Retirement may seem like a distant dream, especially when you’re just starting out in your career. But the truth is, the sooner you start saving, the better. Early retirement savings can make a huge difference in your financial future, allowing you to retire comfortably and pursue your passions without financial stress. It’s never too early to start planning for your golden years, and the benefits of starting early far outweigh the perceived inconvenience.

This article will explore best practices for saving for retirement early, covering everything from setting realistic goals to choosing the right investment strategies. We’ll also address common concerns and provide actionable tips to help you get started on your journey to financial security. Whether you’re fresh out of college or just starting to think about retirement, this guide will equip you with the knowledge and motivation to secure your financial future.

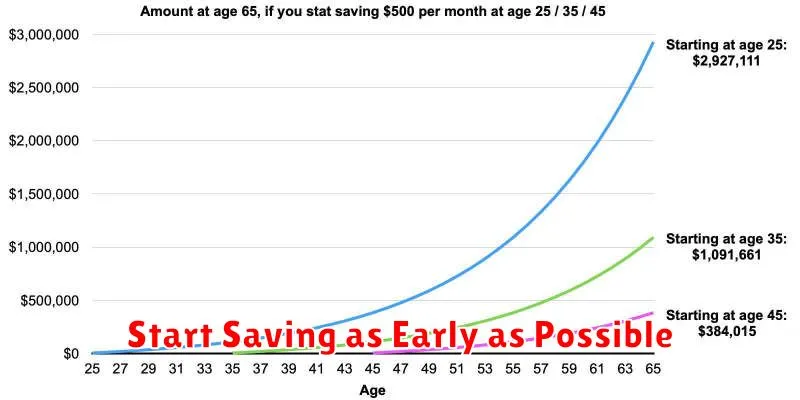

Start Saving as Early as Possible

The earlier you start saving for retirement, the better. This is because of the magic of compound interest. Compound interest is the interest earned on your savings, plus the interest earned on that interest. The longer your money has to grow, the more it will compound.

For example, if you invest $1,000 at age 25 and earn an average annual return of 7%, you will have over $76,000 by age 65. But if you wait until age 35 to start investing, you will only have about $44,000 by age 65.

Even if you can only afford to save a small amount each month, every dollar counts. The key is to start saving early and consistently.

Set Clear Retirement Goals and Create a Plan

Before you start saving for retirement, it’s essential to have a clear picture of your financial goals. Ask yourself some important questions: What kind of lifestyle do you envision in retirement? How much income will you need to maintain that lifestyle? What age do you plan to retire? What are your potential retirement expenses?

Once you have a clear understanding of your retirement aspirations, you can set specific, measurable, achievable, relevant, and time-bound (SMART) goals. These goals should be both short-term and long-term, providing a roadmap for your savings journey.

With your goals defined, you can create a comprehensive retirement plan. This plan should include details about your savings strategy, investment choices, and potential sources of retirement income. Regularly reviewing and adjusting your plan as needed is crucial, especially as your circumstances and goals evolve.

Remember, setting clear goals and creating a well-defined plan will provide the foundation for successful retirement savings. It will help you stay motivated, make informed decisions, and ultimately achieve your financial goals for a comfortable and fulfilling retirement.

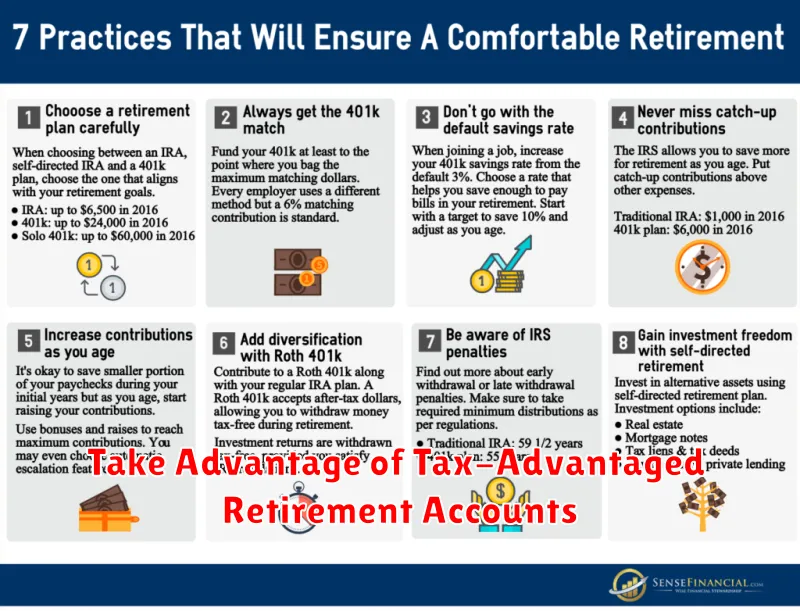

Take Advantage of Tax-Advantaged Retirement Accounts

One of the best things you can do for your retirement is to take advantage of tax-advantaged retirement accounts. These accounts allow you to save money for retirement while reducing your tax burden.

There are two main types of tax-advantaged retirement accounts: traditional IRAs and Roth IRAs. Traditional IRAs allow you to deduct your contributions from your taxes, meaning you’ll pay less in taxes today. However, you’ll have to pay taxes on your distributions in retirement. Roth IRAs, on the other hand, don’t offer any tax deductions for contributions, but your distributions in retirement are tax-free.

Which type of account is right for you depends on your individual circumstances. If you expect to be in a lower tax bracket in retirement than you are now, a traditional IRA may be a better option. If you expect to be in a higher tax bracket in retirement, a Roth IRA may be better.

In addition to IRAs, there are also employer-sponsored retirement plans like 401(k)s and 403(b)s. These plans allow you to contribute pre-tax dollars to your retirement savings. Some employers also offer a matching contribution, which means they will contribute to your account for every dollar you contribute. This is free money, so be sure to take advantage of it!

The earlier you start saving for retirement, the more time your money has to grow. Even if you can only afford to save a small amount each month, it will add up over time. And with the power of compound interest, your savings will grow exponentially over the years.

Don’t wait to start saving for retirement. Take advantage of tax-advantaged retirement accounts and start investing today!

Invest Aggressively in Your Early Years

One of the most impactful things you can do to secure your retirement is to invest aggressively in your early years. This means maximizing your contributions to retirement accounts like 401(k)s and IRAs, and choosing investments with the potential for higher growth, even if they carry more risk. The power of compounding works in your favor, allowing your investments to grow exponentially over time.

The earlier you start, the more time your money has to work for you. Think of it like a snowball effect: the earlier you start rolling, the bigger your snowball will become. Even small contributions made early on can translate into substantial wealth by the time you retire. Don’t underestimate the power of time and early investment.

Live Below Your Means and Avoid Lifestyle Inflation

One of the most crucial steps in saving for retirement early is to live below your means. This means spending less than you earn and avoiding the trap of lifestyle inflation, where your expenses rise as your income increases. It’s tempting to upgrade your lifestyle when you get a raise or promotion, but resisting this urge can make a huge difference in your savings.

To live below your means, create a realistic budget and track your expenses carefully. Identify areas where you can cut back, even if it’s just small amounts here and there. This could include reducing your dining out budget, finding cheaper entertainment options, or negotiating lower rates on your bills.

Avoiding lifestyle inflation involves being conscious of your spending habits and resisting the urge to keep up with the Joneses. When you get a raise, consider using the extra income to increase your retirement savings rather than upgrading your car or moving to a larger house. By staying disciplined and focused on your financial goals, you can build a strong foundation for a comfortable retirement.

Diversify Your Investment Portfolio

One of the most crucial aspects of saving for retirement early is diversifying your investment portfolio. Diversification is the key to mitigating risk and maximizing potential returns. Instead of putting all your eggs in one basket, a diversified portfolio spreads your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This approach helps to balance out potential losses in one area by the potential gains in another.

Think of it like this: Imagine you have a basket of fruits. If you only put apples in the basket, and something happens to the apple trees (like a disease or a bad harvest), your entire basket will be empty. But if you have a mix of fruits, such as apples, oranges, and bananas, even if one fruit type fails, you still have other options.

Similarly, a diversified investment portfolio helps you weather market fluctuations and economic downturns. When one asset class performs poorly, others may perform well, helping to maintain the overall value of your portfolio. A good rule of thumb is to choose investments with varying levels of risk and potential return, and to adjust your portfolio periodically as your financial goals and risk tolerance change.

Consider Working with a Financial Advisor

While it may seem daunting, working with a financial advisor can be a game-changer for your retirement savings journey. They provide invaluable expertise and guidance to help you make informed decisions about your investments.

A financial advisor can help you create a personalized retirement plan tailored to your individual needs, goals, and risk tolerance. They can also help you navigate the complexities of investment options, identify potential tax advantages, and ensure your portfolio is properly diversified.

Moreover, a financial advisor can act as a trusted confidant and provide ongoing support and accountability. They can help you stay on track with your retirement goals and make necessary adjustments along the way.

Ultimately, working with a financial advisor can significantly enhance your chances of achieving a comfortable and secure retirement. Consider consulting with a qualified professional to explore the benefits they can offer.

Automate Your Savings and Investments

One of the most effective ways to ensure you’re saving consistently for retirement is to automate your savings and investments. By setting up automatic contributions to your retirement accounts, you take the guesswork and effort out of saving. This approach offers several key benefits:

Consistency: Automatic contributions ensure you save regularly, even when you forget or are busy. It eliminates the potential for procrastination and helps you stay on track towards your goals.

Discipline: Automating your savings helps you develop financial discipline. By making saving a habit, you’ll be less likely to spend impulsively and more likely to prioritize your future financial security.

Time Savings: You won’t need to manually transfer funds or track your progress. Automation simplifies the process, saving you valuable time and mental energy.

Compounding Benefits: When you automate your investments, you capitalize on the power of compounding. Even small, consistent contributions can grow significantly over time, thanks to the magic of compounding returns.

Dollar-Cost Averaging: Automating investments allows you to take advantage of dollar-cost averaging. This strategy involves investing a fixed amount at regular intervals, regardless of market fluctuations. This helps you avoid trying to time the market and can smooth out your overall returns over time.

Setting up automatic contributions is usually a straightforward process with most retirement accounts and investment platforms. You can choose the amount you want to contribute, the frequency of contributions, and the investment options you prefer. Consider setting up automatic contributions to both your employer-sponsored retirement plan (like a 401(k)) and a Roth IRA or traditional IRA.

Automating your savings and investments is a powerful tool for building a secure financial future. By taking this proactive step, you can set yourself up for a comfortable and fulfilling retirement.

Review and Adjust Your Plan Regularly

Saving for retirement is a long-term game, and your life circumstances can change significantly over time. To ensure you’re on track to meet your goals, it’s crucial to review and adjust your retirement plan regularly. Life events like marriage, the birth of a child, job changes, or a significant increase in your income can affect your savings needs and investment strategy.

Here are some key aspects to review:

- Your savings goals: Are your current savings goals still realistic? Have your financial priorities shifted? Have you achieved any milestones?

- Your investment strategy: Are you still comfortable with your current asset allocation? Do you need to adjust your risk tolerance based on your age and time horizon?

- Your contribution amount: Are you able to increase your contributions? Have you taken advantage of any employer matching programs?

- Your expenses: Have your expenses increased or decreased? Are there any areas where you can cut back to save more for retirement?

It’s recommended to review your plan at least annually. This will ensure that you’re making progress toward your goals and that your plan is still aligned with your current situation. If you’re unsure about how to adjust your plan, consider seeking advice from a financial advisor.