Are you dreaming of a life free from the daily grind of work? Early retirement might seem like a distant dream, but with proper planning, it can become a reality. Early retirement planning is crucial for securing your financial future and enjoying your golden years on your own terms. The benefits of planning early are numerous, including greater financial security, a chance to pursue your passions, and the freedom to live life by your own design.

This article will delve into the financial advantages of early retirement planning. We’ll explore how starting early allows you to maximize your savings, minimize financial stress, and enjoy a comfortable and fulfilling retirement. Whether you’re just starting your career or nearing your mid-career years, understanding the benefits of early retirement planning can empower you to make informed decisions and achieve your financial goals.

Defining Your Early Retirement Goals

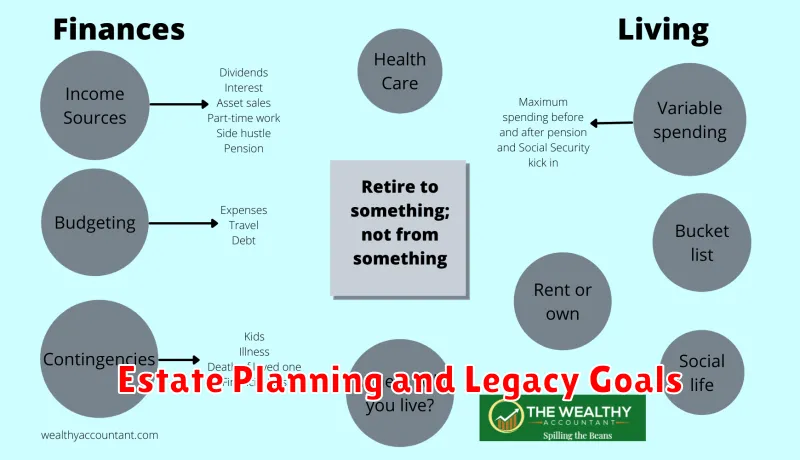

Early retirement planning is all about setting clear and achievable goals. You’re not just retiring early, you’re retiring early to achieve something specific. This could be anything from traveling the world to spending more time with family, pursuing hobbies, or starting your own business. Defining these goals will give you a clear vision of your future and help you stay motivated during the planning process.

To begin, consider what you truly value in life. What activities bring you joy? What are your passions? Once you’ve identified your core values, start thinking about how your early retirement can help you live them to the fullest.

Next, you need to be realistic about your lifestyle. Will you be living a more frugal lifestyle, or will you be maintaining your current spending habits? What about healthcare costs? How will you be funding your leisure activities and travel?

Once you have a better understanding of your values and lifestyle, you can start setting specific retirement goals. These goals should be measurable, achievable, relevant, and time-bound. For example, instead of saying “I want to travel the world,” consider saying “I want to travel to 10 different countries in the next five years.”

Remember, your retirement goals will evolve over time, so it’s important to revisit and adjust them as needed. But having a clear vision of your future is essential for making informed financial decisions and achieving your early retirement dreams.

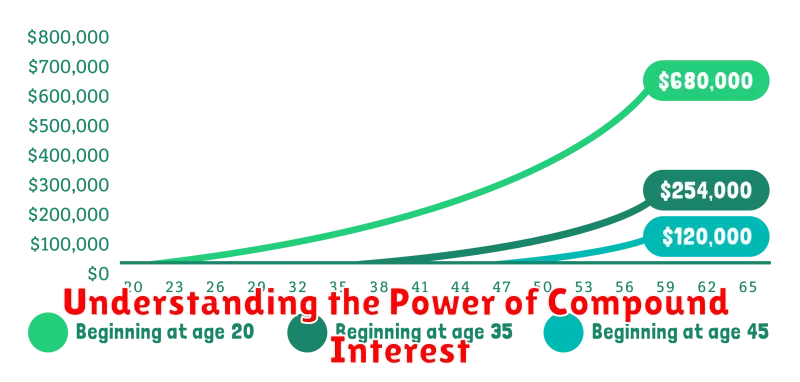

Understanding the Power of Compound Interest

Compound interest is the eighth wonder of the world. It is the most powerful tool for building wealth and achieving financial freedom. It is the interest earned on both the principal amount and the accumulated interest. In other words, it is the snowball effect in finance.

Imagine you invest $10,000 at a 7% annual interest rate. At the end of the first year, you will earn $700 in interest. In the second year, you will earn interest on the original $10,000 and the $700 in interest, which means you will earn more than $700. This cycle continues, and your investment grows exponentially over time.

The earlier you start investing, the more time compound interest has to work its magic. For example, if you invest $1,000 per year starting at age 25, you will have more than $1 million by the time you retire at age 65, assuming a 7% average annual return. However, if you start investing at age 35, you will need to invest $2,000 per year to reach the same goal.

Compound interest is a powerful force that can help you achieve your financial goals. By understanding its power and starting early, you can set yourself up for a comfortable and fulfilling retirement.

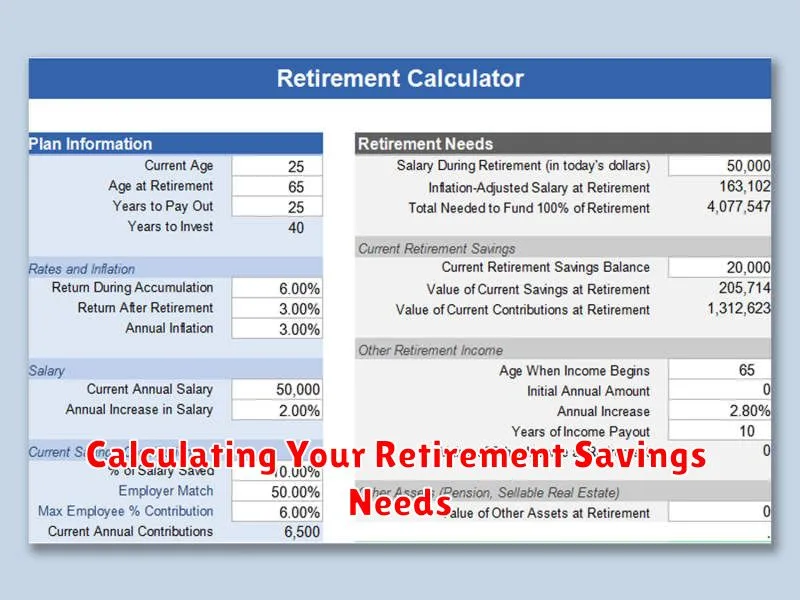

Calculating Your Retirement Savings Needs

Retirement planning is a crucial aspect of financial well-being, and one of the first steps is determining your retirement savings needs. This involves understanding how much money you’ll need to maintain your desired lifestyle during your retirement years. Here’s a step-by-step guide to calculating your retirement savings needs:

1. Estimate Your Retirement Expenses

Start by projecting your annual expenses in retirement. Consider factors like housing, healthcare, food, travel, entertainment, and any other expenses you anticipate. It’s essential to be realistic and consider potential inflation over time.

2. Determine Your Retirement Income Sources

Identify all potential income sources during retirement, including Social Security benefits, pensions, and any other investments or income streams. It’s crucial to factor in the estimated amounts you’ll receive from each source.

3. Calculate Your Savings Gap

Subtract your projected retirement income from your estimated expenses. The resulting figure is your savings gap – the amount you need to accumulate through investments to bridge the gap between your desired lifestyle and your income sources.

4. Use Retirement Savings Calculators

There are numerous online retirement savings calculators available that can help you estimate your savings needs based on your individual circumstances. These calculators typically factor in variables such as your age, desired retirement age, savings rate, investment growth rate, and projected expenses.

5. Review and Adjust Regularly

It’s important to regularly review and adjust your retirement savings plan as needed. Factors like changes in your income, expenses, or investment performance can affect your savings goals. Staying proactive will help you stay on track towards achieving your retirement financial objectives.

Maximizing Retirement Savings Through Tax-Advantaged Accounts

One of the most impactful strategies for early retirement planning is maximizing retirement savings through tax-advantaged accounts. These accounts offer significant financial benefits by allowing you to grow your savings tax-deferred or tax-free, ultimately accelerating your path to retirement. Key examples include:

- 401(k)s: Offered by employers, these accounts allow pre-tax contributions to grow tax-deferred, with withdrawals taxed in retirement. Many employers also offer matching contributions, essentially free money towards your retirement.

- Traditional IRAs: Individuals can contribute pre-tax dollars to a Traditional IRA, enjoying tax-deferred growth and tax-deductible contributions, resulting in immediate tax savings. The withdrawals are then taxed in retirement.

- Roth IRAs: Contributions to a Roth IRA are made after taxes, meaning withdrawals in retirement are tax-free, providing significant tax advantages for those anticipating being in a higher tax bracket later in life.

- Health Savings Accounts (HSAs): These accounts are specifically designed for healthcare expenses, offering tax-deductible contributions and tax-free withdrawals for qualified medical costs. They can also be used for retirement savings, offering additional flexibility.

By diligently contributing to these accounts, you can take advantage of compound interest and tax benefits, allowing your retirement savings to grow exponentially. The earlier you start, the more time your money has to work for you, amplifying your retirement potential.

Investing for Growth and Income in Retirement

Planning for retirement is crucial, and starting early provides significant financial benefits. One of the key aspects of early retirement planning is investing for growth and income. This strategy aims to build a diversified portfolio that generates both capital appreciation and regular income streams to support your lifestyle during retirement.

Investing for growth allows your portfolio to outpace inflation and maintain its purchasing power over time. This can be achieved through investments in equities, real estate, or other asset classes with the potential for long-term appreciation. On the other hand, investing for income provides a consistent stream of cash flow to cover your living expenses. This can be generated through investments in bonds, dividend-paying stocks, or other income-generating assets.

The ideal retirement portfolio strikes a balance between growth and income. A diversified portfolio containing a mix of growth and income investments helps mitigate risk and maximize returns. By starting early, you allow your investments to benefit from the power of compounding, where returns on investments generate further returns over time. This can significantly accelerate your wealth accumulation and create a comfortable financial foundation for retirement.

Seeking professional financial advice can be valuable in developing a comprehensive retirement investment plan. An advisor can help you determine your risk tolerance, assess your financial goals, and recommend a portfolio that aligns with your individual needs. Early planning and a strategic approach to investing for growth and income can set the stage for a financially secure and fulfilling retirement.

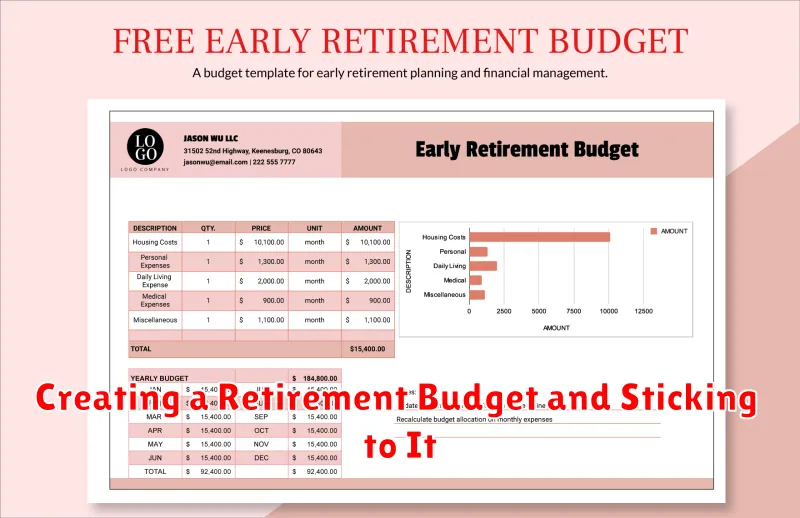

Creating a Retirement Budget and Sticking to It

A retirement budget is essential for planning a comfortable and financially secure retirement. It helps you determine how much money you need to save, how to manage your expenses, and how to make your savings last. To create a retirement budget, start by estimating your monthly expenses in retirement. This includes housing, food, healthcare, transportation, entertainment, and other necessities. You can base these estimates on your current expenses, adjusting them for inflation and potential lifestyle changes.

Next, you need to figure out your income sources in retirement. This will include Social Security benefits, pensions, and any investment income you expect to receive. Once you know your income and expenses, you can determine if you have a budget surplus or deficit. If you have a deficit, you may need to adjust your retirement plans, consider working longer, or find ways to reduce your expenses. If you have a surplus, you can use it to grow your savings or invest in a way that aligns with your risk tolerance.

To stick to your retirement budget, it’s important to track your spending. This will help you identify areas where you can cut back or save more. Regularly reviewing your budget and making adjustments as needed will help you stay on track towards your financial goals.

Creating a retirement budget and sticking to it may seem daunting, but it’s an important step toward a secure and fulfilling retirement. By taking the time to plan and track your finances, you can set yourself up for a comfortable and enjoyable retirement.

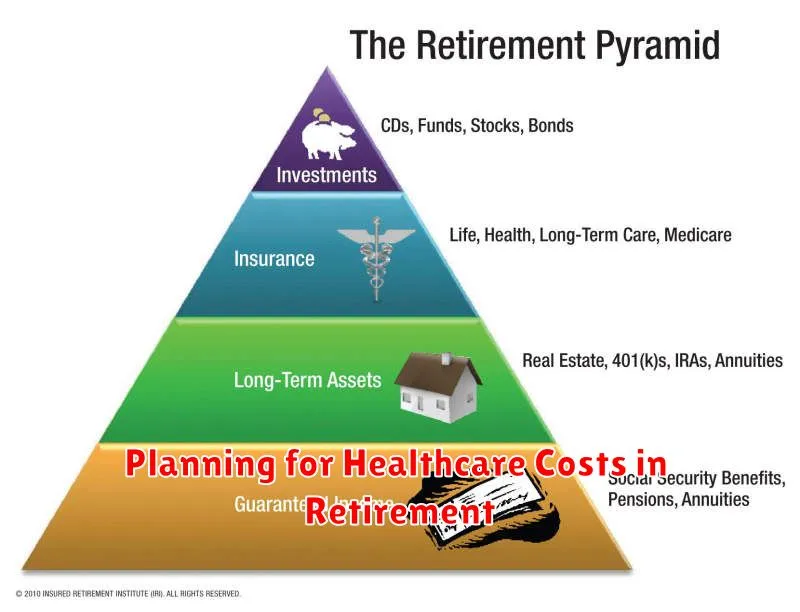

Planning for Healthcare Costs in Retirement

One of the biggest concerns for many people planning for retirement is the cost of healthcare. As you age, the likelihood of needing medical care increases, and those costs can be significant. That’s why it’s crucial to plan for healthcare expenses in retirement. Here are a few tips:

Start saving early: The earlier you begin saving for retirement, the more time your money has to grow. Consider contributing to a health savings account (HSA) if you’re eligible, as these funds can be used for healthcare expenses in retirement and grow tax-free.

Get educated: Understand the different types of healthcare coverage available in retirement, including Medicare, Medigap plans, and private insurance. Talk to a financial advisor to develop a healthcare plan that fits your needs and budget.

Consider long-term care: The possibility of needing long-term care in retirement is something many people overlook. Long-term care can be very expensive, so it’s wise to explore long-term care insurance or other strategies to prepare for this potential expense.

Live a healthy lifestyle: Maintaining a healthy lifestyle can help reduce your healthcare costs in retirement. By eating right, exercising regularly, and managing stress, you can lower your risk of chronic conditions that often require expensive treatment.

Stay informed: Keep abreast of changes in healthcare legislation and regulations. This information can help you make informed decisions about your retirement healthcare planning.

By planning for healthcare costs in retirement, you can minimize the financial burden and enjoy a more secure and comfortable retirement.

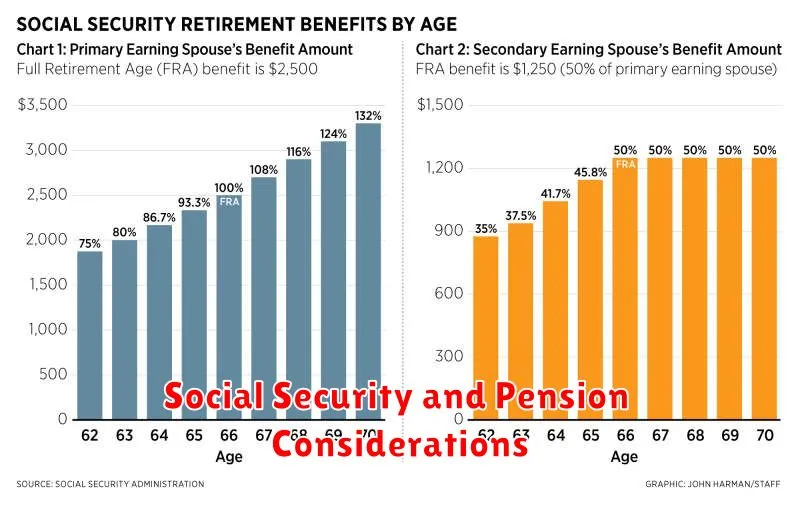

Social Security and Pension Considerations

Social Security and pension benefits can be a significant part of your retirement income. It’s important to understand how these benefits work and how they can be maximized.

Social Security: You can begin receiving Social Security benefits as early as age 62, but your benefits will be reduced. If you wait until your full retirement age (FRA), typically between ages 66 and 67, you’ll receive your full benefit. Delaying claiming Social Security beyond your FRA can increase your monthly benefit. This is often a good strategy if you are in good health and expect to live a long life.

Pensions: If you have a defined benefit pension, you’ll receive a monthly payment for life after you retire. The amount of your pension is typically based on your years of service and your average salary. You may have the option to start receiving your pension earlier, but this will usually result in a smaller monthly payment.

Coordination: It’s important to consider how Social Security and your pension might interact. Some pensions may be subject to a “Social Security offset,” which reduces the amount of your pension based on your Social Security benefit. This is why it’s essential to understand the details of your pension plan and how it interacts with Social Security before you make any decisions about claiming benefits.

Planning: Early retirement planning is essential to ensure you can maximize your Social Security and pension benefits. Work with a financial advisor to determine the best time to claim your benefits, based on your individual circumstances.

Estate Planning and Legacy Goals

Early retirement planning offers a unique opportunity to proactively address your estate planning and legacy goals. By starting early, you gain control over how your assets will be distributed and ensure your wishes are fulfilled. This allows you to shape your legacy and provide for your loved ones in a way that aligns with your values.

For example, you can use your retirement funds to create a trust for your children or grandchildren, allowing them to access the funds at specific milestones or ensuring the funds are used for their education or future endeavors. You can also establish a charitable foundation to support causes close to your heart, leaving a lasting impact beyond your lifetime.

By proactively engaging in estate planning as part of your early retirement strategy, you can mitigate potential tax burdens and ensure your assets are transferred efficiently. This can lead to substantial financial benefits for your beneficiaries and allow them to receive the full value of your hard-earned savings.