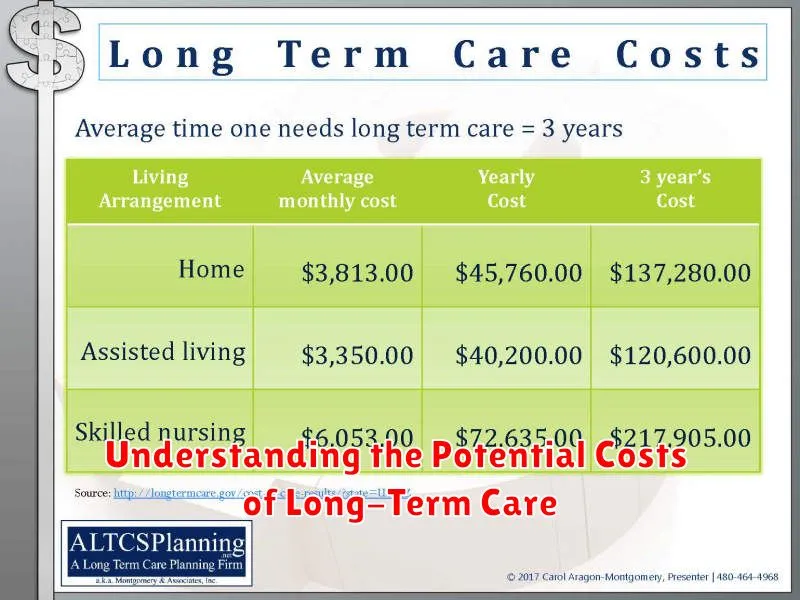

Understanding the Potential Costs of Long-Term Care

Planning for long-term care costs is an essential part of retirement planning, but it can feel overwhelming. As you navigate your retirement years, understanding the potential costs of long-term care is crucial. These expenses can vary greatly based on individual needs and location, but it’s important to acknowledge that they can be substantial.

Long-term care can include a wide range of services, such as assisted living, nursing home care, home health care, and adult day care. The costs associated with these services can fluctuate significantly, with factors like the level of care required, the geographic location, and the type of facility all playing a role. It’s important to consider that long-term care can be a substantial financial burden, potentially exceeding the cost of college tuition or even a mortgage.

For instance, the national median annual cost of a private room in a nursing home is around $100,000, while assisted living facilities can range from $3,000 to $5,000 per month. Home health care services can also be costly, with hourly rates varying depending on the type of care needed. It’s crucial to understand that these costs can add up quickly, and planning for them is essential to ensure financial stability during retirement.

While the prospect of paying for long-term care may seem daunting, there are options available. By starting your planning early, you can explore potential strategies to minimize the financial impact of long-term care expenses.

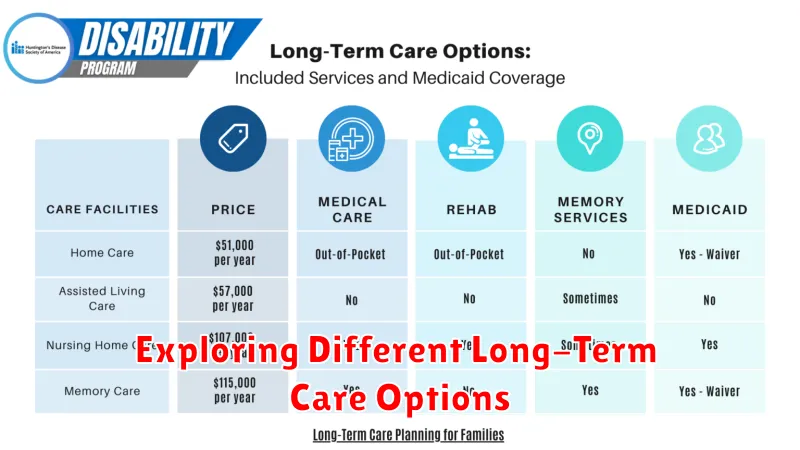

Exploring Different Long-Term Care Options

Long-term care is a broad term that encompasses a range of services designed to assist individuals who need help with activities of daily living (ADLs), such as bathing, dressing, eating, and using the toilet. The need for long-term care can arise due to various factors, including age, chronic illness, disability, and cognitive decline. As you plan for retirement, it is essential to understand the different long-term care options available and how they can help you navigate potential future needs.

Here are some of the common long-term care options you may encounter:

In-Home Care

In-home care offers the convenience and familiarity of receiving care in one’s own home. This option provides personalized assistance with daily tasks and can include:

- Personal care: Bathing, dressing, toileting, and grooming

- Homemaking services: Cleaning, laundry, meal preparation, and grocery shopping

- Companionship and supervision

- Respite care: Temporary relief for family caregivers

In-home care can be provided by:

- Home health agencies: These agencies offer skilled nursing care, physical therapy, occupational therapy, and speech therapy.

- Homemaker services: These services provide non-medical assistance with household chores and personal care.

- Private caregivers: These caregivers can be hired directly and offer personalized care based on individual needs.

Assisted Living

Assisted living facilities provide housing and supportive services for individuals who need help with ADLs but do not require the level of care offered in a nursing home. They typically offer amenities such as dining, social activities, and transportation, along with assistance with medication management, bathing, dressing, and other personal care needs.

Nursing Homes

Nursing homes offer 24-hour skilled nursing care for individuals who require a higher level of medical attention. They provide services such as:

- Skilled nursing care: Wound care, medication administration, and other medical treatments

- Physical therapy, occupational therapy, and speech therapy

- Dietary assistance

- Personal care: Bathing, dressing, toileting, and grooming

Continuing Care Retirement Communities (CCRCs)

CCRCs provide a continuum of care options, allowing residents to age in place. They offer a range of housing choices, including independent living, assisted living, and skilled nursing care. Residents typically pay a hefty entrance fee and monthly fees to access the full range of services offered by the community.

Evaluating Your Personal Health History and Family Situation

Before diving into the financial aspects of long-term care planning, it’s crucial to assess your personal health history and family situation. This provides a foundation for understanding potential risks and needs.

Review your own medical records and consider any preexisting conditions, particularly those that might escalate with age. Family history is also a valuable indicator. Do you have a history of chronic illnesses such as heart disease, dementia, or diabetes in your family? Understanding these factors can help you estimate the likelihood of needing long-term care and the potential duration of care.

Don’t shy away from difficult conversations. Discuss your health concerns and family history with your loved ones. This open communication can be a starting point for realistic planning and ensures everyone is on the same page.

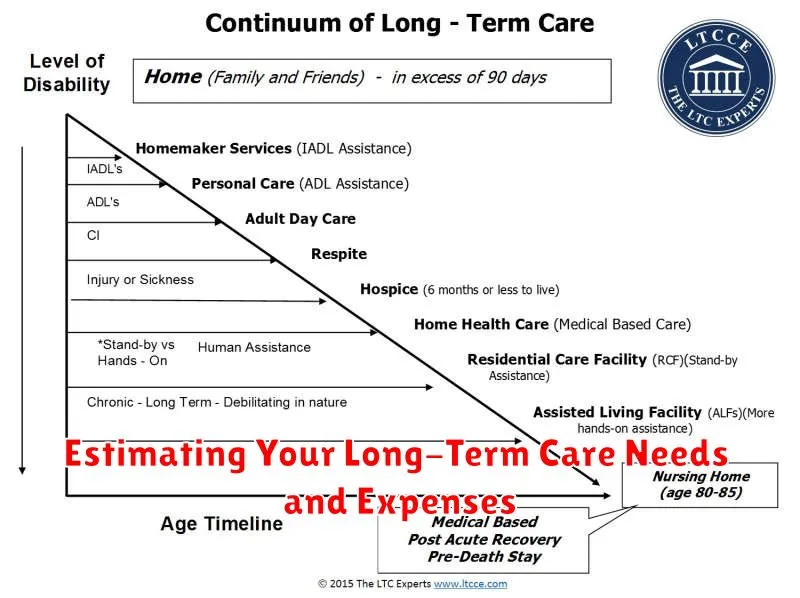

Estimating Your Long-Term Care Needs and Expenses

As you approach retirement, it’s crucial to consider the potential for long-term care needs and their associated expenses. Long-term care encompasses a wide range of services, including assistance with daily living activities like bathing, dressing, and eating, as well as medical care and supervision. These services are often required due to chronic illnesses, disabilities, or cognitive decline.

To estimate your long-term care needs, consider your family history and current health status. If you have a family history of certain conditions like Alzheimer’s disease or heart disease, you may be at increased risk of requiring long-term care. Evaluate your current health and lifestyle factors, such as your diet, exercise habits, and any existing health conditions. Consult with your physician to discuss your individual risk factors.

Determining the potential expenses associated with long-term care is equally important. Costs can vary significantly depending on the type and level of care required, the location, and the chosen facility. Assisted living facilities, nursing homes, and home health services all come with different price tags. Research local costs for these services to get an accurate picture of potential expenses.

Several resources can assist you in estimating your long-term care expenses. Websites like the Genworth Cost of Care Survey provide national and regional averages for long-term care costs. You can also contact local providers directly to obtain specific pricing information. It’s recommended to factor in inflation and potential increases in care costs over time when making your estimations.

By understanding your long-term care needs and expenses, you can begin planning for these costs in retirement. This might involve exploring various financing options, including long-term care insurance, government assistance programs, or saving strategies. It’s essential to start planning early and make informed decisions to ensure you have adequate financial resources to meet your future long-term care needs.

Types of Long-Term Care Insurance Policies Available

Long-term care insurance policies are designed to help cover the costs of care for people who can no longer care for themselves due to a chronic illness, injury, or cognitive impairment. These policies can cover a wide range of services, such as nursing home care, assisted living, adult day care, and in-home care.

There are several different types of long-term care insurance policies available, each with its own benefits and drawbacks. Here are some of the most common types of long-term care insurance policies:

Traditional Long-Term Care Insurance

These policies offer comprehensive coverage for a wide range of services, including nursing home care, assisted living, adult day care, and in-home care. Traditional policies typically have a daily benefit amount that can be used to pay for eligible care services. The length of time that benefits are paid for can vary depending on the policy.

Hybrid Long-Term Care Insurance

These policies combine elements of traditional long-term care insurance with other types of insurance, such as life insurance or an annuity. Hybrid policies can be more expensive than traditional long-term care insurance, but they may offer a higher death benefit or other benefits.

Partnership Long-Term Care Insurance

These policies are offered in conjunction with state governments. Partnership policies provide the same benefits as traditional long-term care insurance, but they also offer an asset protection feature. If you use your Partnership policy benefits, your state will not count the value of the benefits you receive as assets when determining your eligibility for Medicaid.

Long-Term Care Riders on Life Insurance

Some life insurance policies offer a long-term care rider. These riders allow you to use a portion of your life insurance death benefit to pay for long-term care services. This can be a good option if you are concerned about the cost of long-term care and don’t want to purchase a separate long-term care insurance policy.

It is important to compare different long-term care insurance policies from different companies before making a decision. You should also consider your personal needs and financial situation when choosing a policy.

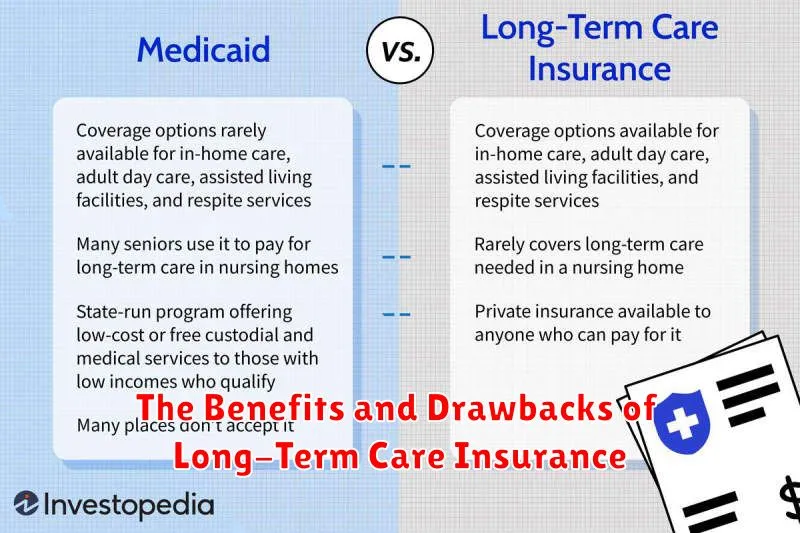

The Benefits and Drawbacks of Long-Term Care Insurance

Long-term care insurance (LTCI) is a type of insurance that helps pay for the costs of long-term care services, such as assisted living, nursing homes, and home health care. These services are often needed by people who have chronic illnesses or disabilities that make it difficult for them to live independently.

There are many benefits to having LTCI, including:

- Protection from financial ruin. Long-term care can be very expensive, and without insurance, you could be forced to spend down your life savings or rely on family members to provide care. LTCI can help you protect your assets and keep your retirement funds intact.

- Peace of mind. Knowing that you have LTCI can give you peace of mind, knowing that you’ll be able to afford the care you need if you become ill or disabled. You’ll also have the freedom to choose the type of care that’s right for you, without worrying about the cost.

- Access to a wider range of care options. LTCI can give you access to a wider range of care options, including assisted living, nursing homes, and home health care. This means you’ll be able to choose the best option for your needs and preferences.

However, LTCI also has some drawbacks, including:

- High premiums. Premiums for LTCI can be expensive, especially for older people or people with pre-existing health conditions. You’ll need to carefully consider whether you can afford the premiums before buying a policy.

- Limited coverage. Most LTCI policies have limits on the amount of coverage they provide. This means you could be responsible for paying some of the costs of your long-term care out of pocket.

- Complexity. LTCI policies can be very complex, and it can be difficult to understand all of the terms and conditions. You’ll need to carefully read your policy and ask your insurance agent any questions you have before you buy it.

Overall, LTCI can be a valuable investment for some people, but it’s important to carefully weigh the benefits and drawbacks before making a decision. If you’re considering buying LTCI, talk to a qualified insurance agent to get personalized advice.

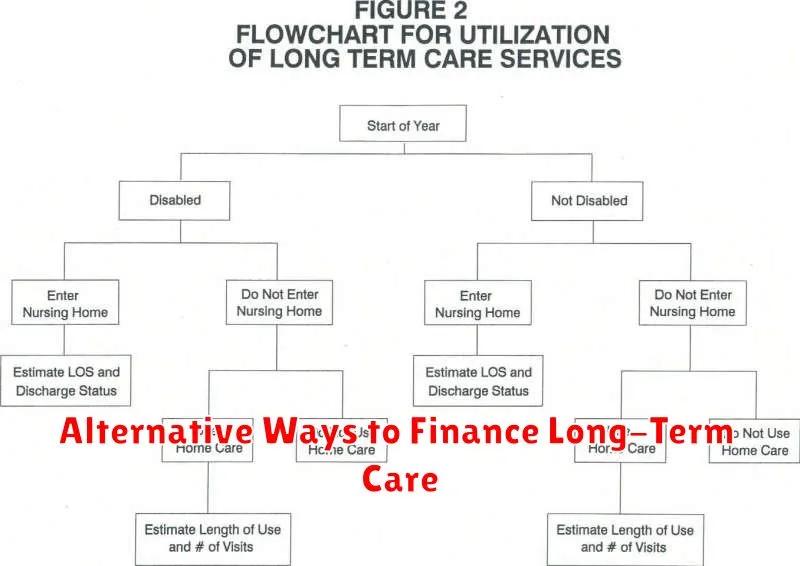

Alternative Ways to Finance Long-Term Care

Planning for long-term care is crucial in retirement, as the cost of care can quickly drain your savings. While traditional methods like Medicare and Medicaid can help, they have limitations. Fortunately, alternative financing options exist to help you cover these expenses.

One option is long-term care insurance, which provides financial protection against the high cost of care. However, it’s important to weigh the premiums against potential benefits, as policies can be expensive. Another option is reverse mortgages, which allow you to tap into your home equity. However, this option comes with risks, such as losing your home if you can’t repay the loan.

If you have assets, you can consider a life settlement, which allows you to sell your existing life insurance policy for a lump sum. This money can be used to finance long-term care. Finally, home care services can be a more affordable option than assisted living or nursing homes, but they may not be suitable for everyone.

It’s essential to research these options thoroughly and consult with financial professionals to find the best approach for your individual needs and circumstances. Remember, planning ahead and taking proactive steps can alleviate financial stress and ensure you receive the care you need in retirement.

Integrating Long-Term Care Planning into Your Overall Retirement Strategy

As you plan for retirement, it’s crucial to consider the potential need for long-term care. This often overlooked expense can significantly impact your financial security and overall retirement plan. Integrating long-term care planning into your overall retirement strategy is essential to ensure a smooth transition into your golden years.

Start by assessing your risk tolerance. How comfortable are you with the possibility of incurring substantial long-term care costs? If you have a high risk tolerance, you might consider self-insuring, relying on your savings and investments to cover potential expenses. However, for those with lower risk tolerance, exploring long-term care insurance or other financial planning options is highly recommended.

Next, create a detailed budget that includes potential long-term care costs. Consider factors like your age, health, family history, and local care costs. This will help you understand the potential financial burden and make informed decisions about your long-term care plan.

Once you have a clear understanding of your risk tolerance and potential costs, you can explore various long-term care solutions. This could include long-term care insurance, which provides financial assistance for care services, or hybrid life insurance, which combines life insurance with long-term care benefits. Additionally, consider strategies such as reverse mortgages or annuities, which can provide a stream of income to cover long-term care expenses.

Lastly, regularly review and update your plan as your circumstances and needs change. As you age and your health status evolves, your long-term care planning should be adjusted accordingly. This ensures your plan remains aligned with your current needs and financial goals.

Integrating long-term care planning into your overall retirement strategy is essential for achieving financial peace of mind and ensuring your well-being in your later years. By proactively addressing potential long-term care needs, you can mitigate financial risks and focus on enjoying a comfortable and fulfilling retirement.