Are you looking for a way to build wealth and secure your financial future? Look no further than real estate investment. Real estate has historically been one of the most reliable and profitable investment avenues, offering a diverse range of options to suit different financial goals and risk appetites. From purchasing rental properties to investing in REITs, there are numerous ways to capitalize on the power of real estate and watch your wealth grow.

This comprehensive guide will delve into the intricacies of real estate investment, providing you with valuable insights and practical strategies to navigate the market successfully. We’ll explore various investment approaches, analyze the potential risks and rewards, and equip you with the knowledge to make informed decisions that align with your financial aspirations. So, whether you’re a seasoned investor or just starting your journey, join us as we unlock the secrets to building wealth through the dynamic world of real estate.

Types of Real Estate Investments: Residential, Commercial, and More

Real estate investment offers a diverse range of avenues for building wealth. Understanding the various types of real estate investments is crucial for making informed decisions. Here are some common categories:

Residential Real Estate: This segment encompasses properties designed for residential purposes, such as single-family homes, townhouses, condominiums, and multi-family dwellings. It’s often considered a more accessible entry point for new investors due to its potential for rental income and appreciation.

Commercial Real Estate: Commercial properties are designed for business use, including office buildings, retail spaces, industrial facilities, and hotels. These investments often require larger capital outlay but also offer higher potential returns, driven by long-term leases and tenant businesses.

Industrial Real Estate: This category comprises properties used for manufacturing, warehousing, and distribution. Industrial properties are typically characterized by large spaces and specific infrastructure requirements.

Land: Investing in raw land can be a long-term strategy. Land value can appreciate over time, especially in areas experiencing growth and development. This type of investment often involves holding the land for future development or resale.

REITs (Real Estate Investment Trusts): REITs are publicly traded companies that own and operate income-producing real estate assets. They offer investors a way to diversify their portfolio by investing in a basket of real estate assets, including residential, commercial, and industrial properties.

Real Estate Crowdfunding: This emerging investment avenue allows investors to pool their resources to fund real estate projects, such as residential developments, commercial buildings, or land acquisition. It provides access to projects that may not be accessible to individual investors.

Understanding the nuances of each type of real estate investment is essential for selecting strategies aligned with your financial goals and risk tolerance. It’s recommended to conduct thorough research, consult with financial advisors, and seek professional guidance to make informed investment decisions.

Analyzing Real Estate Markets and Identifying Opportunities

Before diving into any real estate investment, it’s crucial to thoroughly analyze the market you’re interested in. This involves understanding the current state of the market, identifying potential trends, and pinpointing areas with strong growth potential. There are several key factors to consider:

Economic Indicators: Look at factors like job growth, population growth, and income levels. A strong economy with a growing population and rising incomes generally indicates a healthy real estate market.

Demographics: Analyze the age, income, and family size of the target audience. Knowing the demographics can help you predict demand for different property types and sizes. For example, a growing number of young professionals might indicate an increased demand for urban condominiums.

Local Development: Assess the presence of new businesses, infrastructure projects, or government initiatives. These factors can significantly impact property values and rental demand. For instance, a new highway or a tech hub in a particular area could drive up property prices.

Competition: Understand the current supply of available properties and the level of competition among landlords or sellers. High supply and low demand might signal a buyer’s market, while low supply and high demand could indicate a seller’s market.

Rental Market Analysis: If you’re considering rental properties, research average rental prices, occupancy rates, and vacancy rates in the area. This will help you determine the potential rental income and the overall stability of the rental market.

Property Values: Analyze historical property values and trends in the area. Look for markets with a consistent appreciation rate and a history of stability. This information can help you estimate potential returns on your investment.

By meticulously analyzing these factors, you can identify potential opportunities for profitable investments in real estate. It’s crucial to be patient, conduct thorough research, and adapt your strategy based on market dynamics.

Financing Options for Real Estate Investments

Securing financing is a crucial step in real estate investing. Fortunately, there are several options available, each with its pros and cons:

Traditional Mortgages: These loans are obtained from banks or mortgage lenders and are typically used for residential properties. They often require a down payment of 20% or more and come with fixed or adjustable interest rates.

Private Loans: These loans are obtained from private individuals or institutions, and they can offer more flexibility in terms of loan terms and requirements. However, they often come with higher interest rates.

Hard Money Loans: Hard money loans are short-term loans secured by real estate. They are often used for quick property flips or renovations. These loans usually have high interest rates and fees.

Seller Financing: In this scenario, the seller provides financing for the buyer, often in the form of a land contract or owner financing. This option can be beneficial for buyers with limited credit or a small down payment.

Home Equity Loans: These loans are secured against the equity of a homeowner’s existing property. They can be used for a variety of purposes, including real estate investments.

Crowdfunding: Crowdfunding platforms allow investors to pool their money to fund real estate projects. This can be a viable option for investors looking to invest in larger projects.

REITs (Real Estate Investment Trusts): REITs are companies that own and operate income-producing real estate. Investors can purchase shares of REITs, providing them with exposure to the real estate market without directly owning property.

The best financing option for you will depend on your individual financial situation, investment goals, and risk tolerance. It’s important to compare different loan options carefully and seek advice from a qualified financial advisor.

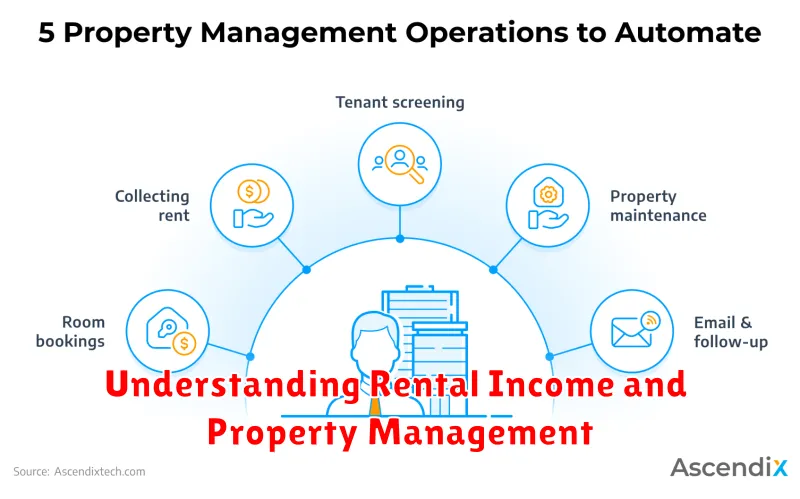

Understanding Rental Income and Property Management

Rental income is the lifeblood of any real estate investment. It’s the money you earn from renting out your property. Understanding how to maximize your rental income and manage your properties effectively is crucial to building wealth through real estate. Here are some key factors to consider:

Rental Rates: Research the current market and comparable properties to set competitive rental rates. You want to attract tenants while ensuring you’re getting a fair return on your investment.

Vacancy Rates: It’s unlikely you’ll have a tenant living in your property 100% of the time. Account for potential vacancy periods by calculating a realistic vacancy rate. This rate can fluctuate based on location, property type, and market conditions.

Operating Expenses: Don’t forget about the costs associated with owning and managing a rental property. These expenses include property taxes, insurance, utilities, maintenance, repairs, and marketing.

Property Management: You can choose to manage your properties yourself or hire a property manager. Self-management can save on fees but requires time and effort, while hiring a manager provides professional expertise and frees up your time.

Cash Flow: By understanding the interplay between rental income, expenses, and vacancy rates, you can calculate your property’s net cash flow. This figure reflects how much money you’re actually making from the investment.

Long-Term Growth: While rental income provides immediate cash flow, it’s also essential to consider the long-term appreciation of your property. Factors like location, market trends, and property improvements can all contribute to increasing your property’s value over time.

The Importance of Due Diligence and Property Inspections

Real estate investment, while potentially lucrative, involves inherent risks. To mitigate these risks and make informed decisions, due diligence and property inspections are crucial. Due diligence involves thorough research and analysis of the property, market, and financial aspects of the investment. It helps you understand the property’s value, potential risks, and the feasibility of your investment strategy.

Property inspections are equally essential. They provide a comprehensive assessment of the property’s physical condition, identifying any potential issues that could impact your investment. A qualified inspector can evaluate structural integrity, plumbing, electrical systems, roof condition, and other critical aspects. This information helps you determine potential repair costs, negotiate a better purchase price, or even decide against the investment if the problems are too significant.

By conducting thorough due diligence and property inspections, you can gain valuable insights into the property’s true condition and its potential for future appreciation. This knowledge empowers you to make informed investment decisions, minimizing risks and maximizing your chances of success in the real estate market.

Leveraging Tax Advantages and Depreciation Benefits

Real estate investing offers a unique set of tax advantages that can significantly enhance your returns. One of the most notable benefits is depreciation, which allows you to deduct a portion of your property’s value each year, reducing your taxable income. This depreciation is calculated based on the property’s useful life and applies only to the building itself, not the land.

Other tax advantages include deductions for mortgage interest, property taxes, and operating expenses. These deductions can substantially offset your rental income, reducing your tax liability and increasing your after-tax profits.

Beyond tax deductions, real estate investors also benefit from capital gains tax advantages. When you sell an investment property, you can often defer capital gains taxes by using a 1031 exchange. This strategy allows you to reinvest the proceeds from the sale into another property without paying taxes until you ultimately sell and withdraw the capital.

Understanding and effectively utilizing these tax benefits is crucial to maximizing your returns in real estate. Consulting with a qualified tax professional can help you navigate the intricacies of real estate tax laws and optimize your financial strategy.

Building a Real Estate Portfolio for Long-Term Growth

Building a real estate portfolio is a strategic approach to achieving long-term wealth through property investment. It involves diversifying your investments across various properties, potentially including rental properties, commercial spaces, or even land, to generate passive income, appreciation, and tax benefits.

The core principle of building a real estate portfolio for long-term growth lies in diversification. By acquiring properties in different locations, property types, and market segments, you can mitigate risk and enhance the potential for steady returns over time.

To effectively construct a portfolio, consider the following:

- Define your investment goals: Determine your financial objectives, risk tolerance, and desired returns. This will guide your property selection.

- Research and analyze the market: Conduct thorough market research to identify promising areas with strong growth potential and stable rental markets.

- Develop a sound investment strategy: Establish a clear plan that outlines your investment approach, budget allocation, and property acquisition timeline.

- Choose the right properties: Select properties that align with your investment goals, possess attractive rental yields, and have the potential for appreciation.

- Manage your properties effectively: Implement efficient property management practices, including tenant screening, maintenance, and rent collection, to maximize returns and minimize risks.

By meticulously constructing a diverse real estate portfolio, you can leverage the power of property investment to build long-term wealth, create passive income streams, and potentially achieve significant financial growth.

Mitigating Risks Associated with Real Estate Investing

Real estate investing can be a lucrative way to build wealth, but it’s not without its risks. Understanding and mitigating these risks is essential for any investor who wants to succeed. Here are some key risks and strategies for minimizing them:

Market Fluctuations: Real estate prices can go up and down, influenced by economic conditions, interest rates, and local market dynamics. Diversification is crucial. Investing in multiple properties in different locations or property types can help mitigate the impact of a downturn in one specific market.

Vacancy and Rent Default: There’s always the risk of tenants not paying rent or leaving a property vacant. Thorough tenant screening, including credit checks and background checks, can help minimize this risk. Having an emergency fund for unexpected expenses also provides a buffer.

Property Maintenance and Repairs: Unexpected repairs can be costly. Regular maintenance and a proactive approach to identifying and addressing potential issues can help prevent major problems. Setting aside funds for repairs is essential.

Interest Rate Changes: Rising interest rates can increase mortgage payments, affecting profitability. Locking in a fixed-rate mortgage can provide protection against fluctuating interest rates.

Property Management Challenges: Managing properties can be time-consuming. Hiring a reputable property manager can alleviate this burden and ensure properties are well-maintained and efficiently rented.

Investing in real estate involves inherent risks, but with careful planning, research, and proper risk mitigation strategies, you can significantly increase your chances of success.