The age-old question, “rent or buy?” continues to plague individuals across the globe. It’s a decision filled with weighty implications, both financial and personal. While renting offers a sense of flexibility and lower upfront costs, buying a home provides the opportunity to build equity and establish a sense of stability. The path you choose ultimately hinges on your individual circumstances, goals, and risk tolerance.

This article will delve into the pros and cons of renting versus buying a home. We’ll explore the financial implications, lifestyle considerations, and potential long-term benefits of each option. By weighing the advantages and disadvantages of both sides, you can make an informed decision that aligns with your unique needs and aspirations.

Understanding Your Financial Situation and Goals

Before you start weighing the pros and cons of renting versus buying, it’s crucial to have a clear understanding of your financial situation and goals. This involves taking a honest look at your current income, expenses, and savings. Ask yourself:

- What are your current monthly expenses?

- How much can you comfortably afford to spend on housing?

- How much do you have saved for a down payment?

- What are your long-term financial goals?

Consider factors like retirement savings, education expenses, and potential future financial needs. Once you have a grasp of your financial picture, you can start to assess whether buying a home aligns with your short-term and long-term goals.

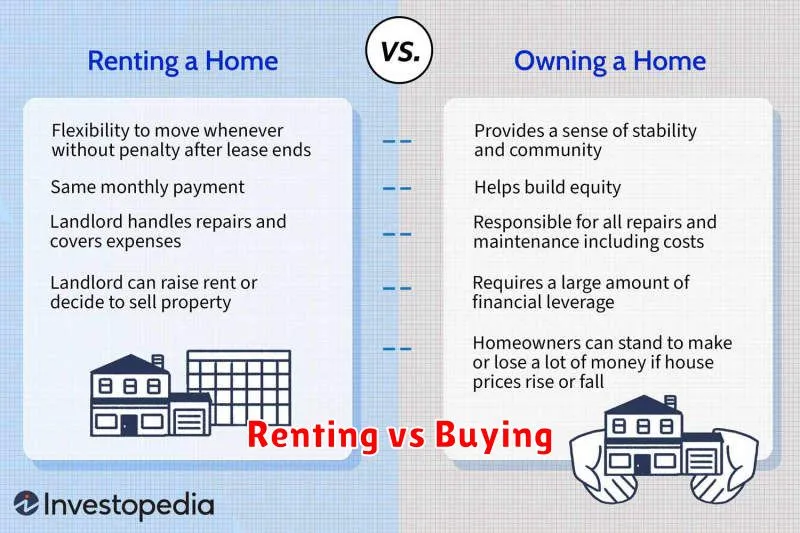

The Pros of Renting a Home

Renting a home offers several advantages, making it a suitable option for various individuals and circumstances. Here are some of the key pros of renting:

Flexibility and Mobility: Renting provides greater flexibility, allowing you to move more easily compared to owning a home. You can relocate for work, pursue new opportunities, or simply try out different neighborhoods without the hassle of selling a property.

Lower Upfront Costs: Renting typically requires a smaller upfront investment compared to buying a home. You’ll need to pay a security deposit and possibly the first month’s rent, but you won’t face the costs associated with a down payment, closing costs, or mortgage payments.

Less Responsibility: Renters are typically responsible for maintaining their own units but not for larger repairs and maintenance of the property. The landlord is usually responsible for handling major repairs, such as plumbing issues, roof repairs, or structural problems.

Amenities and Services: Some rental properties offer amenities and services that you might not have access to as a homeowner. This can include amenities like swimming pools, fitness centers, or laundry facilities, as well as services like trash removal and landscaping.

Predictable Costs: Rent payments are usually fixed, providing a sense of predictability in your monthly expenses. This can be especially helpful for budgeting purposes, as you won’t be subject to fluctuations in property taxes, insurance premiums, or unexpected maintenance costs.

The Cons of Renting a Home

While renting offers flexibility and lower upfront costs, it also comes with its own set of drawbacks. Here are some of the cons of renting a home:

Lack of Equity: One of the biggest downsides of renting is that you’re not building equity. Every rent payment goes directly to the landlord, not towards your own homeownership. This means you’re not building wealth through your housing costs.

Limited Customization: As a renter, you have limited freedom to customize your living space. You may not be allowed to paint the walls, install new fixtures, or even hang pictures without permission from your landlord. This can be frustrating for those who want to personalize their home.

Rent Increases: Landlords can raise rent prices, sometimes with little notice, putting a strain on your budget. This can make it challenging to plan for the future, especially if you’re on a fixed income.

Unpredictable Lease Renewals: Your lease agreement may not be automatically renewed, leading to uncertainty about your housing situation in the future. You might face the prospect of needing to move, potentially at an inconvenient time, or even find a new home in a tight housing market.

Landlord Issues: Dealing with a difficult or unresponsive landlord can be a significant stress factor. Issues with repairs, maintenance, or even noise complaints might take longer to resolve, impacting your living experience.

The Pros of Buying a Home

Owning a home offers a range of advantages that can significantly impact your life. Here are some of the key pros of buying a home:

Building Equity: One of the most significant benefits of buying a home is that you’re building equity. As you pay down your mortgage, you gain ownership of your property. This equity can be a valuable asset, as it can be used to finance future endeavors, such as starting a business or funding your children’s education.

Tax Deductions: Homeownership offers tax advantages, including deductions for mortgage interest and property taxes. These deductions can help reduce your tax liability and save you money.

Stability and Control: Owning a home provides a sense of stability and control. You’re no longer subject to rent increases or the possibility of your landlord selling the property. You have the freedom to customize your home and make it your own.

Investment Potential: Real estate is often considered a solid investment. Over time, home values tend to appreciate, potentially increasing your net worth. You also have the flexibility to sell your home when you’re ready and capture any capital gains.

Pride of Ownership: Owning a home can bring a sense of pride and accomplishment. It signifies financial stability and provides a place to create lasting memories with your family.

The Cons of Buying a Home

While buying a home offers several advantages, it also comes with its own set of drawbacks. Here are some key cons to consider before making the leap:

Financial Commitment: Buying a home requires a significant upfront investment, including a down payment, closing costs, and ongoing expenses like mortgage payments, property taxes, and insurance. This can put a strain on your finances and limit your flexibility for other financial goals.

Maintenance Costs: As a homeowner, you are responsible for all maintenance and repairs, which can be costly and time-consuming. From plumbing issues to roof repairs, unexpected expenses can arise, potentially impacting your budget.

Lack of Flexibility: Buying a home ties you to a specific location for an extended period. If your job requires you to relocate or your lifestyle changes, selling and moving can be a significant hassle and potentially result in financial losses.

Property Value Fluctuations: The value of your home can fluctuate based on market conditions, economic factors, and local developments. You may not always see an increase in your property’s value, and in some cases, you might even experience a decrease.

Limited Liquidity: Your home equity is generally considered illiquid, meaning it’s not easily accessible for other financial needs. Tapping into your home equity through a loan or refinancing can come with additional costs and risks.

Factors to Consider When Making the Decision

The decision of whether to rent or buy a home is a significant one, and it’s not always straightforward. There are several factors you should consider before making a decision that’s right for you. These include your financial situation, lifestyle, and long-term goals.

Financial Situation is a primary factor to consider. Buying a home requires a significant down payment, closing costs, and ongoing expenses such as mortgage payments, property taxes, and insurance. Renting requires less of an upfront financial investment, but you’ll be paying rent each month. It’s important to evaluate your current financial situation and determine if you can afford to purchase a home, including the ongoing costs of homeownership.

Lifestyle is another crucial factor. If you are someone who enjoys moving frequently or having the flexibility to relocate easily, then renting may be a better option. On the other hand, if you plan to stay in one place for a long time and desire a more stable living situation, buying could be the way to go.

Long-term goals are also vital when making the decision. If you plan to build equity and enjoy the potential for home appreciation, buying can be a better option. But, if you’re not planning on staying in a place for a long time, renting may be the better choice for you.

Ultimately, the decision of whether to rent or buy comes down to your personal circumstances and priorities. Carefully assess your financial situation, lifestyle, and long-term goals to make the best decision for you.

Calculating the Costs Associated with Renting vs. Buying

When deciding whether to rent or buy a home, it’s crucial to weigh the financial implications of each option. While renting offers flexibility and lower upfront costs, buying a home can provide long-term financial benefits and equity building. To make an informed decision, consider the following cost factors:

Renting

Monthly Rent: This is the most obvious cost associated with renting. Rent prices vary widely depending on location, size, and amenities.

Utilities: Depending on the rental agreement, tenants may be responsible for paying utilities such as electricity, gas, water, and trash.

Security Deposit: A security deposit is typically required by landlords to cover potential damages to the property.

Other Expenses: Renters may also incur additional costs like renter’s insurance, moving expenses, and parking fees.

Buying

Down Payment: A significant upfront cost when buying a home. Conventional loans typically require a down payment of 20%, while FHA loans offer lower down payment options.

Mortgage Payments: Monthly payments include principal, interest, property taxes, and homeowners insurance.

Closing Costs: These are expenses incurred during the closing process, including appraisal fees, title insurance, and attorney fees.

Homeowners Insurance: Essential to protect your investment against damage or liability.

Property Taxes: Paid annually to the local government, the amount varies depending on the property’s value.

Maintenance and Repairs: Homeowners are responsible for repairs and upkeep, which can involve significant costs.

HOA Fees (if applicable): Homeowners associations charge monthly fees to cover common area maintenance and amenities.

It’s important to carefully analyze these costs and factor in your personal financial situation when making a decision. Tools like mortgage calculators and online financial calculators can assist you in evaluating the costs associated with renting versus buying.

Long-Term vs. Short-Term Housing Needs

One of the key considerations when deciding between renting and buying a home is your long-term versus short-term housing needs. If you anticipate staying in one place for a considerable period, perhaps five years or more, buying a home might be a more financially advantageous option. You’ll build equity, avoid rent increases, and potentially enjoy tax benefits associated with homeownership. However, if you foresee needing to move frequently due to career changes, family growth, or other life circumstances, renting offers greater flexibility and can save you from the hassle and costs of selling a home. Ultimately, the best decision depends on your individual circumstances and future plans.

The Impact of Market Conditions on Your Decision

When deciding whether to rent or buy a home, market conditions play a significant role. A strong market, characterized by low interest rates and increasing home values, may make buying more attractive. This is because lower interest rates mean more affordable monthly payments, while rising home values suggest potential for future appreciation. Conversely, a weak market with high interest rates and stagnant or declining home values could favor renting, as buying might not offer the same financial advantages.

It’s essential to consider the current economic climate. Factors like inflation, unemployment, and interest rate changes can influence your decision. If the economy is uncertain, you might be hesitant to take on the financial responsibility of homeownership. A strong economy, on the other hand, could inspire confidence in making a significant purchase.

Finally, analyze the local housing market. Is there a shortage or surplus of homes for sale? Are prices appreciating or declining? Are rents stable or increasing? Understanding these local market dynamics can help you determine if renting or buying aligns better with your financial goals and personal circumstances.

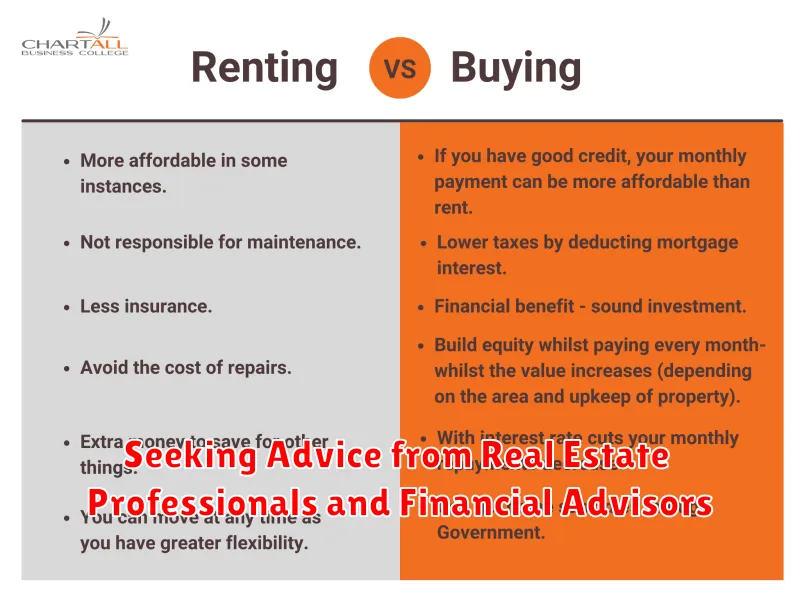

Seeking Advice from Real Estate Professionals and Financial Advisors

When making the decision to rent or buy, it’s crucial to seek advice from experienced professionals in both real estate and finance. A real estate agent can provide valuable insights into the local market, current trends, and potential investment opportunities. They can help you understand the pros and cons of buying in your desired area, negotiate prices, and guide you through the buying process.

A financial advisor can help you assess your financial situation, evaluate your budget, and determine if buying a home is financially feasible. They can also provide guidance on mortgage options, loan terms, and investment strategies.

By seeking advice from both a real estate professional and a financial advisor, you can gain a comprehensive understanding of your options and make an informed decision that aligns with your financial goals and lifestyle.

Making the Right Choice for Your Individual Circumstances

Ultimately, the decision of whether to rent or buy a home is a deeply personal one, and the right choice will depend on your individual circumstances, financial situation, and personal goals. There is no one-size-fits-all answer. Here are some factors to consider:

Financial Stability and Goals: Buying a home typically requires a significant down payment and ongoing mortgage payments, which can strain your budget. Renting, on the other hand, offers more flexibility and lower upfront costs. If you are uncertain about your future financial situation, renting might be a safer option.

Lifestyle and Mobility: Are you planning to move frequently or are you looking for a long-term home? If you value flexibility and mobility, renting might be more suitable. Buying a home often involves a significant commitment to a location and can make it challenging to move quickly.

Time Horizon: How long do you plan to live in a particular location? If you are planning to stay in a location for a significant amount of time, buying a home could be a worthwhile investment. Renting might be more appropriate if you have a shorter time horizon.

Personal Preferences: Some people value the stability and freedom that comes with owning a home. Others prefer the flexibility and lower financial commitment of renting. Consider your individual preferences and what you find most important in a living situation.