Life is unpredictable. One moment you can be enjoying a smooth ride and the next, you’re facing a financial crisis caused by an unexpected event. This is where insurance comes in. Insurance is a powerful tool that can protect your financial future from unforeseen circumstances. By transferring the risk of financial loss to an insurance company, you can create a safety net that cushions you from the harsh realities of life’s surprises.

From health emergencies to property damage, insurance offers a wide range of coverage options that cater to your individual needs. Whether you’re a homeowner, a car owner, or simply looking to secure your health, there’s an insurance plan available to shield you from financial ruin. This article will explore the vital role of insurance in protecting your financial future, highlighting its benefits and how it can provide peace of mind in the face of uncertainty.

Understanding Different Types of Insurance

Insurance is an essential tool for protecting your financial future and mitigating risks. Different types of insurance serve various purposes, providing coverage for specific situations and needs. Understanding the different types of insurance available is crucial for making informed decisions that align with your individual circumstances.

Health insurance covers medical expenses, including doctor visits, hospitalization, and prescription drugs. It safeguards you from financial strain in case of illness or injury.

Life insurance provides financial protection for your loved ones in the event of your death. It can help replace income, pay off debts, and cover funeral expenses.

Property insurance protects your home and belongings from damage or loss due to events like fire, theft, or natural disasters. It covers the cost of repairs or replacement.

Auto insurance is legally required in most states. It covers damages to your vehicle and injuries to others in the event of an accident.

Disability insurance provides income replacement if you become unable to work due to an illness or injury. It helps maintain your financial stability during periods of disability.

Liability insurance protects you from financial losses arising from claims of negligence or wrongdoing. It can cover legal fees and settlements.

Travel insurance provides coverage for unexpected events while traveling, such as medical emergencies, flight delays, or lost luggage.

Understanding the types of insurance and their benefits is crucial for making informed choices about your financial well-being. By choosing the right insurance policies, you can effectively protect yourself and your loved ones from unforeseen circumstances and safeguard your financial future.

Life Insurance: Protecting Your Loved Ones

Life insurance is a crucial component of a comprehensive financial plan, serving as a safety net for your loved ones in the unfortunate event of your passing. It provides a financial cushion to help them cope with the loss of your income and cover essential expenses like mortgage payments, debt obligations, education costs, and everyday living expenses.

When you purchase life insurance, you choose a death benefit amount that your beneficiaries will receive upon your death. This lump sum payment can be used to cover various financial needs, ensuring that your family’s financial security remains intact. By providing this financial protection, life insurance helps alleviate the burden of financial stress during a difficult time, allowing your loved ones to focus on grieving and moving forward.

Choosing the right type and amount of life insurance is essential, considering factors like your income, dependents, debts, and long-term financial goals. Consulting with a financial advisor can help you determine the appropriate coverage and ensure your family’s financial well-being is secured in the years to come.

Health Insurance: Covering Medical Expenses

Health insurance plays a crucial role in safeguarding your financial future by providing coverage for unexpected medical expenses. In today’s world, healthcare costs can be exorbitant, and a single illness or accident can quickly deplete your savings. Health insurance acts as a financial safety net, helping you manage these costs without jeopardizing your financial stability.

When you have health insurance, you are typically covered for a wide range of medical services, including:

- Doctor’s visits

- Hospital stays

- Surgery

- Prescription drugs

- Preventive care

The specific coverage provided by your health insurance plan will depend on your chosen policy and provider. However, most plans will cover a significant portion of your medical expenses, reducing your out-of-pocket costs and protecting you from financial ruin.

Beyond covering medical expenses, health insurance also offers valuable benefits such as:

- Access to quality healthcare: Health insurance gives you access to a network of qualified doctors and hospitals, ensuring you receive the best possible care.

- Preventive care: Many health insurance plans cover routine checkups and screenings, helping you identify potential health issues early and maintain your well-being.

- Peace of mind: Knowing you have health insurance provides peace of mind, knowing you’re protected financially in case of unexpected medical events.

In conclusion, health insurance is an essential component of protecting your financial future. It provides coverage for medical expenses, safeguards your savings, and ensures access to quality healthcare. By investing in health insurance, you are taking proactive steps to secure your financial stability and well-being for the long term.

Disability Insurance: Income Protection When You Need It Most

In the tapestry of life, unforeseen circumstances can disrupt our carefully woven plans. One such challenge that can significantly impact our financial well-being is disability. While we often focus on protecting our assets through property and casualty insurance, disability insurance plays a crucial role in safeguarding our most valuable asset – our ability to earn an income.

Imagine being unable to work due to an injury or illness. The financial implications can be daunting, leaving you struggling to cover essential expenses like rent, mortgage payments, and medical bills. Disability insurance acts as a safety net, providing a monthly income stream that replaces a portion of your lost earnings, helping you maintain financial stability during this challenging time.

Disability insurance is available in various forms, tailored to individual needs and circumstances. Short-term disability coverage provides temporary income replacement for a limited period, while long-term disability insurance offers ongoing support for extended periods, ensuring financial security in the face of prolonged incapacitation.

The benefits of disability insurance extend beyond financial protection. It provides peace of mind, allowing you to focus on your recovery without the added stress of financial worries. By securing disability insurance, you are taking proactive steps to protect yourself and your loved ones from the potentially devastating consequences of a disability.

Property Insurance: Safeguarding Your Home and Belongings

In the realm of financial security, property insurance emerges as a crucial safeguard, protecting your most valuable assets: your home and belongings. Imagine a devastating fire, a damaging storm, or even a theft – these events can wreak havoc, leaving you financially vulnerable. Property insurance acts as a safety net, providing financial coverage to rebuild or repair your home and replace your possessions.

This type of insurance offers protection against a range of perils, including:

- Fire: Covers damage caused by fires, including smoke and water damage.

- Windstorm: Protects against damage from strong winds, including hurricanes and tornadoes.

- Hail: Covers damage to your roof and other exterior surfaces caused by hailstorms.

- Theft: Provides coverage for stolen belongings from your home.

- Vandalism: Protects against damage caused by vandalism or malicious acts.

Beyond the protection of your dwelling, property insurance often extends coverage to your personal belongings, including furniture, electronics, clothing, and jewelry. This ensures that you can replace or repair these items in the event of a covered loss.

By having property insurance, you gain peace of mind knowing that your financial future is protected from unexpected disasters. It provides a safety net that helps you recover from a devastating event and rebuild your life. Remember, property insurance is an investment in your financial well-being, offering peace of mind and financial security.

The Cost of Not Having Adequate Insurance

The lack of sufficient insurance can have devastating financial consequences, putting a significant strain on your financial well-being. Without adequate coverage, you are essentially taking on an enormous risk that could lead to overwhelming debt, financial hardship, and even bankruptcy.

Imagine facing a catastrophic event like a house fire, a serious accident, or a medical emergency. Without proper insurance, you would be solely responsible for covering the costs associated with these events. The financial burden could be immense, potentially wiping out your savings, forcing you to sell assets, and leaving you struggling to make ends meet.

The cost of not having adequate insurance goes far beyond immediate expenses. It can also impact your future financial goals. For example, a lack of health insurance could leave you with astronomical medical bills, making it impossible to save for retirement or your children’s education.

The financial peace of mind that insurance provides is invaluable. It offers a safety net that can protect you from unexpected and potentially financially crippling events. While it might seem like an extra expense, adequate insurance is an essential investment in your financial future.

How Insurance Premiums are Calculated

Insurance premiums are the monthly or annual payments you make to an insurance company in exchange for coverage. These premiums are calculated based on a variety of factors, designed to reflect the risk the insurer takes on by covering you. Here’s a breakdown of the key elements influencing your premium:

Type of Coverage: Different insurance types, like health, auto, or home, have varying levels of risk. Health insurance, for example, is more complex due to a wider range of potential medical expenses, so premiums tend to be higher than, say, auto insurance.

Your Personal Risk Factors: Several factors specific to you can impact your premium. For example, in health insurance, your age, health history, and lifestyle choices can all contribute to your premium. In car insurance, your driving record, the make and model of your car, and where you live all play a role.

Coverage Limits and Deductibles: The amount of coverage you choose and your deductible amount are directly linked to your premium. Higher coverage limits and lower deductibles typically mean higher premiums, as you’re transferring more risk to the insurance company.

Claims History: Your past claims experience plays a crucial role. If you’ve filed numerous claims, insurers might perceive you as a higher risk and charge you more.

Overall Market Conditions: Factors beyond your control, like interest rates and inflation, can also affect premium pricing. The insurance industry is constantly evolving, so premiums can fluctuate based on these broader economic influences.

Understanding how insurance premiums are calculated can help you make informed choices about your coverage. By managing your risk factors and shopping around for competitive rates, you can find the best insurance value to protect your financial future.

Choosing the Right Insurance Coverage for Your Needs

Insurance is an essential part of protecting your financial future. It provides a safety net against unexpected events that could otherwise devastate your finances. However, with so many different types of insurance available, it can be overwhelming to know which ones are right for you.

The first step in choosing the right insurance coverage is to assess your individual needs and risks. Consider your age, health, income, assets, and dependents. For example, if you have a young family, you may want to prioritize life insurance and health insurance. If you own a home, you’ll need homeowners insurance.

Once you understand your needs, you can research different types of insurance and compare quotes from different providers. Be sure to read the policy carefully to understand the coverage and limitations.

It’s also important to consider your budget. Insurance premiums can vary widely depending on the type of coverage, your age, and your location. It’s essential to find coverage that fits your financial situation without leaving you vulnerable to risks.

Here are some key types of insurance to consider:

- Health insurance: Protects against the high costs of medical care.

- Life insurance: Provides financial security for your loved ones in the event of your death.

- Homeowners insurance: Covers damage to your home and belongings from fire, theft, and other disasters.

- Auto insurance: Protects against financial losses from accidents involving your car.

- Disability insurance: Provides income replacement if you’re unable to work due to an illness or injury.

Choosing the right insurance coverage is crucial for safeguarding your financial future. By assessing your needs, researching options, and considering your budget, you can find the coverage that provides the protection you need without breaking the bank.

Tips for Saving Money on Insurance Premiums

Insurance is an essential part of protecting your financial future, but premiums can be costly. Fortunately, there are several strategies you can use to save money on your insurance premiums.

Shop around and compare quotes. Don’t settle for the first quote you get. Contact multiple insurance companies and compare their rates. You can use online comparison websites to make this process easier.

Increase your deductible. Your deductible is the amount you pay out of pocket before your insurance kicks in. Increasing your deductible can lower your premium. However, make sure you can afford to pay the higher deductible if you need to file a claim.

Bundle your insurance policies. Many insurance companies offer discounts if you bundle your home, auto, and other insurance policies with them. This can save you a significant amount of money.

Take advantage of discounts. Insurance companies offer a variety of discounts, such as discounts for good driving records, safe home features, and being a member of certain organizations. Ask your insurance agent about the discounts you qualify for.

Improve your credit score. Your credit score can impact your insurance premiums. A higher credit score can lead to lower premiums. Consider improving your credit score to save money on insurance.

Consider dropping unnecessary coverage. Some insurance policies may include coverage you don’t need. Review your policy and consider dropping coverage that you don’t use.

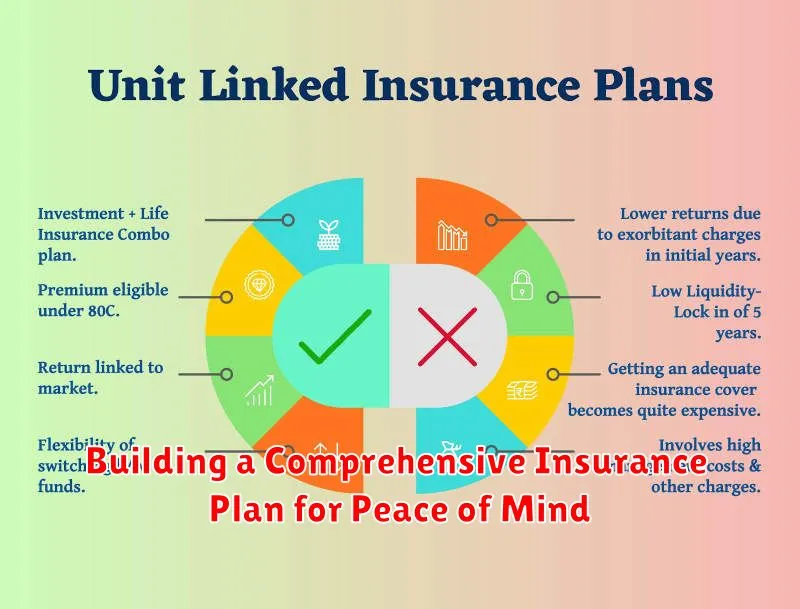

Building a Comprehensive Insurance Plan for Peace of Mind

Life is full of uncertainties, and unexpected events can significantly impact your financial well-being. A comprehensive insurance plan acts as a safety net, safeguarding your financial future and providing peace of mind. Building a robust insurance strategy involves a thoughtful assessment of your individual needs and risk tolerance.

A comprehensive insurance plan should cover essential areas such as health insurance, life insurance, property insurance, and liability insurance. Health insurance protects you from the financial burden of medical expenses, while life insurance provides financial support to your loved ones in case of your untimely demise. Property insurance safeguards your home and possessions against unforeseen events like fire, theft, or natural disasters. Liability insurance covers legal expenses and damages resulting from accidents or negligence.

In addition to these core types, you may consider other specialized insurance products such as disability insurance, long-term care insurance, or travel insurance, depending on your individual circumstances. Disability insurance provides income replacement if you become unable to work due to an illness or injury. Long-term care insurance covers expenses related to assisted living or nursing home care. Travel insurance safeguards you against unforeseen medical emergencies or travel disruptions while traveling abroad.

By carefully evaluating your needs, consulting with a qualified insurance advisor, and choosing the right insurance products, you can create a comprehensive plan that provides financial security and peace of mind. A well-designed insurance plan empowers you to navigate life’s uncertainties with confidence, knowing that your financial future is protected.