Are you tired of constantly wondering where your money goes each month? Do you feel like you’re stuck in a cycle of spending more than you earn? You’re not alone! Many people struggle to track and analyze their spending habits. Understanding where your money goes is the first step to achieving financial freedom.

Fortunately, there are proven methods and tools that can help you gain control over your finances. This article will equip you with actionable strategies to track and analyze your spending habits, helping you identify areas where you can save, budget more effectively, and ultimately reach your financial goals.

The Importance of Tracking Your Spending

Tracking your spending is crucial for anyone who wants to gain control of their finances. It’s like looking under the hood of your car – you can’t fix what you don’t understand. By tracking your spending, you gain valuable insights into where your money is going and whether it aligns with your financial goals. This knowledge empowers you to make informed decisions about your finances, ultimately leading to better financial health.

Here are some key reasons why tracking your spending is essential:

- Identify spending leaks: Tracking helps you discover hidden areas where you’re overspending, such as subscriptions you’ve forgotten about or impulsive purchases.

- Stay on budget: Tracking helps you stay aware of your spending habits and whether you’re sticking to your budget. This empowers you to make necessary adjustments before it’s too late.

- Reach financial goals: Tracking helps you see progress toward your financial goals, whether it’s saving for a down payment, paying off debt, or investing for retirement. This helps you stay motivated and on track.

- Make informed decisions: Tracking provides you with the information you need to make smart decisions about your money. You can prioritize spending on what matters most and cut back on unnecessary expenses.

- Gain financial confidence: Tracking helps you develop a better understanding of your finances, leading to greater financial confidence and control.

By embracing the habit of tracking your spending, you unlock the power to manage your finances effectively and achieve your financial goals.

Identifying Spending Triggers and Patterns

Once you have a clear picture of your spending, the next step is to identify your spending triggers and patterns. These are the situations, emotions, or environments that lead you to spend money.

Common spending triggers include:

- Boredom

- Stress

- Hunger

- Social pressure

- Feeling sad or lonely

- Seeing a sale or discount

Once you know your triggers, you can start to develop strategies for avoiding them. For example, if you tend to spend money when you’re bored, try to find other activities to do that don’t involve spending. If you’re feeling stressed, try to find healthy ways to cope, such as exercise or meditation. If you’re prone to impulse buying, try to leave your credit cards at home and only bring cash with you when you go shopping.

Identifying spending patterns can help you understand how your spending habits change over time. For example, you may find that you spend more money during the holidays or when you’re on vacation. Once you understand your spending patterns, you can start to budget accordingly.

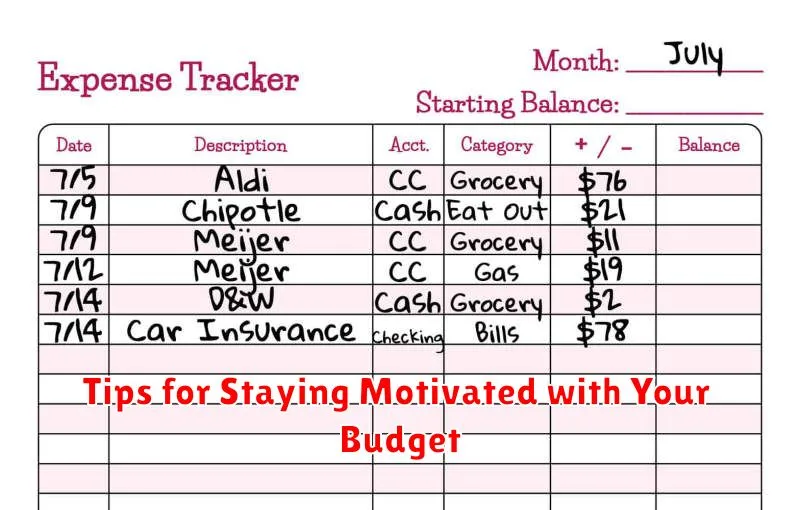

Manual Budgeting Methods: Expense Tracking Spreadsheet

A simple yet effective way to manage your finances is by using a manual budgeting method, and one of the most popular methods is an expense tracking spreadsheet. This spreadsheet allows you to meticulously record all your income and expenses. By keeping track of your spending, you can identify areas where you’re overspending and make adjustments to your budget.

The beauty of an expense tracking spreadsheet lies in its customizability. You can create categories that align with your specific financial goals and spending patterns. For example, you can separate your expenses into categories like housing, transportation, groceries, entertainment, and savings. This allows you to easily visualize where your money goes each month and make informed decisions about your spending.

There are numerous online templates and resources available to help you get started with creating an expense tracking spreadsheet. Once you have your spreadsheet set up, you can update it daily or weekly, depending on your preference. Ensure you record all transactions, including both income and expenses, so you have a complete picture of your financial status.

Budgeting Apps and Software: Automating Your Expense Tracking

Keeping track of your spending can be a tedious task. Thankfully, technology offers a solution with budgeting apps and software. These tools automate expense tracking, making it easier to monitor your financial habits. By integrating with your bank accounts, these apps automatically categorize transactions, provide insights into your spending patterns, and offer real-time updates on your budget.

Here are some key features to look for in budgeting apps:

- Automatic Transaction Tracking: Connect your bank accounts to automatically categorize and record your expenses.

- Budgeting Tools: Set spending limits for various categories and track your progress towards your financial goals.

- Expense Analysis: Gain insights into where your money is going through detailed breakdowns and charts.

- Financial Goals: Set and monitor goals like saving for a house, vacation, or retirement.

Popular options include Mint, Personal Capital, YNAB (You Need a Budget), and EveryDollar. Each app offers unique features and pricing models, so explore their functionalities to find the best fit for your needs.

Categorizing Your Expenses: Needs vs. Wants

Understanding your spending habits is crucial for managing your finances effectively. A key step in this process is categorizing your expenses into needs and wants. This distinction helps you prioritize your spending and make informed financial decisions.

Needs are essential expenses that you can’t live without. These include:

- Housing

- Food

- Utilities

- Transportation

- Healthcare

Wants, on the other hand, are things that you desire but don’t necessarily need. These can include:

- Entertainment

- Dining out

- Shopping

- Travel

- Luxury items

By categorizing your expenses, you can gain valuable insights into your spending patterns. You can identify areas where you may be overspending on wants and potentially cut back to free up more money for your needs.

Setting Realistic Budget Goals and Timelines

Once you have a clear understanding of your spending habits, it’s time to set realistic budget goals and timelines. This involves identifying areas where you can cut back and setting achievable targets for reducing your expenses. Don’t try to overhaul your entire spending habits overnight. Start with small, manageable changes and gradually work your way towards bigger goals.

For example, you might start by setting a goal to reduce your dining out expenses by 10% in the next month. This could involve cooking more meals at home or finding cheaper alternatives for your favorite restaurants. Once you’ve achieved this goal, you can then set a new goal to further reduce your dining out expenses or target another spending category.

When setting goals, it’s important to be realistic about what you can achieve. Avoid setting goals that are too ambitious or difficult to maintain over time. Remember that it’s better to start small and gradually work your way up than to set yourself up for failure from the beginning.

In addition to setting goals, it’s also helpful to establish timelines for achieving them. This can help you stay on track and motivated. For example, you might set a goal to reduce your grocery expenses by 15% within the next three months. This would give you a clear target to work towards and a timeline for achieving it.

Finally, make sure to track your progress and adjust your goals and timelines as needed. If you find that you’re struggling to achieve your goals, don’t be afraid to revise them or extend your timelines. The key is to be flexible and adjust your approach as needed.

Analyzing Your Spending Habits for Insights

Once you’ve diligently tracked your spending for a period, it’s time to delve into the data and uncover valuable insights. This analysis empowers you to make informed decisions about your finances. Here’s a breakdown of how to analyze your spending habits:

Categorize Your Expenses: Begin by categorizing your expenses into meaningful groups. This could include necessities like housing, food, and utilities, as well as discretionary spending like entertainment, shopping, and dining out. This categorization provides a clear picture of where your money is going.

Identify Spending Patterns: Analyze your spending patterns over time. Look for recurring expenses, seasonal variations, and any trends that emerge. This can reveal areas where you might be overspending or where you can potentially cut back. For example, you might discover a spike in entertainment spending during the summer months or a consistent pattern of dining out on weekends.

Compare Your Spending to Your Budget: Compare your actual spending to your budget. This comparison highlights any discrepancies and helps you identify areas where you’re falling short of your financial goals. If you’re consistently overspending in certain categories, it might be time to adjust your budget or find ways to reduce those expenses.

Identify Potential Savings: Analyzing your spending data can uncover opportunities for savings. Perhaps you’re subscribing to multiple streaming services you rarely use or consistently buying coffee every morning. By identifying these areas, you can cut back and redirect those funds towards your financial priorities.

Track Progress and Make Adjustments: Once you’ve analyzed your spending habits and made adjustments, it’s crucial to track your progress and make further refinements as needed. Regularly review your spending data to ensure you’re staying on track and achieving your financial goals.

Identifying Areas for Spending Reduction

Once you have a clear picture of your spending habits, it’s time to identify areas where you can cut back. This process involves examining your spending categories and identifying any areas where you’re spending more than you need to or where you can make adjustments. Start by analyzing your expenses in each category and comparing them to your budget. Look for potential areas where you could save money, such as:

- Dining out: Consider cooking more meals at home and reducing your restaurant visits.

- Entertainment: Evaluate your subscription services, movie tickets, and other entertainment expenses, and see if you can cut back.

- Shopping: Analyze your online and in-store purchases, looking for impulse buys and unnecessary items.

- Transportation: Explore alternative transportation options, such as public transit or biking, to reduce fuel costs.

- Utilities: Check your energy bills and identify ways to reduce your consumption, such as using energy-efficient appliances and lowering your thermostat.

By identifying these areas, you can develop strategies to reduce your spending and achieve your financial goals. For example, you could set a monthly limit for dining out, negotiate lower prices on your utilities, or commit to a “no-spend” day each week. Remember that even small adjustments in your spending habits can make a significant difference over time.

Strategies for Curbing Impulsive Spending

Impulsive spending can quickly derail your financial goals. To curb these unwanted expenses, implement these strategies:

1. Delay gratification: Before making a purchase, give yourself a cooling-off period. This could be 24 hours, a week, or even longer. This allows you time to reflect on the purchase and determine if it’s truly necessary.

2. Track your spending: Knowing where your money goes is essential. Use budgeting apps or a spreadsheet to track your daily expenses. This provides valuable insights into spending patterns and helps you identify areas where you can cut back.

3. Create a shopping list: Before heading to the store, make a detailed list of what you need. This prevents impulsive buys of items not on your list.

4. Unsubscribe from tempting emails: Those promotional emails can be irresistible. Unsubscribe from retailers that trigger your impulsive buying behavior.

5. Set a budget: Allocate specific amounts for categories like entertainment, dining, and clothing. Sticking to a budget helps prevent overspending in areas prone to impulsive purchases.

6. Shop with a purpose: Avoid browsing through stores or online retailers aimlessly. Have a clear objective for each shopping trip.

7. Reward yourself: Setting aside funds for occasional treats can be helpful. This gives you something to look forward to and can help curb impulsive purchases when you’re feeling tempted.

By implementing these strategies, you can gradually break the cycle of impulsive spending and gain control over your finances.

The Role of Financial Awareness in Managing Spending

Financial awareness is crucial for managing your spending effectively. It’s the foundation of building healthy financial habits. When you’re financially aware, you understand your income, expenses, and financial goals. You can then make informed decisions about your money and avoid impulsive spending.

Financial awareness empowers you to identify areas where you can cut back and save money. For example, you may realize you’re spending too much on dining out or subscriptions you don’t use. Understanding your spending patterns allows you to prioritize your needs over wants and allocate your resources wisely.

By being financially aware, you can also avoid accumulating unnecessary debt. You can make informed decisions about borrowing and ensure that your spending aligns with your budget. This awareness can help you achieve financial stability and avoid financial stress.

Creating a Sustainable Budget You Can Stick To

Once you’ve got a good understanding of your spending habits, it’s time to create a budget that works for you. A sustainable budget is one that you can stick to in the long term, without feeling deprived or overwhelmed. It’s about making conscious choices about your money and aligning your spending with your values and goals.

The first step is to figure out your income and expenses. This includes your regular income from your job, any other sources of income, and all your monthly bills, including housing, utilities, transportation, food, and entertainment.

Next, you can create a budget that allocates your income to different categories. This could include essential expenses like housing and groceries, as well as discretionary spending like dining out and entertainment. Make sure your budget includes money for savings and debt repayment, if applicable.

Remember, a sustainable budget should be flexible and realistic. It’s okay to make adjustments as needed. The key is to track your progress and make sure your spending stays within the boundaries of your budget.

Tips for Staying Motivated with Your Budget

Sticking to a budget can be tough, especially when you’re faced with tempting purchases or unexpected expenses. However, staying motivated is essential for achieving your financial goals. Here are some tips to help you stay on track:

Set Realistic Goals: Don’t try to change your spending habits overnight. Start with small, achievable goals and gradually work your way up. For example, you could aim to reduce your eating out expenses by $50 per month or save $100 for a specific purchase.

Celebrate Your Successes: When you reach a budget milestone, reward yourself with something small and meaningful. This could be a special dinner out, a new book, or a donation to your favorite charity. Celebrating your progress will keep you motivated and prevent burnout.

Visualize Your Goals: Create a vision board or a list of your financial goals and keep them in a visible place. Seeing your goals regularly can serve as a powerful reminder of why you’re working hard to stick to your budget.

Seek Support: Talk to friends, family, or a financial advisor about your budget goals. Having a support system can help you stay accountable and motivated.

Remember Your “Why”: Reflect on why you’re creating a budget in the first place. Are you trying to save for a down payment on a house, pay off debt, or achieve financial freedom? Keeping your motivation in mind will help you stay focused when things get tough.

The Benefits of Regularly Reviewing and Adjusting Your Budget

Regularly reviewing and adjusting your budget is an essential part of managing your finances effectively. By taking the time to analyze your spending habits and make necessary changes, you can reap numerous benefits, including:

Increased financial awareness: Regularly reviewing your budget allows you to gain a clear understanding of where your money is going. You can identify areas where you are overspending and areas where you can potentially save more. This awareness can lead to informed financial decisions and help you make the most of your income.

Improved financial discipline: The process of reviewing your budget can help you stay accountable for your spending. It encourages you to be more mindful of your expenses and make conscious decisions about how you allocate your money. This discipline can contribute to long-term financial stability.

Reaching your financial goals faster: By understanding your spending patterns, you can adjust your budget to allocate more funds towards your financial goals, such as saving for a down payment on a house, paying off debt, or investing for retirement. Regular adjustments ensure that your budget remains aligned with your evolving financial objectives.

Reduced stress and anxiety: When you have a well-planned and regularly reviewed budget, you can feel more confident and secure about your financial situation. This can reduce financial stress and anxiety, leading to a greater sense of peace of mind.

In conclusion, regularly reviewing and adjusting your budget is a valuable habit that can significantly improve your financial well-being. By tracking your spending, identifying areas for improvement, and making necessary adjustments, you can gain financial awareness, enhance your discipline, reach your goals faster, and reduce financial stress.