Are you a seasoned investor looking to maximize your returns or a newbie seeking a reliable source of passive income? Regardless of your experience level, understanding the role of dividends in stock investments is crucial. Dividends, the portion of a company’s profits distributed to shareholders, are a powerful tool for investors, offering a steady stream of income and the potential for capital appreciation.

This comprehensive guide will unravel the complexities of dividends, exploring their significance in stock investment strategies. From understanding different types of dividends and their tax implications to evaluating dividend-paying companies, this article will provide you with the knowledge you need to make informed decisions and unlock the potential of dividend-generating stocks.

What are Dividends?

Dividends are payments made by companies to their shareholders as a way to distribute a portion of their profits. When a company earns profits, it can choose to reinvest those profits back into the business or distribute them to shareholders. These payments can be made in cash or in the form of additional stock, which is known as a stock dividend.

Dividends are usually paid out on a quarterly basis, though some companies may pay them annually or semi-annually. The amount of the dividend is determined by the company’s board of directors and is often based on the company’s profitability. When a company pays a dividend, it is typically distributed to shareholders who own the stock at a specific date, known as the record date. The dividend payment is made on a later date, known as the payable date.

Dividends can be a valuable source of income for investors, especially those who are looking for a steady stream of cash flow. However, it is important to note that dividends are not guaranteed and can be reduced or eliminated altogether if a company experiences financial difficulties. Investors should also consider the company’s dividend history and its ability to maintain its current dividend payments before investing in a stock based solely on its dividend yield.

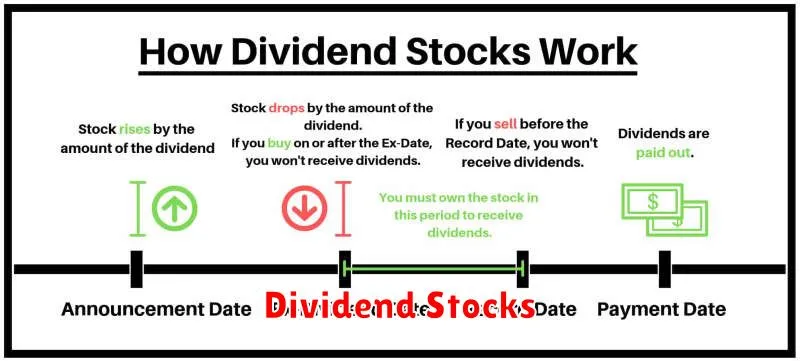

How Dividends Work

Dividends are a portion of a company’s profits that are distributed to its shareholders. When a company is profitable, it can choose to reinvest those profits back into the business or distribute them to shareholders as dividends.

Dividends are typically paid out on a quarterly basis, but they can also be paid out monthly, semi-annually, or annually, depending on the company’s dividend policy. The amount of the dividend is determined by the company’s board of directors and is usually expressed as a dollar amount per share.

There are two main types of dividends:

- Cash Dividends: The most common type of dividend, cash dividends are paid out to shareholders in the form of cash.

- Stock Dividends: Instead of cash, stock dividends are paid out in the form of additional shares of stock. These dividends do not generate any immediate cash flow for shareholders, but they increase their ownership stake in the company.

To receive a dividend, you must be a shareholder of record on the ex-dividend date. The ex-dividend date is the date on which the stock begins to trade without the dividend. This means that if you buy a stock on or after the ex-dividend date, you will not be entitled to the next dividend payment.

Types of Dividends

Dividends are payments made by a company to its shareholders out of its profits. Dividends are a crucial part of stock investment, offering investors a direct share of the company’s success. There are several types of dividends, each with unique characteristics.

Cash dividends are the most common type of dividend. As the name suggests, they are paid in cash directly to shareholders. They are typically paid quarterly and are the most straightforward and widely understood dividend type.

Stock dividends are paid in the form of additional shares of the company’s stock. These dividends are not a direct cash payment; instead, they increase the investor’s ownership stake in the company. This can be beneficial for shareholders as it potentially leads to higher future cash dividends.

Special dividends are one-time payments that are typically larger than regular dividends. They are often paid when a company has generated a significant amount of excess cash or when there is a specific event, such as a sale of a major asset or a spin-off of a subsidiary.

Dividend reinvestment plans (DRIPs) allow shareholders to automatically reinvest their dividends into additional shares of the company’s stock. DRIPs can be a powerful tool for long-term investors, as they allow them to grow their investment stake over time without having to pay any trading commissions.

Benefits of Dividend Investing

Dividend investing offers several advantages over traditional stock investing, providing a steady stream of income and potential for capital appreciation. Here are some key benefits:

Passive Income: Dividends provide a regular source of income, even if the stock price doesn’t move. This income stream can be helpful for supplementing retirement income, covering living expenses, or reinvesting back into the market.

Potential for Growth: While dividends can be a source of passive income, companies that pay dividends often also have strong track records of growth. This can lead to both dividend increases over time and potential capital appreciation on the stock price.

Enhanced Returns: Reinvesting dividends back into the market can lead to greater long-term returns due to the power of compounding. This strategy allows investors to buy more shares of the company or other investments, potentially accelerating growth.

Stability and Resilience: Companies that consistently pay dividends often have stable earnings and strong fundamentals. This can provide a degree of protection against market volatility and economic downturns, offering greater peace of mind for investors.

Focus on Quality: Many investors believe that companies that pay dividends are generally more focused on creating long-term value for shareholders. This focus on quality can potentially lead to better returns and sustainable growth.

Risks of Dividend Investing

While dividend investing can offer attractive returns, it’s important to understand the potential risks involved. Here are some key risks to consider:

Dividend Cuts: Companies can reduce or eliminate dividends due to financial difficulties, changes in business strategy, or other factors. This can significantly impact your returns and may even signal broader financial trouble for the company.

Dividend Sustainability: A company’s ability to maintain its dividend payouts depends on its profitability and cash flow. If a company’s financial performance deteriorates, its dividends may become unsustainable.

Yield Traps: High dividend yields can be tempting, but they can sometimes be a red flag. Companies with high dividend yields may be struggling and using dividends to attract investors while masking their financial weaknesses.

Market Volatility: Dividend stocks are not immune to market fluctuations. Even if a company maintains its dividend payouts, the value of its stock can still decline, impacting your investment returns.

Tax Implications: Dividend income is typically taxed as ordinary income, which can be a significant consideration, especially for high-income earners.

Diversification: It’s important to diversify your investments beyond dividend-paying stocks. Investing solely in dividend stocks could expose you to higher risks if one or more companies experience financial difficulties.

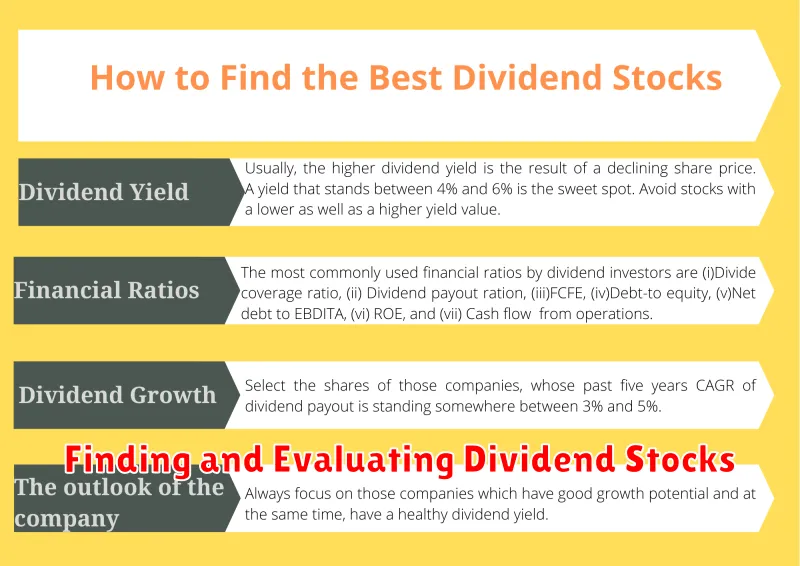

Finding and Evaluating Dividend Stocks

Dividend stocks are a popular investment choice for many investors, as they offer the potential for both capital appreciation and regular income. However, it’s important to carefully evaluate dividend stocks before investing to ensure they meet your investment goals and risk tolerance.

Here are some key factors to consider when finding and evaluating dividend stocks:

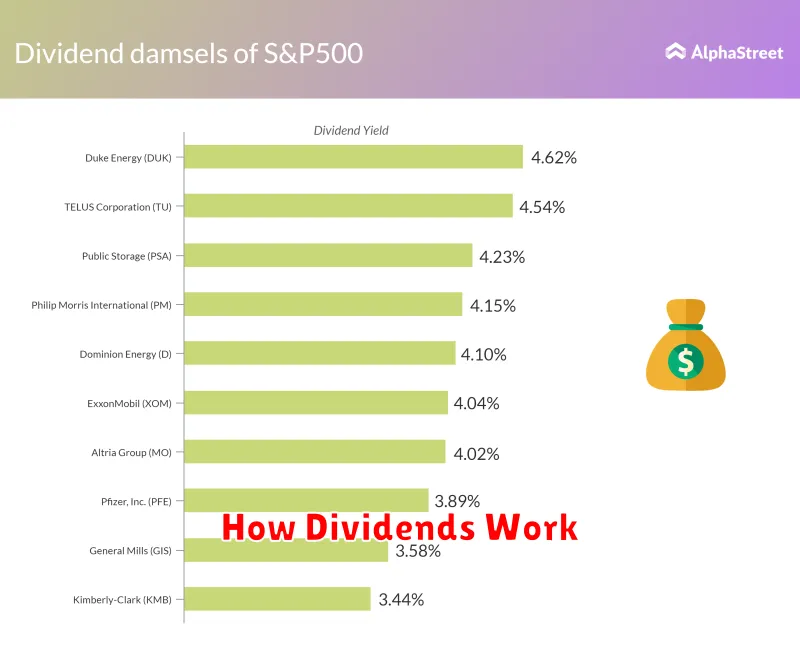

Dividend Yield

The dividend yield is a measure of how much a company pays out in dividends relative to its stock price. A higher dividend yield generally indicates a higher return on your investment, but it’s important to remember that a high yield doesn’t always mean a good investment. Look for companies with a consistent history of paying dividends and a sustainable dividend payout ratio.

Dividend Growth

A growing dividend can be a sign of a healthy and profitable company. Look for companies with a history of increasing their dividends annually. This indicates that the company is confident in its future earnings and is committed to returning value to shareholders.

Financial Health

Before investing in a dividend stock, it’s important to assess the company’s financial health. Look at key financial metrics such as earnings per share (EPS), debt-to-equity ratio, and return on equity (ROE). A strong financial position will give you more confidence that the company can continue to pay its dividends in the future.

Industry Outlook

Consider the outlook for the industry in which the company operates. Investing in a company that is operating in a declining industry may not be a good long-term investment, even if it has a high dividend yield. Look for companies that are well-positioned for growth in their respective industries.

Investment Goals

Ultimately, the best dividend stocks for you will depend on your investment goals. If you’re looking for income, you may prefer companies with high dividend yields. If you’re looking for growth, you may prefer companies with strong dividend growth potential. It’s important to find companies that align with your investment goals.

By carefully evaluating dividend stocks and considering these factors, you can increase your chances of finding profitable investments that will help you achieve your financial goals.

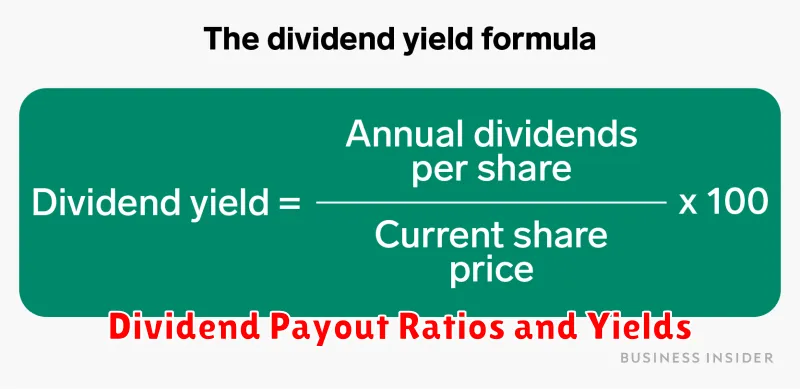

Dividend Payout Ratios and Yields

When it comes to stock investments, dividends play a crucial role. Dividends are a portion of a company’s profits that are distributed to shareholders. To understand dividends, investors need to understand two key metrics: dividend payout ratios and dividend yields.

The dividend payout ratio measures the percentage of earnings a company distributes as dividends. It’s calculated by dividing the total dividends paid out by the net income. A high payout ratio indicates that a company is returning a significant portion of its profits to shareholders, while a low ratio suggests that the company is retaining more profits for reinvestment or debt repayment.

The dividend yield, on the other hand, represents the annual dividend payment as a percentage of the stock’s current price. It’s calculated by dividing the annual dividend per share by the stock’s current price. A high dividend yield implies that a company is paying out a larger percentage of its earnings to shareholders. However, it’s important to note that a high yield doesn’t necessarily mean a better investment.

Understanding both the dividend payout ratio and dividend yield can help investors assess a company’s dividend policy and its potential for future dividend growth. A company with a consistent track record of dividend payments and a sustainable payout ratio can be an attractive investment for income-seeking investors.

Dividend Growth Investing

Dividend growth investing is a long-term investment strategy that focuses on acquiring shares of companies with a history of consistently increasing their dividend payments. This approach prioritizes companies that demonstrate robust financial health, sustainable earnings growth, and a commitment to rewarding shareholders through regular dividend distributions.

The core principle of dividend growth investing revolves around the belief that consistent dividend growth is a sign of a company’s strong financial position and long-term potential. Investors who adopt this strategy seek companies with a track record of increasing their dividend payments over time, often at a rate that exceeds inflation.

By investing in companies with a history of dividend growth, investors aim to generate a steady stream of income from their investments. These dividends can be reinvested back into the portfolio, further accelerating wealth accumulation through the power of compounding. The strategy also provides a level of portfolio stability, as dividend-paying companies often exhibit less volatility compared to their non-dividend-paying counterparts.

Key Factors to Consider for Dividend Growth Investing:

- Dividend Growth History: Look for companies with a history of consistent dividend increases.

- Payout Ratio: Evaluate the percentage of earnings that a company distributes as dividends. A sustainable payout ratio indicates the company’s ability to maintain dividend payments.

- Financial Strength: Analyze the company’s balance sheet, debt levels, and profitability to ensure its financial stability.

- Industry Outlook: Assess the future prospects of the industry in which the company operates.

- Management Team: Consider the quality and experience of the company’s leadership team.

Dividend Reinvestment Plans (DRIPs)

Dividend reinvestment plans (DRIPs) are a popular way for investors to grow their stock holdings. These plans allow investors to automatically reinvest their dividends into more shares of the company. This can be a great way to compound returns over time, as dividends are used to buy more stock, which in turn generates more dividends, and so on. Many companies offer DRIPs as a convenient way to invest, and often offer discounts on the purchase price. Some companies offer both cash and DRIP options, while others may only offer a DRIP.

Here are some of the benefits of DRIPs:

- Compounding returns: DRIPs allow investors to take advantage of the power of compounding, as dividends are used to buy more stock, which generates more dividends. This can lead to significant long-term growth in your portfolio.

- Dollar-cost averaging: DRIPs automatically invest your dividends at regular intervals. This helps you avoid the risk of market timing and can help you buy stocks at a lower average price.

- Convenience: DRIPs take the hassle out of investing, as your dividends are automatically reinvested. This can be a great option for investors who are busy or new to investing.

- Discounts on share purchases: Some companies offer discounts on the purchase price of shares through their DRIPs. This can help you save money on your investment.

However, there are some drawbacks to DRIPs. One of the major drawbacks is that you are required to pay brokerage fees and other costs, although the DRIP program will most likely be cheaper than purchasing the shares individually.

DRIPs can be a great way to invest for the long term. They can help you compound your returns, dollar-cost average your investments, and make investing easier. If you are considering investing in a company that offers a DRIP, be sure to weigh the pros and cons before you decide.

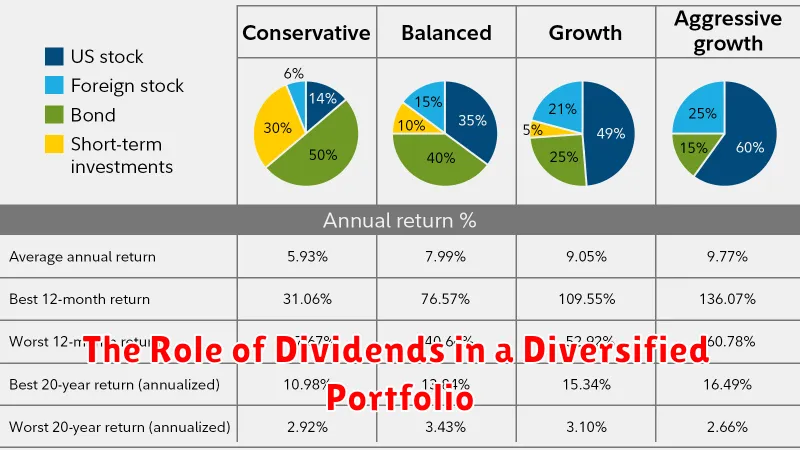

The Role of Dividends in a Diversified Portfolio

Dividends, the regular payments companies make to their shareholders, can play a significant role in a diversified portfolio. They offer several advantages that investors should consider:

Income Generation: Dividends provide a consistent stream of income, especially for investors seeking to supplement their retirement income or generate passive income. This regular income can be reinvested back into the market, potentially accelerating portfolio growth through compounding.

Risk Mitigation: Dividends can act as a cushion against market volatility. During market downturns, dividend-paying stocks often tend to outperform their non-dividend-paying counterparts, providing some stability to a portfolio.

Portfolio Diversification: Including dividend-paying stocks in a diversified portfolio can provide exposure to various sectors and industries. This helps reduce overall portfolio risk by spreading investments across different asset classes.

Valuation Signal: Dividend payments can signal a company’s financial health and commitment to shareholder value. Companies that consistently pay dividends often have a strong track record of profitability and stability.

However, it’s important to note that dividends are not guaranteed and can be reduced or eliminated at any time. Investors should carefully consider the financial health and dividend history of companies before investing.