Are you tired of throwing money away on interest payments? Do you dream of owning your home outright? If so, then paying off your mortgage early could be the answer. Paying off your mortgage early can save you thousands of dollars in interest, free up your cash flow, and give you peace of mind knowing that you’re building equity in your home. While it may seem daunting, there are several ways to accelerate your mortgage payoff and achieve financial freedom sooner.

This article will delve into the numerous benefits of paying off your mortgage early. We will explore how early payoff can significantly reduce interest charges, boost your net worth, and provide you with greater financial flexibility. We will also discuss practical strategies and tips to help you reach your goal faster, such as making extra payments, refinancing to a shorter term, or taking advantage of windfalls.

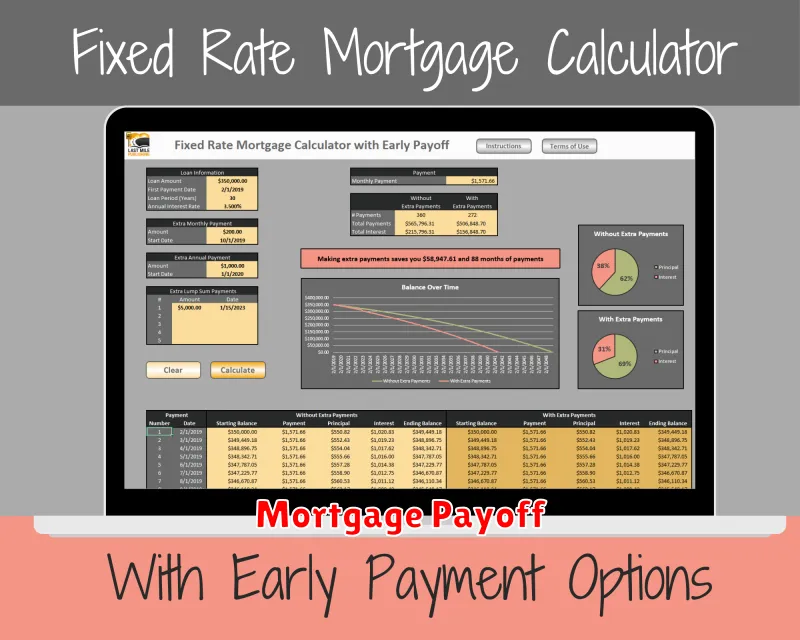

Understanding Your Mortgage Amortization Schedule

A mortgage amortization schedule is a detailed breakdown of your mortgage payments over the life of the loan. It shows how much of each payment goes towards principal and how much goes towards interest. Understanding your amortization schedule can help you make informed decisions about your mortgage, such as whether to pay it off early.

The principal is the original amount of money you borrowed. The interest is the cost of borrowing that money. The amortization is the process of gradually paying off the principal over time.

Your amortization schedule will show you how much you will owe each month, the total amount of interest you will pay over the life of the loan, and the amount of principal you will pay off each month.

You can use your amortization schedule to see how different payment amounts will affect the amount of time it takes to pay off your mortgage and the total amount of interest you will pay. You can also use it to see how much extra you would need to pay each month to pay off your mortgage early.

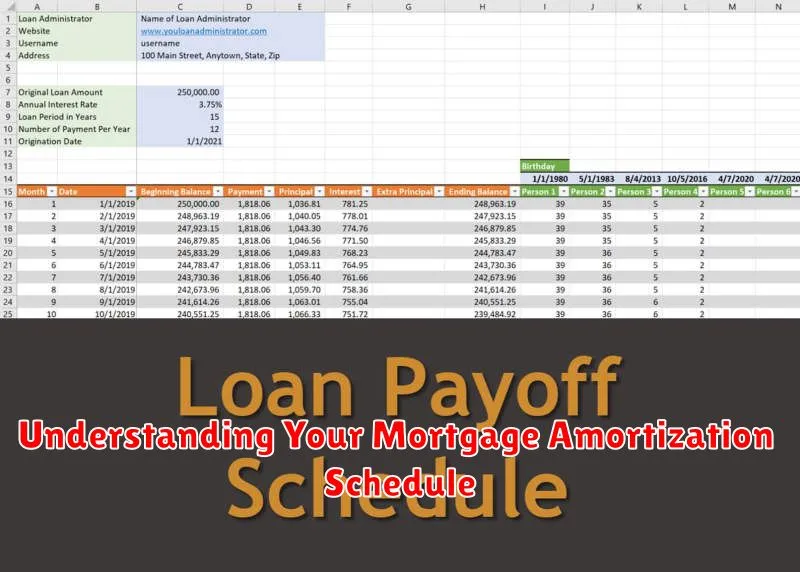

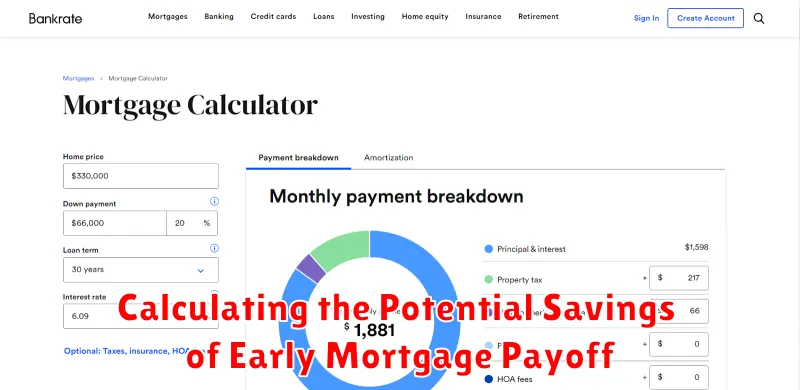

Calculating the Potential Savings of Early Mortgage Payoff

Paying off your mortgage early can save you a significant amount of money in interest charges. To calculate the potential savings, you’ll need to consider your current mortgage terms and the amount of extra money you can afford to put towards your principal each month.

There are several online calculators available that can help you estimate your potential savings. You’ll typically need to input information such as your loan amount, interest rate, remaining term, and the additional monthly payment amount.

For example, let’s say you have a 30-year mortgage of $200,000 at a 4% interest rate. If you make an extra payment of $200 per month, you could potentially save over $50,000 in interest charges and pay off your mortgage 7 years earlier!

Remember that the more you can afford to pay extra, the greater the potential savings will be.

Strategies for Paying Off Your Mortgage Early

Paying off your mortgage early can save you thousands of dollars in interest and provide financial freedom. Here are some strategies to help you achieve this goal:

Make extra payments: Even small extra payments can make a big difference over time. You can make an additional payment once a year, or even a small amount each month.

Make bi-weekly payments: Instead of making one monthly payment, you can make half of your monthly payment every two weeks. This will result in 13 payments per year, which is equivalent to one extra monthly payment.

Refinance to a shorter term: If interest rates are lower than your current mortgage rate, you can refinance to a shorter term. This will result in a higher monthly payment, but you will pay off your mortgage faster.

Consider a lump-sum payment: If you receive a large sum of money, such as a bonus or inheritance, you can use it to make a lump-sum payment towards your mortgage principal.

Increase your income: This could involve getting a raise, finding a side hustle, or investing in your career. The extra income can be used to make extra mortgage payments.

Reduce your expenses: By cutting down on unnecessary expenses, you can free up more money to put towards your mortgage.

Remember, paying off your mortgage early requires discipline and commitment. But the financial benefits are well worth it.

Bi-Weekly Payments vs. Monthly Payments

One popular strategy for paying off your mortgage early is making bi-weekly payments. Instead of making one monthly payment, you split it into two equal payments and make them every two weeks. This might seem like a small change, but it can have a big impact on the amount of interest you pay over the life of your loan and how quickly you pay off your mortgage.

Here’s how it works: A standard monthly mortgage payment is calculated based on a 12-month year. However, there are 52 weeks in a year, meaning you make 26 bi-weekly payments. This equates to an extra monthly payment per year, which is applied directly to the principal of your loan.

While the difference might seem small, it adds up over time. The extra payments will significantly reduce the interest you pay, allowing you to pay off your mortgage faster. It’s like making an extra principal payment every year without having to make a large lump sum.

Pros of Bi-Weekly Payments:

- Faster payoff: You make extra principal payments each year, leading to a shorter loan term.

- Lower interest paid: You’ll pay less interest over the life of the loan, saving you money.

- More flexibility: You can adjust the amount of your bi-weekly payments if your financial situation changes.

Cons of Bi-Weekly Payments:

- May require careful budgeting: Ensuring you have enough to make two payments every month.

- Not all lenders offer this option: Some lenders might not allow bi-weekly payments.

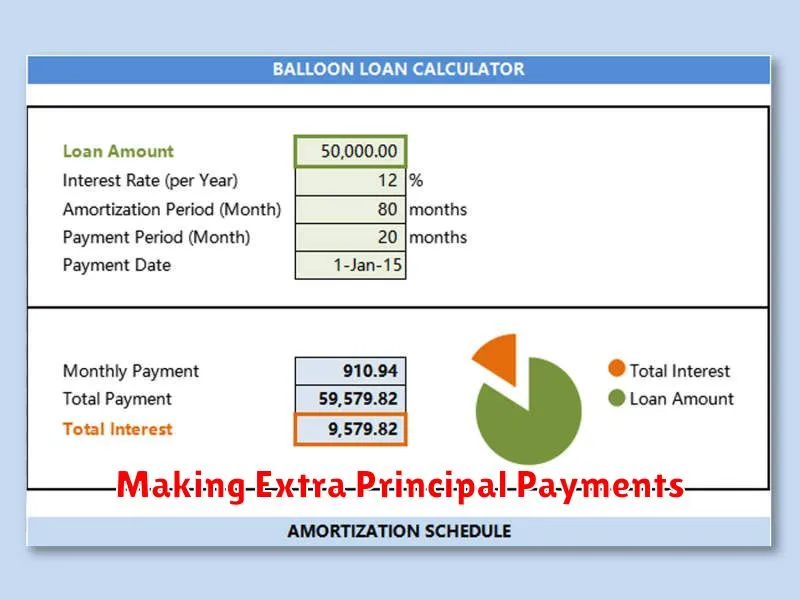

Making Extra Principal Payments

Making extra principal payments on your mortgage can be a great way to pay off your loan faster and save a significant amount of money on interest. This strategy involves paying more than your regular monthly payment, which directly reduces your principal balance. As the principal decreases, the amount of interest you accrue also reduces, leading to faster loan repayment and substantial savings.

There are several ways to make extra principal payments, such as:

- Making a lump-sum payment annually or semi-annually.

- Making an extra payment with each monthly payment.

- Rounding up your monthly payment to the nearest hundred dollars.

By making extra principal payments, you can significantly reduce the overall cost of your mortgage. Consider your financial situation and choose the method that works best for you. It’s important to remember that making extra principal payments requires discipline and consistency, but the long-term benefits are worth it.

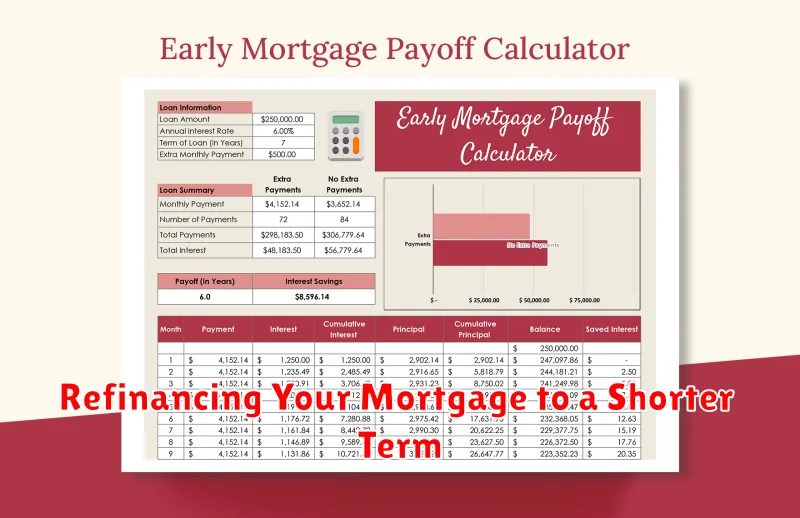

Refinancing Your Mortgage to a Shorter Term

One of the most effective ways to pay off your mortgage early is to refinance to a shorter term. This will increase your monthly payment, but you’ll pay far less interest over the life of the loan. Let’s say you have a 30-year mortgage and you refinance to a 15-year mortgage. You’ll end up paying off your home in half the time, which means you’ll be debt-free sooner. This is a huge benefit in and of itself, but the savings on interest can be substantial as well.

For example, let’s say you have a $200,000 mortgage with a 4% interest rate. If you refinance to a 15-year mortgage, you’ll end up paying about $100,000 in interest over the life of the loan. If you keep your 30-year mortgage, you’ll end up paying about $180,000 in interest! This is a difference of $80,000! That’s a significant amount of money that you could be saving by simply refinancing to a shorter term.

Of course, refinancing to a shorter term does have its drawbacks. Your monthly payment will be higher, and you’ll have less flexibility in your budget. However, the savings on interest and the peace of mind that comes with paying off your mortgage early can be worth it for many people.

If you’re thinking about refinancing to a shorter term, be sure to shop around for the best rates and terms. You should also consider your financial situation and make sure that you can comfortably afford the higher monthly payments. But if you’re looking for a way to pay off your mortgage early and save money on interest, refinancing to a shorter term is a great option to consider.

Using Windfalls to Pay Down Your Mortgage

A windfall is a sudden, unexpected sum of money. It can come from a variety of sources, such as an inheritance, a tax refund, a bonus at work, or even winning the lottery. If you’re lucky enough to receive a windfall, you might be tempted to spend it on something frivolous. However, a better way to use a windfall is to pay down your mortgage.

There are a number of benefits to paying down your mortgage early. First, it can save you a significant amount of money in interest payments. Second, it can reduce your monthly mortgage payments, freeing up more cash flow for other financial goals. Third, it can give you peace of mind knowing that you are getting closer to owning your home outright.

If you decide to use a windfall to pay down your mortgage, there are a few things to keep in mind. First, make sure that you have enough money left over to cover your essential expenses. Second, consider whether it makes more sense to make a lump-sum payment or to use the windfall to increase your monthly mortgage payment. Finally, talk to your lender about the best way to apply the windfall to your mortgage.

Using a windfall to pay down your mortgage is a smart financial move that can save you money, reduce your debt, and give you peace of mind. It’s a great way to make the most of unexpected funds and accelerate your path to financial freedom.

The Psychological Benefits of Being Mortgage-Free

Beyond the financial advantages, paying off your mortgage early can bring a significant sense of relief and liberation. The psychological benefits of being mortgage-free are numerous, offering a sense of financial freedom, reduced stress, and a boost in overall well-being.

Imagine waking up every morning without the burden of a monthly mortgage payment looming over your head. It’s a feeling of financial security that can significantly reduce your stress levels. You’ll have more discretionary income to pursue your passions, travel, or simply enjoy life without worrying about making ends meet.

The psychological benefits extend beyond finances. Being mortgage-free can give you a sense of achievement and control over your financial future. You’ve accomplished a significant financial goal, which can boost your self-confidence and motivation to continue making smart financial decisions. This sense of accomplishment can have a positive ripple effect on other areas of your life, making you feel more empowered and optimistic about the future.

Ultimately, the psychological benefits of being mortgage-free can significantly improve your overall well-being. You’ll experience a sense of peace of mind knowing that you’ve secured your housing and have more freedom to focus on what matters most. This reduced stress and increased sense of security can lead to better sleep, improved relationships, and a more fulfilling life overall.