Investing your money is a crucial step towards securing your financial future, but navigating the complex world of investments can be overwhelming. A common piece of advice you hear from financial experts is to diversify your portfolio. But what exactly does this mean, and why is it so important? Diversification is the key to mitigating risk and maximizing returns in your investments. By spreading your money across various asset classes, industries, and geographies, you reduce your exposure to any single investment’s volatility.

Imagine putting all your eggs in one basket – if that basket falls, you lose everything. Similarly, if you invest solely in stocks and the stock market crashes, your entire investment could be wiped out. Diversification is like placing your eggs in multiple baskets, ensuring that if one basket falls, you still have eggs in the others. In this article, we’ll delve into the benefits of diversification, explore different asset classes you can consider, and provide actionable tips for building a diversified portfolio.

Understanding Investment Diversification

Investment diversification is a strategy that involves spreading your investments across different asset classes, industries, and geographies. This approach aims to mitigate risk by reducing the impact of any single investment’s performance on your overall portfolio.

Think of it as not putting all your eggs in one basket. By diversifying, you can lessen the potential for significant losses if one investment underperforms. For example, if you invest heavily in a single stock and that company experiences a downturn, your entire portfolio could suffer. However, if your portfolio is diversified across different stocks, bonds, real estate, and other assets, the impact of one investment’s decline is likely to be less severe.

Diversification is a key principle of investing, and it’s essential for achieving long-term financial goals. By spreading your risk, you can potentially increase your returns while minimizing potential losses.

Why Diversification Matters

Diversification is a key principle in investing that aims to reduce risk by spreading your investments across different asset classes, sectors, and geographies. Instead of putting all your eggs in one basket, diversification helps you mitigate potential losses by minimizing the impact of any single investment’s performance on your overall portfolio.

Think of it like this: if you invest in only one stock and that company experiences a downturn, your entire investment could be at risk. However, if you invest in a diversified portfolio of stocks, bonds, real estate, and other assets, the impact of any single investment’s decline will be lessened by the performance of your other holdings.

Here are some key reasons why diversification is crucial:

- Reduces Risk: Diversification helps you avoid putting all your eggs in one basket, which can significantly reduce your overall investment risk.

- Improves Returns: While diversification doesn’t guarantee higher returns, it can help you achieve consistent growth over the long term by smoothing out fluctuations in the market.

- Protects Against Market Volatility: Different asset classes tend to perform differently during market downturns. By diversifying your portfolio, you can benefit from the potential for positive returns in some assets while others may be struggling.

Diversification is not about eliminating risk entirely, but it’s about managing it in a way that allows you to achieve your investment goals with greater confidence.

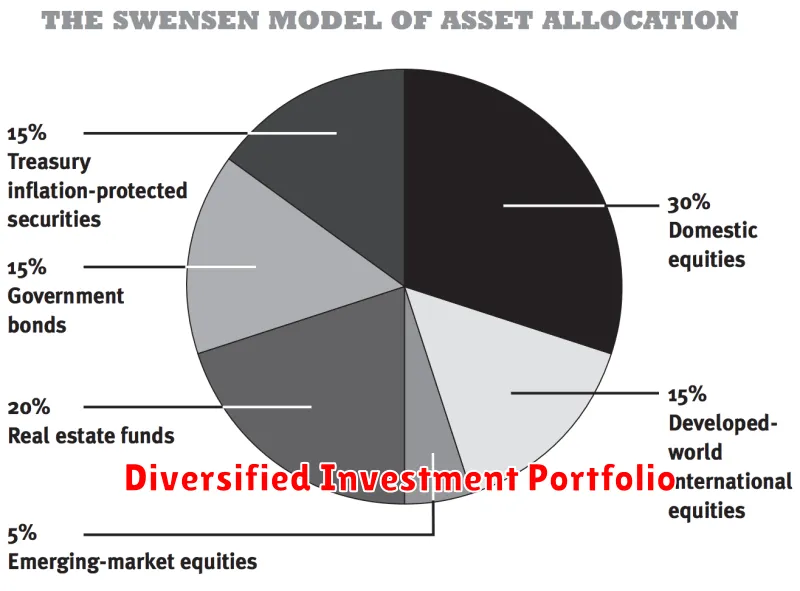

Asset Allocation Strategies

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, real estate, and cash. This is a crucial step in diversification because it helps reduce risk and increase potential returns. By spreading your investments across different asset classes, you’re less likely to be heavily affected by fluctuations in any one market.

Here are some common asset allocation strategies:

- Strategic Asset Allocation: This is a long-term approach that involves determining the optimal mix of assets based on your investment goals, risk tolerance, and time horizon. It’s typically reviewed and adjusted periodically.

- Tactical Asset Allocation: This is a more active approach that involves making short-term adjustments to your portfolio based on market conditions. It can be more risky than strategic asset allocation, but it also has the potential for higher returns.

- Life-Cycle Asset Allocation: This approach takes into account your age and stage of life when determining your asset allocation. Younger investors typically have a higher risk tolerance and can afford to invest more in growth-oriented assets like stocks. As investors age, they often shift to a more conservative approach with a greater emphasis on bonds.

The best asset allocation strategy for you will depend on your individual circumstances. It’s important to consult with a financial advisor to create a plan that meets your specific needs.

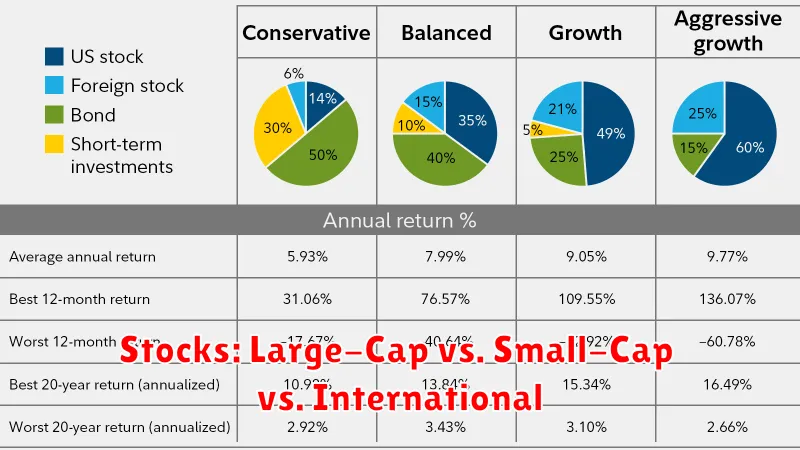

Stocks: Large-Cap vs. Small-Cap vs. International

Investing in stocks can be a great way to grow your wealth over time, but it’s important to diversify your portfolio to mitigate risk. One way to do this is by investing in different types of stocks, such as large-cap, small-cap, and international stocks.

Large-cap stocks are shares of companies with a market capitalization of over $10 billion. These companies are typically well-established and have a strong track record of profitability. They tend to be less volatile than smaller companies and offer a more stable investment. Examples of large-cap stocks include Apple, Microsoft, and Amazon.

Small-cap stocks are shares of companies with a market capitalization of under $2 billion. These companies are often younger and less established than large-cap companies, but they also have the potential for higher growth. However, they can also be more volatile and risky. Examples of small-cap stocks include Tesla, Beyond Meat, and Zoom.

International stocks are shares of companies located outside of the United States. These stocks can offer diversification benefits and exposure to different economies. However, they can also be more difficult to research and understand, and they may be subject to currency fluctuations. Examples of international stocks include Nestle, Toyota, and Samsung.

The best way to determine the right mix of large-cap, small-cap, and international stocks for your portfolio is to consider your investment goals, risk tolerance, and time horizon. A financial advisor can help you develop a strategy that meets your individual needs.

Bonds: Government, Corporate, and Municipal

Bonds are a type of investment that represents a loan made by an investor to a borrower (typically a company or government). In return for lending their money, investors receive regular interest payments and the principal amount back when the bond matures. Bonds can be a valuable part of a diversified investment portfolio because they offer different risk and return profiles compared to stocks.

Government Bonds

Government bonds are issued by federal, state, and local governments to fund various projects and operations. These bonds are generally considered to be less risky than corporate bonds because they are backed by the full faith and credit of the issuing government. U.S. Treasury bonds are considered the safest type of government bond, as they are backed by the full faith and credit of the United States government.

Corporate Bonds

Corporate bonds are issued by companies to raise capital for operations, expansion, or other projects. These bonds are generally considered to be riskier than government bonds because they are subject to the financial health of the issuing company. However, they also offer the potential for higher returns. Corporate bonds can be further categorized into investment-grade and high-yield (junk) bonds.

Municipal Bonds

Municipal bonds are issued by state and local governments to finance projects such as schools, roads, and infrastructure. These bonds are often attractive to investors because the interest income is typically exempt from federal income tax and may also be exempt from state and local taxes. However, municipal bonds are generally considered to be less liquid than other types of bonds.

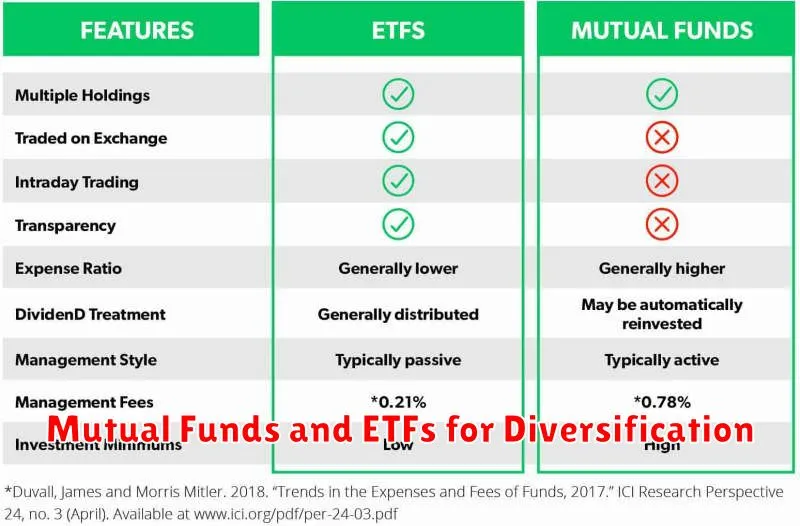

Mutual Funds and ETFs for Diversification

Diversification is a crucial strategy for mitigating risk in your investment portfolio. Mutual funds and exchange-traded funds (ETFs) offer excellent vehicles for achieving diversification across various asset classes, sectors, and geographies.

Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities. They are managed by professional fund managers who select and trade assets in accordance with the fund’s investment objectives. Mutual funds are typically categorized based on their investment strategies, such as growth, value, or income.

ETFs, on the other hand, are similar to mutual funds but are traded on stock exchanges like individual stocks. They track a specific index or basket of assets, providing investors with exposure to a broad market segment. ETFs are generally known for their lower expenses and greater flexibility compared to mutual funds.

Here’s how mutual funds and ETFs contribute to portfolio diversification:

- Asset Class Diversification: Invest in a combination of stocks, bonds, real estate, commodities, and other asset classes through funds that specialize in these areas.

- Sector Diversification: Funds can provide exposure to different sectors of the economy, such as technology, healthcare, or energy, reducing your reliance on any single industry.

- Geographic Diversification: Investing in funds that hold assets across different countries and regions can help mitigate risks associated with specific economies.

When choosing mutual funds and ETFs for diversification, consider factors like:

- Investment Objectives: Align your fund selections with your risk tolerance and financial goals.

- Expense Ratios: Look for funds with low expense ratios to minimize costs over time.

- Performance History: While past performance doesn’t guarantee future results, reviewing historical data can provide insights into a fund’s track record.

- Fund Manager Expertise: Research the fund manager’s experience and investment philosophy.

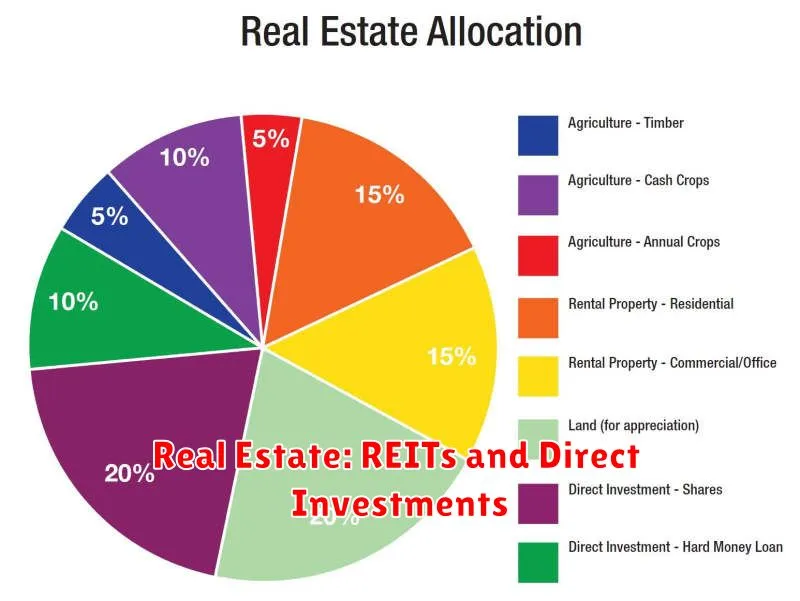

Real Estate: REITs and Direct Investments

Real estate can be a great addition to a diversified investment portfolio. It offers the potential for both income and appreciation, and it can provide a hedge against inflation. However, investing in real estate can be complex and time-consuming. Fortunately, there are two main ways to invest in real estate: through REITs and through direct investments.

REITs, or Real Estate Investment Trusts, are companies that own and operate income-producing real estate. They are traded on stock exchanges, so you can buy and sell them like stocks. REITs can provide investors with a steady stream of income through dividends, and they also offer the potential for capital appreciation. However, REITs are subject to market risk, so their prices can fluctuate like stocks.

Direct investments in real estate involve purchasing properties directly. This could include single-family homes, multi-family properties, commercial buildings, or land. Direct investments can be more hands-on than investing in REITs, but they also offer the potential for higher returns. However, direct investments are also more risky, as they require significant capital and can be illiquid.

The best way to invest in real estate for you will depend on your individual investment goals, risk tolerance, and financial situation. If you are looking for a relatively low-risk way to invest in real estate, REITs may be a good option. If you are looking for higher potential returns and are willing to take on more risk, direct investments may be a better choice.

Alternative Investments: Commodities, Private Equity, and More

Diversifying your investment portfolio is crucial for mitigating risk and maximizing returns. While traditional assets like stocks and bonds form the backbone of many portfolios, exploring alternative investments can offer unique opportunities to enhance your overall strategy.

Commodities, representing raw materials like oil, gold, and agricultural products, provide a hedge against inflation and offer potential for capital appreciation. Investing in commodities can be done through futures contracts, exchange-traded funds (ETFs), or commodity-linked bonds.

Private equity involves investing in non-publicly traded companies, offering potential for high returns but with a longer lock-up period and lower liquidity. Private equity funds pool capital from various investors to invest in promising businesses, aiming for significant growth.

Other alternative investments include real estate, offering potential for both income and capital appreciation, hedge funds, employing advanced strategies to generate returns across market conditions, and cryptocurrencies, digital currencies with a volatile but potentially high growth potential. However, it’s crucial to remember that these alternative investments often carry higher risk and may not be suitable for all investors.

Before diving into any alternative investment, it’s essential to conduct thorough research, understand the risks and potential rewards, and consult with a financial advisor to ensure it aligns with your investment goals and risk tolerance.

Determining Your Risk Tolerance

Risk tolerance refers to your ability and willingness to accept potential losses in exchange for the possibility of higher returns. It’s a crucial aspect of portfolio diversification, influencing your asset allocation decisions. Understanding your risk tolerance is essential for creating a portfolio that aligns with your financial goals and personal comfort level.

To determine your risk tolerance, consider factors like:

- Time horizon: How long do you plan to invest?

- Financial goals: What are you saving for? (e.g., retirement, down payment, education)

- Financial situation: What are your current income, expenses, and debt levels?

- Risk appetite: How comfortable are you with potential fluctuations in your investments?

- Personal circumstances: Age, health, and family responsibilities can influence your risk tolerance.

There are various risk tolerance questionnaires and assessments available online. These tools can help you gauge your risk tolerance and identify your preferred investment approach. Remember that your risk tolerance can change over time, so it’s essential to review and adjust your portfolio periodically to reflect your evolving circumstances.

Rebalancing Your Portfolio Over Time

Rebalancing your portfolio involves adjusting your asset allocation to maintain your desired risk and return profile. Over time, asset classes will perform differently, causing your portfolio to drift away from your original allocation. Rebalancing ensures you don’t become overly exposed to certain assets and maintain a balance between risk and reward.

For example, imagine you initially allocated 60% of your portfolio to stocks and 40% to bonds. If stocks outperform bonds over a period, your stock allocation might increase to 70% while your bond allocation drops to 30%. Rebalancing would involve selling some stocks and buying more bonds to restore your initial allocation.

The frequency of rebalancing depends on your individual investment goals and risk tolerance. Some investors choose to rebalance annually, while others rebalance quarterly or even monthly. It’s important to determine a schedule that works for you and stick to it. Regular rebalancing helps to ensure your portfolio remains aligned with your long-term investment objectives.

Seeking Professional Financial Advice

While diversification is essential for a healthy investment portfolio, seeking professional financial advice can significantly enhance your strategy. A financial advisor can provide personalized guidance based on your financial goals, risk tolerance, and time horizon. They can help you understand the complexities of different investment options and create a diversified portfolio tailored to your specific needs.

Here are some benefits of seeking professional financial advice:

- Objective perspective: Financial advisors offer an unbiased perspective on your investments, free from emotional biases that can cloud your judgment.

- Expertise and knowledge: They have extensive knowledge of the financial markets and can access a wide range of investment opportunities.

- Personalized recommendations: They can tailor investment strategies to your individual circumstances and goals.

- Ongoing support: Financial advisors provide ongoing support and guidance, monitoring your portfolio and making adjustments as needed.

However, it’s crucial to choose a qualified and reputable financial advisor. Consider their credentials, experience, and fees. Look for someone who adheres to ethical standards and has a proven track record of success.

In summary, seeking professional financial advice can be invaluable in diversifying your investment portfolio effectively. By leveraging the expertise and guidance of a qualified advisor, you can increase your chances of achieving your financial goals and securing your future.