Retirement may seem like a distant dream in your 30s and 40s, but the sooner you start planning, the more comfortable and secure your golden years will be. It’s never too early to begin strategizing for the future, and the earlier you start, the less financial stress you’ll face later in life. This article will serve as a roadmap for financial success, guiding you through essential steps to plan for a fulfilling retirement.

Navigating retirement planning can feel overwhelming, but breaking it down into manageable steps can make it seem less daunting. This guide will discuss crucial topics such as saving and investing, determining your retirement goals, understanding your risk tolerance, and exploring different retirement income sources. By following these steps, you can lay a solid foundation for a financially secure future, ensuring you can enjoy retirement to the fullest.

Why Start Retirement Planning in Your 30s and 40s?

While the idea of retirement might seem distant in your 30s and 40s, starting your retirement planning early has numerous advantages that will set you up for a comfortable and secure future. The key is to understand that time is your most valuable asset when it comes to retirement planning.

Here’s why starting early makes a big difference:

- The Power of Compounding: The longer your investments have to grow, the more they can benefit from compound interest. This means that your initial investment can grow exponentially over time, leading to a significantly larger retirement nest egg.

- Flexibility and Control: Starting early allows you to adjust your savings strategy and make changes as your life circumstances evolve. You can experiment with different investment options, diversify your portfolio, and fine-tune your approach based on your individual goals and risk tolerance.

- Reduced Stress: Waiting until your 50s or 60s to start saving can create unnecessary financial pressure and stress. By starting early, you can take a more relaxed approach to retirement planning, knowing that you have ample time to build a solid financial foundation.

- Increased Retirement Income: The earlier you begin saving, the more you can contribute towards your retirement goals. This translates into a larger retirement income, allowing you to live comfortably without financial worries during your golden years.

While starting early is crucial, it’s never too late to begin your retirement planning journey. No matter your age, taking proactive steps to secure your future will pay dividends in the long run.

Assess Your Current Financial Situation

Before you can start planning for retirement, you need to know where you stand financially. This means taking a good look at your income, expenses, and assets. You can use a budgeting app, spreadsheet, or financial advisor to help you track your spending. Once you have a clear picture of your current financial situation, you can start to make plans for the future.

Key areas to assess include:

- Income: How much money do you earn each year?

- Expenses: How much money do you spend each month on housing, food, transportation, and other essentials?

- Assets: What assets do you own, such as a home, car, investments, and savings?

- Debt: How much debt do you have, such as student loans, credit card debt, or a mortgage?

Once you have a good understanding of your current financial situation, you can start to make plans for retirement. If you are in your 30s or 40s, you still have plenty of time to save for retirement. However, it is important to start saving early and often. The earlier you start, the more time your money has to grow.

Define Your Retirement Goals and Lifestyle

Before you can start planning for retirement, you need to have a clear idea of what you want your retirement to look like. What are your goals? Do you want to travel the world, spend more time with family, or pursue hobbies? What kind of lifestyle do you envision? Do you want to live in a big city or a small town? Do you want to be active or relaxed? Answering these questions will help you determine how much money you need to save and what kind of investments you need to make.

Once you have a good understanding of your retirement goals, you can start to create a plan to achieve them. This plan should include a budget, a savings strategy, and an investment strategy. It’s also important to regularly review and adjust your plan as your goals and circumstances change.

Estimate Your Retirement Expenses

Figuring out how much you’ll need to live comfortably in retirement is the first step to financial planning. It’s best to start early, especially in your 30s and 40s, when you have more time to adjust your spending habits. To estimate your retirement expenses, consider your current lifestyle and projected future needs.

Start by listing your current monthly expenses. This includes housing, food, transportation, healthcare, entertainment, and any other regular costs. Once you have a good understanding of your current spending, consider how your needs might change in retirement. For example, you might need to factor in costs for travel, hobbies, healthcare, or long-term care.

To make your estimations more accurate, consider using a retirement calculator. These tools can help you estimate your expenses based on factors like your age, location, and investment goals. However, keep in mind that these calculators are based on averages, so it’s essential to personalize your estimations with your individual circumstances.

It’s also important to factor in inflation. The cost of living is likely to rise over time, so your retirement expenses will likely be higher than they are today. Consider incorporating an inflation rate of 3% when estimating your future costs.

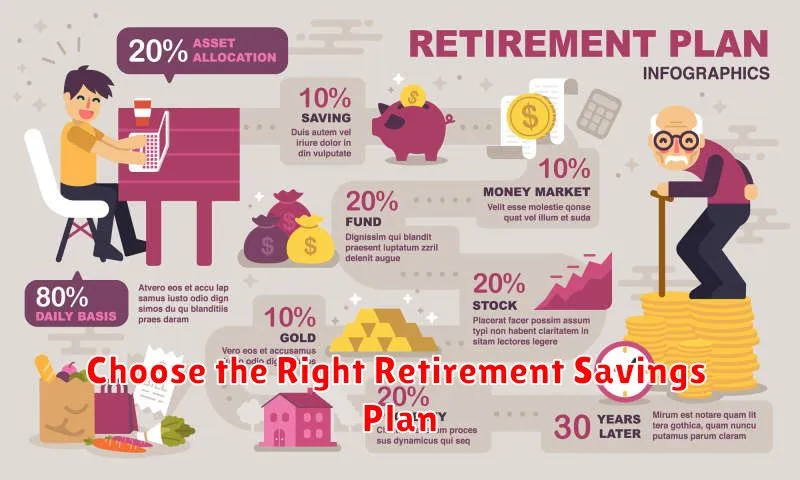

Choose the Right Retirement Savings Plan

Once you have a good idea of how much money you’ll need for retirement, it’s time to start saving. And that means choosing the right retirement savings plan. There are many different types of retirement plans available, each with its own advantages and disadvantages.

Here are a few of the most common types of retirement plans:

- 401(k): A 401(k) is a defined-contribution plan offered by many employers. With a 401(k), you contribute a portion of your paycheck to a tax-deferred account. This means you don’t have to pay taxes on the money until you withdraw it in retirement. Many employers also offer matching contributions to their employees’ 401(k) plans. This means that they will contribute a certain percentage of your contributions to your account.

- 403(b): A 403(b) is similar to a 401(k), but it’s offered by non-profit organizations, such as schools and hospitals.

- Traditional IRA: An IRA is a retirement savings account that allows you to contribute money before taxes. This means you’ll get a tax deduction for your contributions. You’ll pay taxes on your withdrawals in retirement.

- Roth IRA: A Roth IRA is a retirement savings account that allows you to contribute money after taxes. This means you won’t have to pay taxes on your withdrawals in retirement.

- Solo 401(k): A Solo 401(k) is a retirement plan designed for self-employed individuals and small business owners. This type of plan allows you to make contributions as both the employee and the employer.

The best retirement savings plan for you will depend on your individual circumstances. If you’re not sure which plan is right for you, talk to a financial advisor.

Determine Your Risk Tolerance

Before you even think about investing, you need to understand your risk tolerance. This is your ability to handle the ups and downs of the market. If you’re risk-averse, you’ll want to invest in more conservative options like bonds. If you’re comfortable with risk, you might consider stocks or other assets that have the potential for higher returns.

There are a few ways to determine your risk tolerance. You can take an online quiz, talk to a financial advisor, or simply think about how you feel about risk.

Consider these factors when determining your risk tolerance:

- Your time horizon: How long do you have before you need to access your money? The longer your time horizon, the more risk you can take.

- Your financial goals: What are you saving for? Your goals will affect your risk tolerance. If you’re saving for retirement, you can afford to take more risk than if you’re saving for a down payment on a house.

- Your current financial situation: How much debt do you have? How much emergency savings do you have? These factors will also affect your risk tolerance.

Once you understand your risk tolerance, you can start to develop a retirement plan that’s right for you.

Explore Investment Options

Once you’ve established a solid financial foundation, it’s time to explore investment options. The goal is to grow your money over time and ensure you have enough for retirement. Here are some key investment options to consider:

- Retirement Accounts: 401(k)s, 403(b)s, and Roth IRAs offer tax advantages and are designed specifically for retirement savings. Maximize contributions to these accounts to reap the benefits of compounding growth.

- Mutual Funds: These diversify your portfolio by investing in a basket of different stocks, bonds, or other assets. Mutual funds offer professional management and can be tailored to your risk tolerance and investment goals.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges, ETFs provide a cost-effective way to gain broad market exposure or target specific sectors.

- Index Funds: These track a specific market index like the S&P 500, providing low-cost diversification and the potential to mirror market returns.

- Real Estate: Investing in property can generate passive income through rentals, appreciate in value over time, and provide tax benefits. However, real estate is illiquid and requires active management.

Remember that investment strategies vary depending on your individual circumstances, risk tolerance, and financial goals. Consult with a qualified financial advisor to develop a personalized investment plan that aligns with your retirement aspirations.

Maximize Employer-Sponsored Retirement Plans

Employer-sponsored retirement plans, such as 401(k)s and 403(b)s, offer valuable tax advantages and potential company matching contributions. To maximize these benefits, you should contribute the maximum amount allowed, especially if your employer offers a match. This matching contribution is essentially free money, so don’t miss out! Consider increasing your contributions gradually over time to make it less noticeable to your budget.

If you’re unsure about investment options, consult with your plan administrator or a financial advisor. They can help you choose investments that align with your risk tolerance and retirement goals. Remember, you’re not obligated to invest solely in your employer’s stock, and you can diversify your portfolio across various asset classes.

Make sure to understand the plan’s vesting schedule, which determines how much of your employer’s contribution you’re entitled to if you leave the company. Take advantage of any educational resources offered by your employer to learn more about your plan and how to optimize your contributions. By maximizing your employer-sponsored retirement plan, you’ll be setting yourself up for a more secure and comfortable retirement.

Consider Individual Retirement Accounts (IRAs)

Individual Retirement Accounts (IRAs) offer tax advantages that can help you save for retirement. There are two main types of IRAs: traditional and Roth. With a traditional IRA, you contribute pre-tax dollars, meaning you won’t pay taxes on the money until you withdraw it in retirement. Contributions may also be tax-deductible, lowering your current tax liability. Roth IRAs, on the other hand, are funded with after-tax dollars, so your withdrawals in retirement are tax-free.

The best option for you will depend on your individual circumstances, such as your current income, anticipated tax bracket in retirement, and your risk tolerance. If you expect to be in a lower tax bracket in retirement, a traditional IRA may be more advantageous. However, if you anticipate being in a higher tax bracket in retirement, a Roth IRA could be a better choice.

No matter which type of IRA you choose, make sure to contribute the maximum amount allowed each year. This will help you maximize your retirement savings and take advantage of the tax benefits offered by IRAs.

Pay Down High-Interest Debt

It may seem counterintuitive, but paying down high-interest debt is a crucial step in your retirement planning journey, especially during your 30s and 40s. High-interest debt, such as credit card debt or payday loans, can significantly eat into your savings potential. Imagine this: you’re diligently saving for retirement, but simultaneously paying sky-high interest rates on your debt. You’re essentially working for the lender, not for your future self!

By aggressively tackling high-interest debt, you free up a significant portion of your income. This freed-up cash flow can then be redirected towards retirement savings, allowing your investments to grow faster and compound over time. The sooner you eliminate high-interest debt, the sooner you can start maximizing your retirement savings potential.

Review and Adjust Your Plan Regularly

Your retirement plan is not a set-and-forget endeavor. Life is full of unforeseen circumstances and shifting priorities, and your retirement plan needs to adapt accordingly.

Make it a habit to review your plan at least annually, and more often if you experience significant life changes such as a job change, marriage, or the birth of a child. These events can impact your income, expenses, and savings goals, requiring you to adjust your plan.

During your review, consider these key questions:

- Have your income or expenses changed significantly?

- Have your investment goals or risk tolerance shifted?

- Are you on track to meet your retirement savings targets?

- Are there any changes in the tax laws or retirement regulations that could affect your plan?

By regularly reviewing and adjusting your plan, you can ensure that it remains relevant to your needs and helps you achieve your retirement goals.

Seek Professional Financial Advice

Retirement might seem far off, but it’s never too early to start planning. A financial advisor can provide personalized guidance tailored to your specific needs, financial situation, and retirement goals. They can help you with various aspects of your retirement planning, including:

- Determining your retirement savings goals

- Creating a personalized investment strategy

- Choosing appropriate investment vehicles

- Monitoring your portfolio and making adjustments as needed

- Developing a retirement income plan

Seeking professional advice can provide you with peace of mind and ensure that you’re on the right track to achieve your retirement goals. Remember, it’s an investment in your future and a crucial step towards a comfortable and secure retirement.